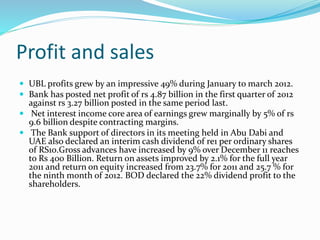

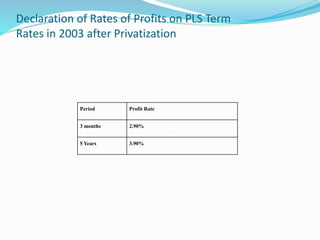

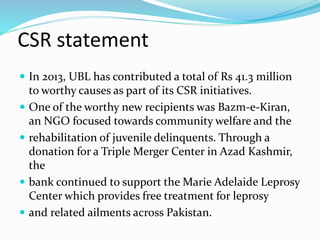

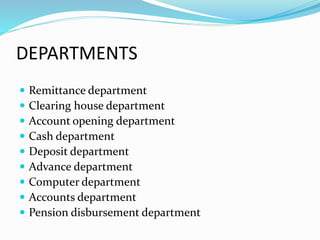

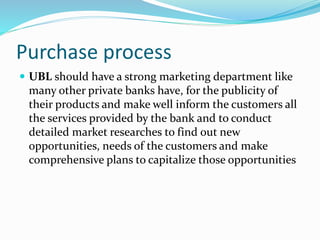

The document discusses United Bank Limited (UBL) in Pakistan. It provides information on the group members working on a project about UBL, an introduction to UBL including its network size and international branches, a brief history since its founding in 1959, its vision, mission and organizational structure with various departments. It also summarizes UBL's financial performance in recent years, corporate social responsibility activities, and some challenges it faces.