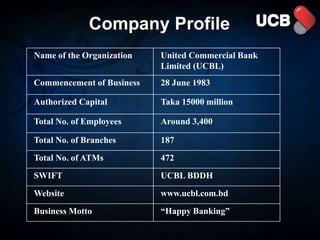

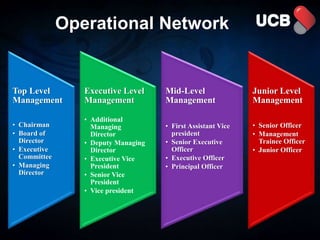

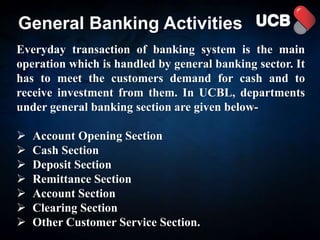

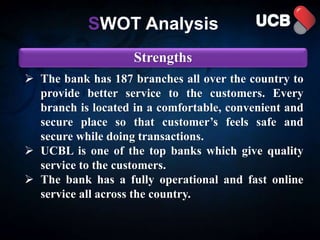

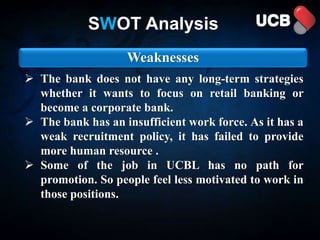

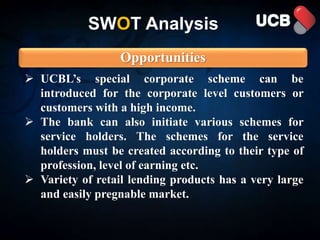

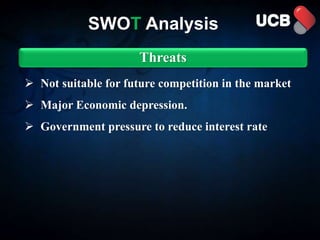

United Commercial Bank Limited (UCBL) is one of the largest banks in Bangladesh, incorporated in 1983. It has 187 branches across the country and over 3,400 employees. UCBL's vision is to be the bank of first choice by maximizing value for clients, shareholders, and employees. The document discusses UCBL's business activities, management structure, strengths like its large branch network, weaknesses like lack of long term strategies, and opportunities to introduce new products and better serve customers. It also provides recommendations on how UCBL can improve, such as establishing more ATMs and emphasizing advertising.