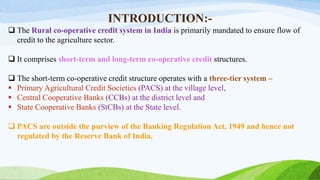

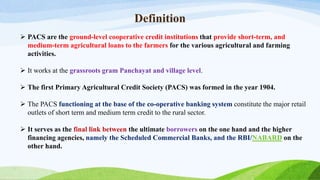

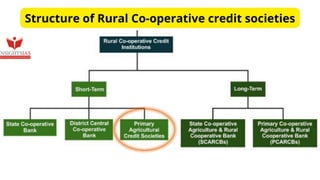

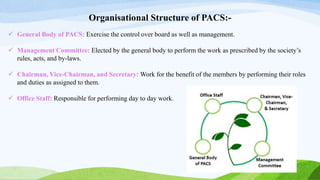

This document discusses Primary Agricultural Credit Societies (PACS) in India. It begins by explaining that PACS operate at the village level and are the primary providers of short-term credit to farmers. It then defines PACS and discusses their organizational structure, capital sources, functions, and significance. The document notes that PACS play an important role in rural credit but also face issues like inadequate coverage, resources, and overdues. It concludes by suggesting ways for PACS to expand their services and strengthen rural economies, such as becoming multi-service centers.