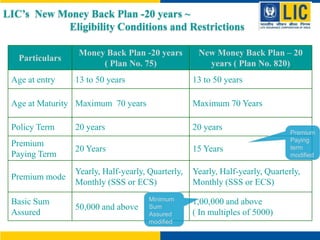

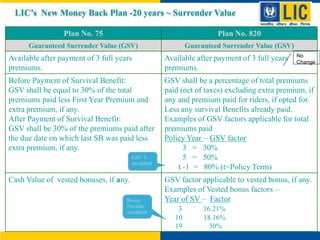

1) The document compares two LIC money back plans - Plan No. 75 and the new Plan No. 820.

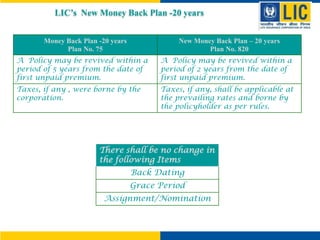

2) Plan No. 820 modifies some benefits and eligibility conditions compared to Plan No. 75, such as increasing the minimum sum assured, decreasing the premium paying term, and reducing the revival period.

3) However, both plans provide maturity benefits of 40% of the basic sum assured along with vested bonuses, and death benefits which are defined as the sum assured on death along with bonuses.

![LIC’s New Money Back Plan -20 years ~ Benefits

What is Sum Assured on Death?

Sum Assured on Death shall be Higher of ~

125% of Basic Sum Assured (1.25 x BSA)

OR

10 times Annualised Premium.(10 x AP).

[Premiums - excluding taxes, extra premiums and premiums for

riders, if any]](https://image.slidesharecdn.com/moneybackplan820-2-140101232023-phpapp01/85/Money-back-plan-8202-LIC-Datacomp-Web-Technologies-3-320.jpg)