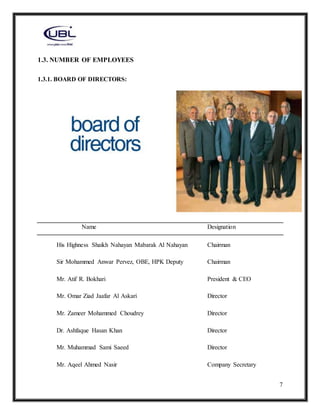

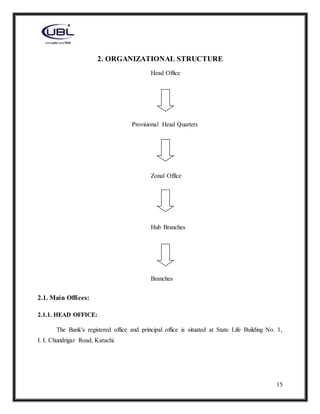

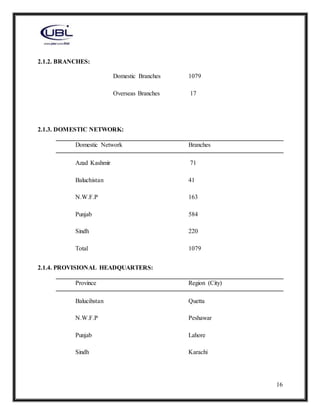

United Bank Limited (UBL) is one of Pakistan's largest banks. This report provides an overview of UBL based on the author's six-week internship at a UBL branch. It discusses UBL's history dating back to its founding in 1959, nationalization in the 1970s, and privatization in 2002. The report also outlines UBL's organizational structure, products and services offered, financial performance, and recommendations.