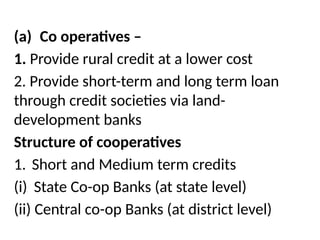

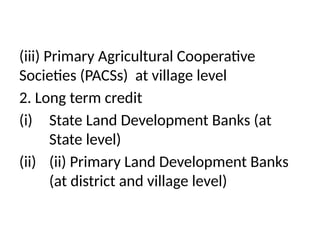

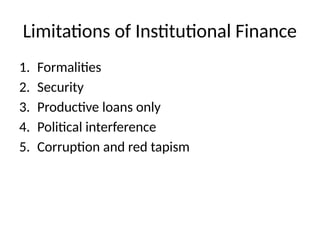

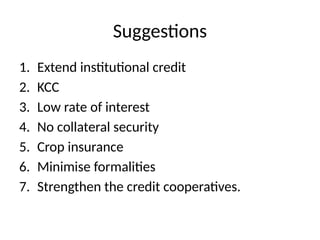

Agricultural finance is essential for farmers to improve productivity and manage risks through various types of credit, including short-term, medium-term, and long-term loans. Sources of agricultural finance are categorized into non-institutional and institutional, with institutions like NABARD providing critical support for rural credit and development. Recent measures have aimed to enhance credit flow to farmers, including the introduction of schemes like Kisan Credit Card, while challenges and limitations persist within the institutional finance framework.