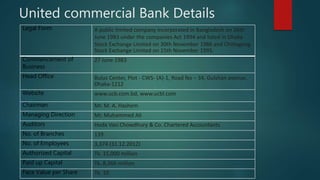

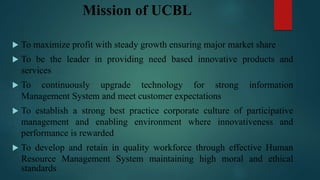

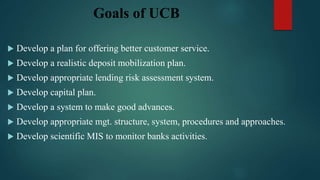

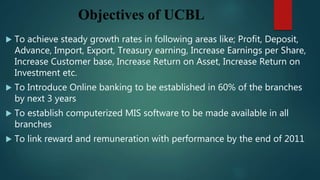

United Commercial Bank Limited is a public limited company incorporated in Bangladesh in 1983 with 139 branches. It is headed by a Chairman and Managing Director and has over 3,300 employees. The bank has an authorized capital of 15 billion taka and paid up capital of over 8 billion taka. It aims to maximize profits through steady growth and innovative products while maintaining high ethical standards.