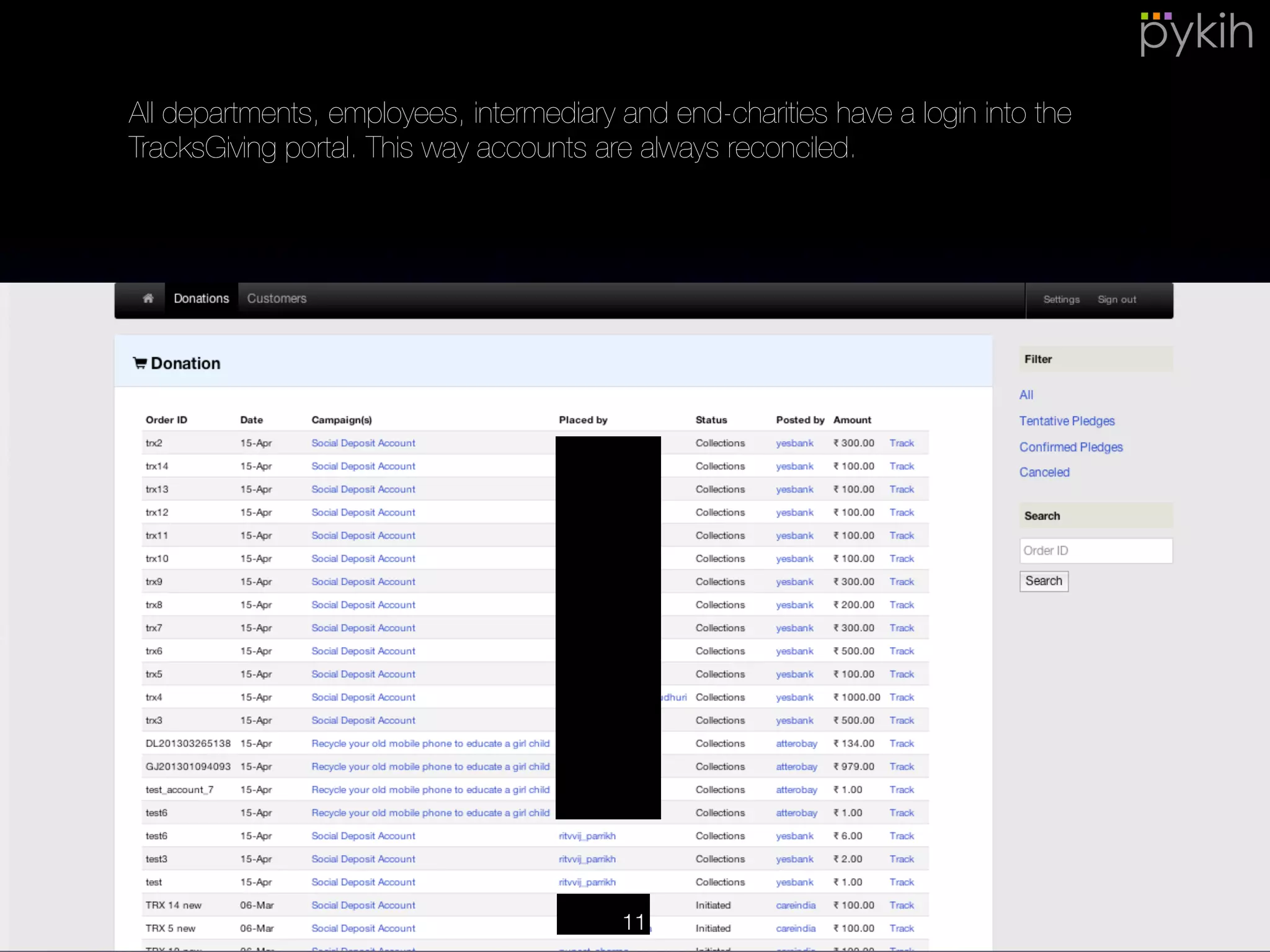

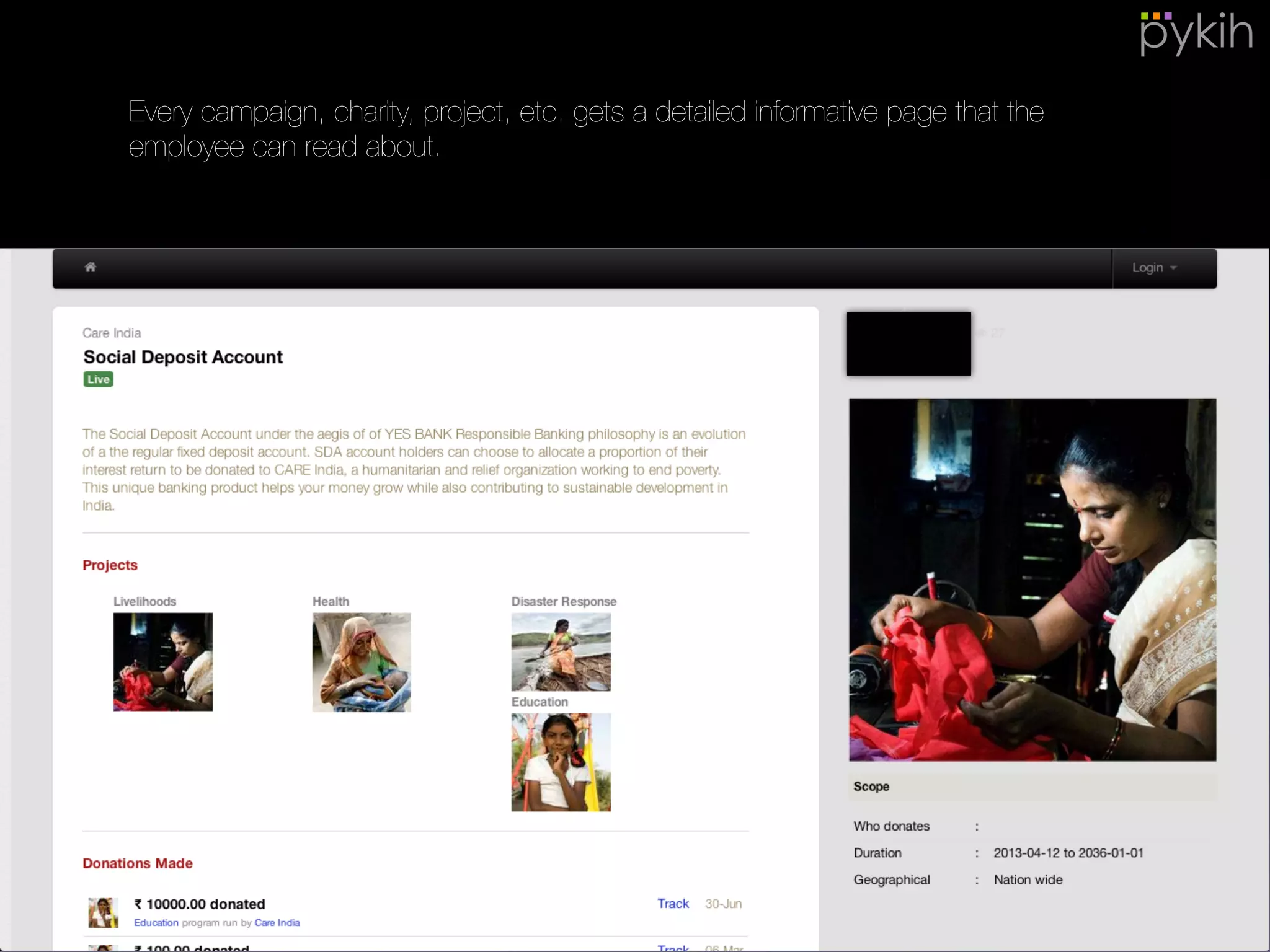

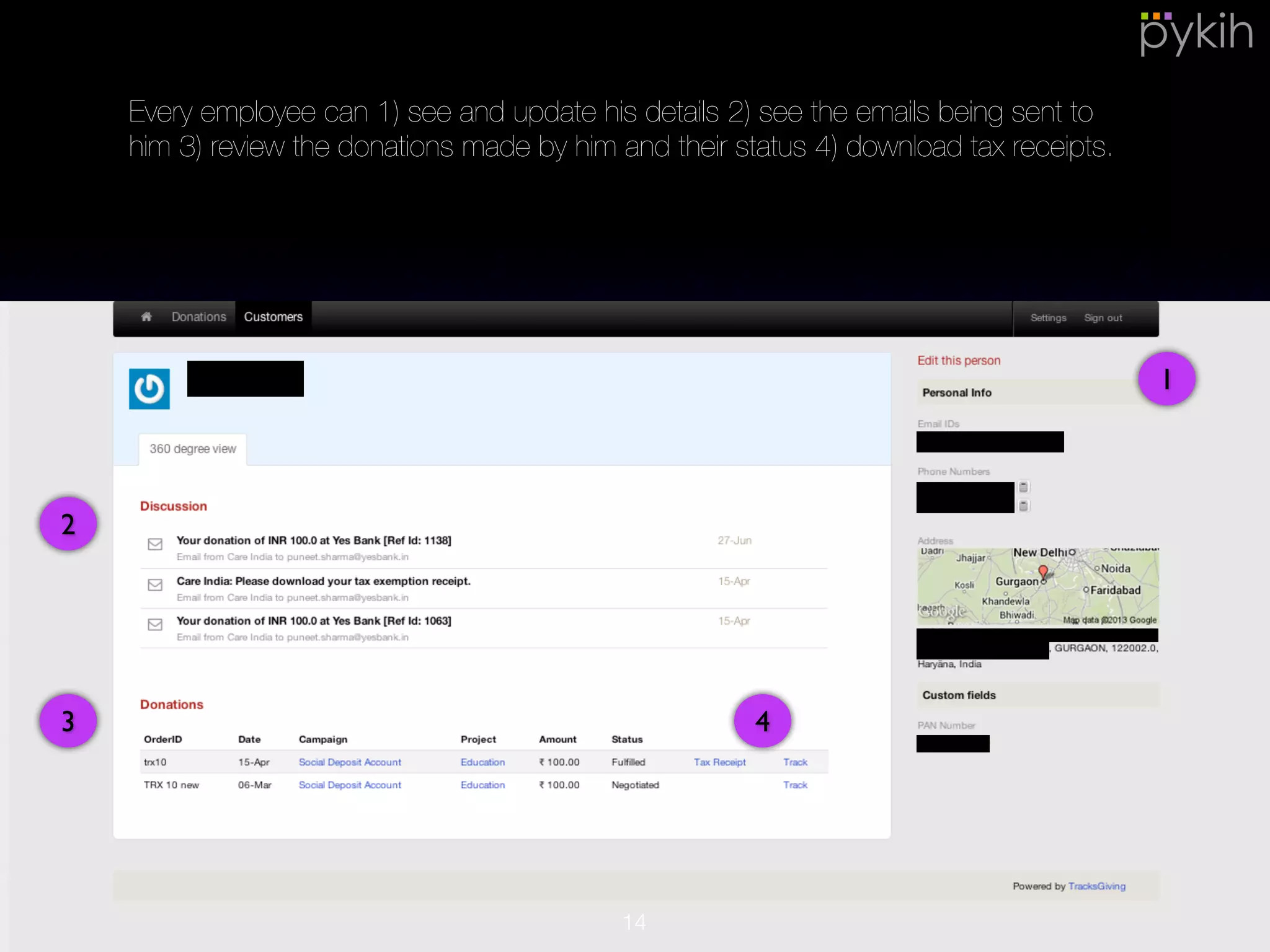

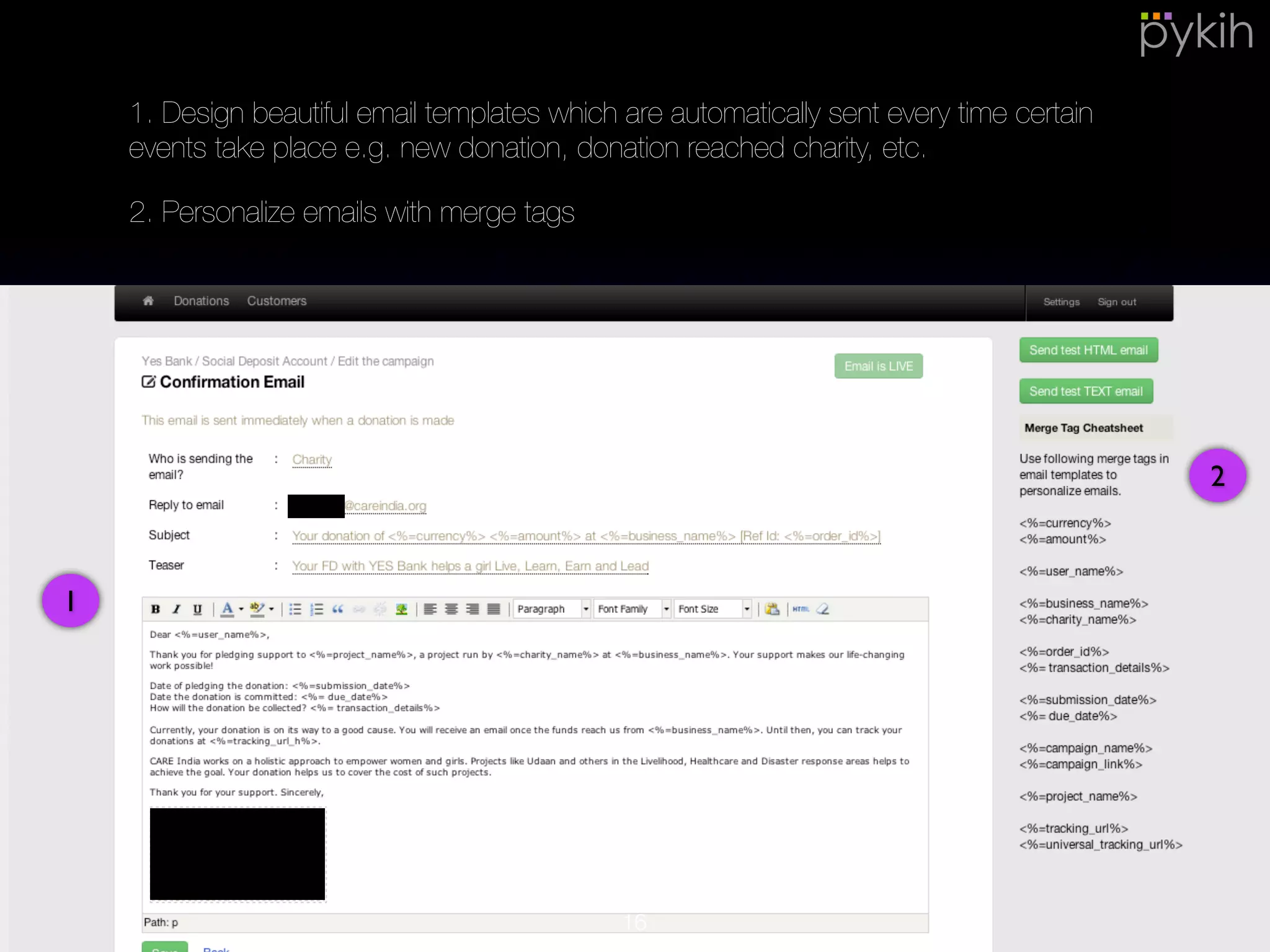

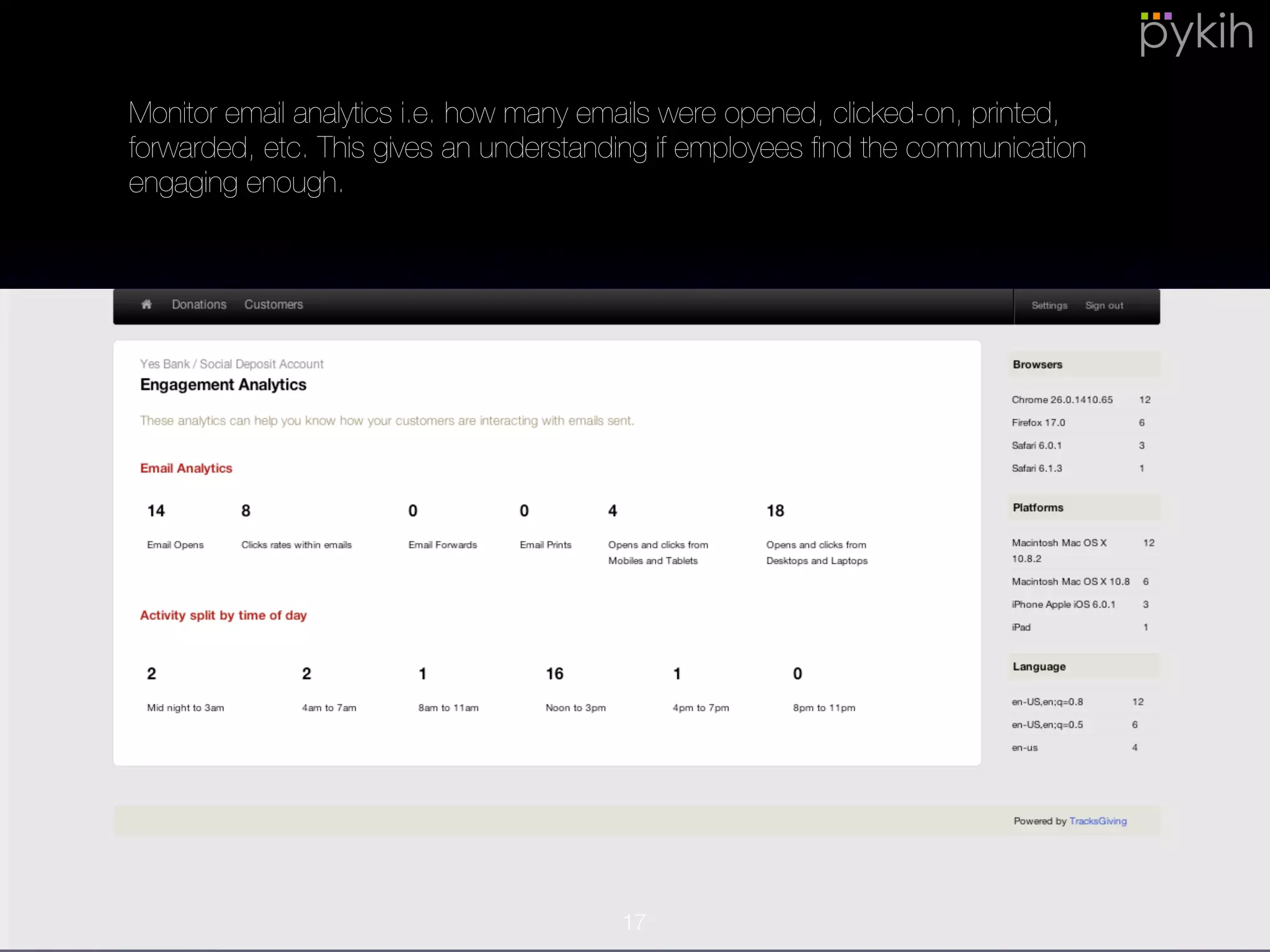

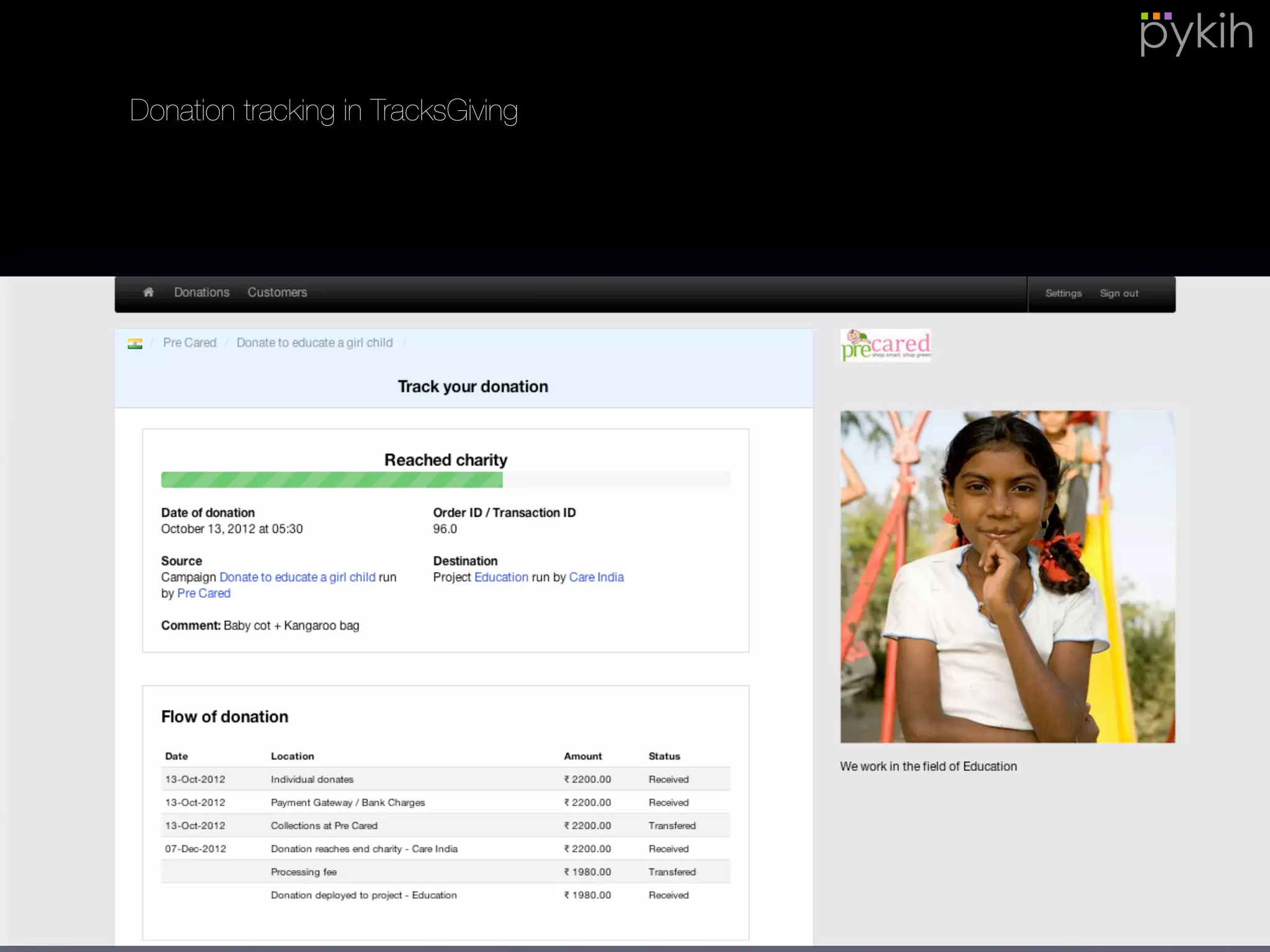

The document outlines Tracksgiving, a donation management system designed to streamline payroll giving and enhance employee engagement. It addresses challenges in current payroll giving processes, highlights benefits such as increased transparency, and outlines functionalities that allow employees to track their donations. Additionally, it emphasizes the potential for innovative gamification strategies to foster a positive giving culture within organizations.