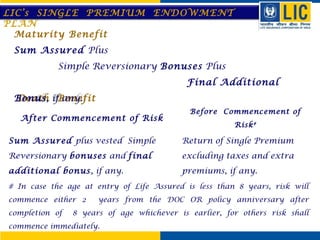

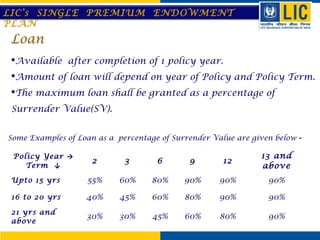

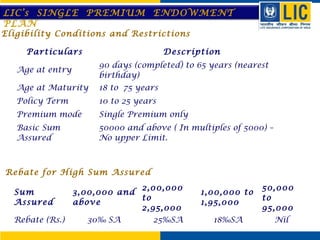

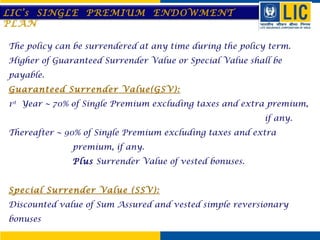

LIC's Single Premium Endowment Plan is a single premium, profit-endowment plan that provides maturity benefits including sum assured plus simple reversionary bonuses and a final additional bonus. In the event of death after commencement of risk, the sum assured plus vested bonuses are payable. For death before commencement of risk, the single premium excluding taxes and extra premiums is returned. The plan is available for ages 90 days to 65 years at entry and provides a policy term of 10 to 25 years. A single premium is paid and loans are available after one year. Surrender value payable is the higher of guaranteed surrender value or special surrender value.