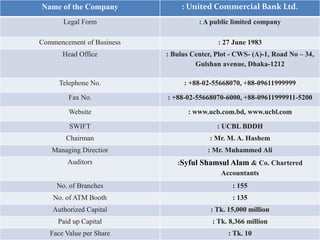

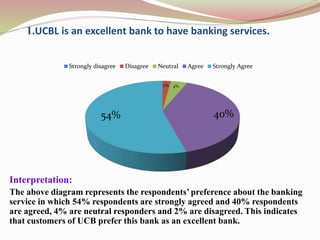

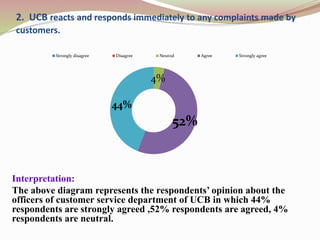

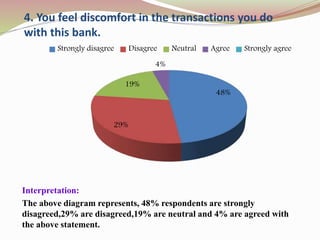

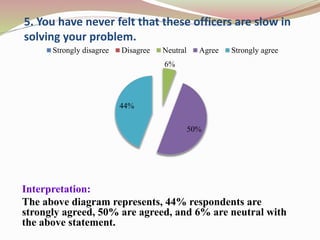

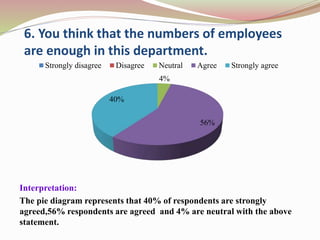

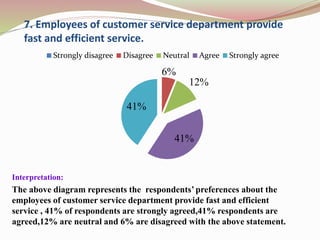

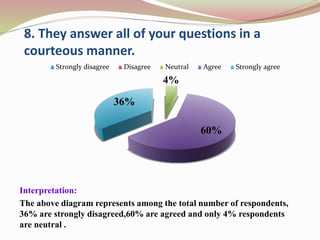

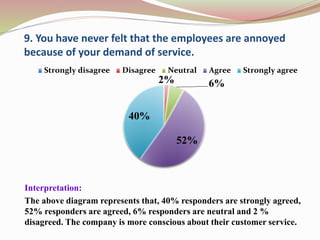

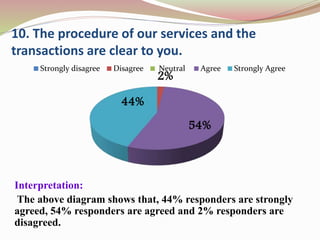

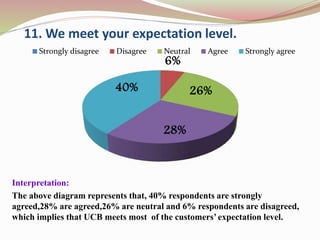

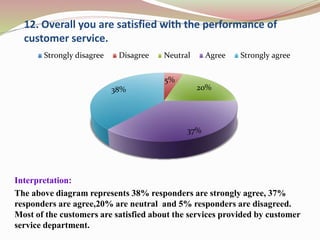

The document discusses a study on measuring the performance of the customer service department of United Commercial Bank Limited (UCB) in Bangladesh. It provides background on UCB and defines customer service. It outlines the objectives, methodology, and limitations of the study, which involved collecting primary data from 50 customers through interviews. Several charts are presented analyzing customers' responses on a Likert scale regarding their satisfaction with various aspects of UCB's customer service such as efficiency, responsiveness, comfort, and employee numbers/speed. Overall, the results indicate high levels of customer satisfaction and preference for UCB as an excellent bank.