Embed presentation

Downloaded 507 times

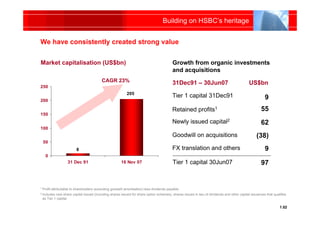

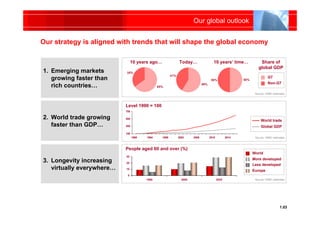

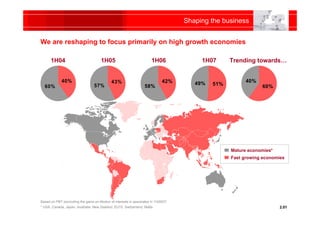

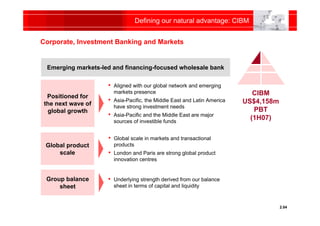

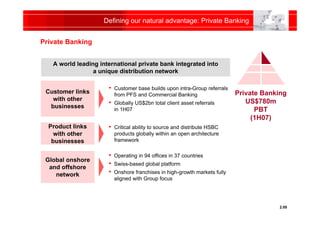

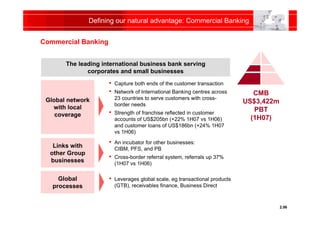

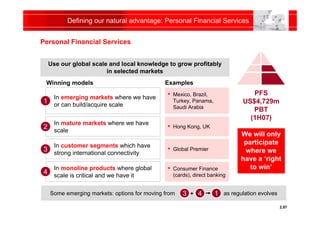

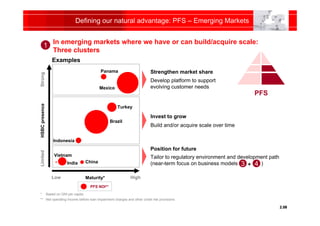

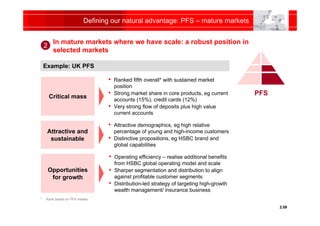

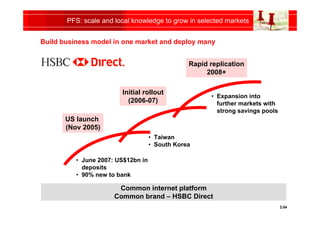

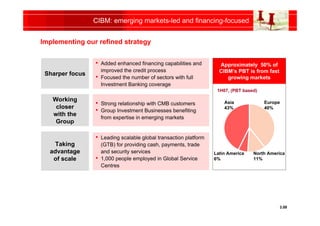

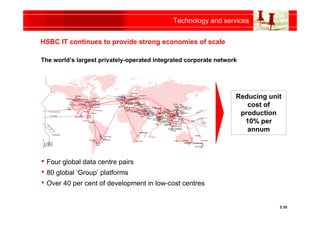

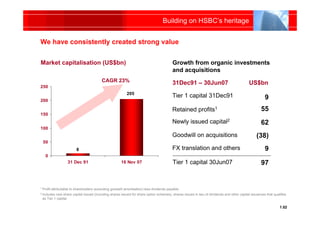

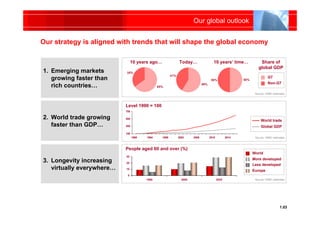

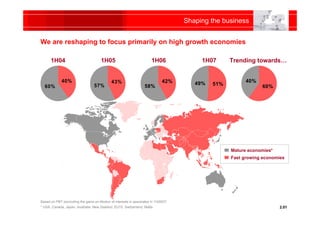

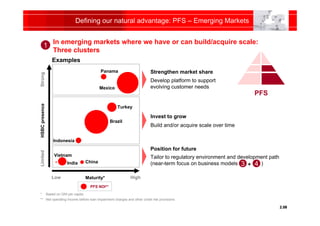

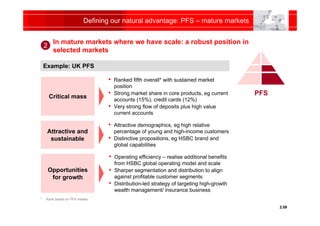

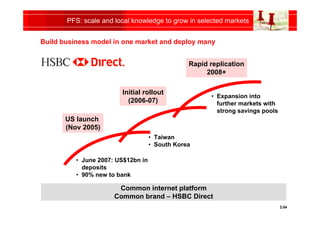

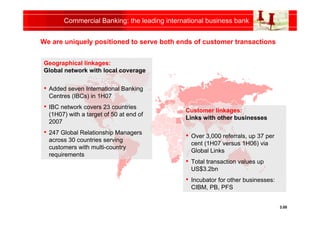

The document provides an agenda and strategy update from HSBC Group Chairman Stephen Green and Group Chief Executive Michael Geoghegan. The agenda outlines that Stephen Green will discuss shaping the business while Michael Geoghegan will discuss joining up the business. HSBC's strategy is focused on delivering superior growth and earnings over time by aligning its presence with global trends, investing primarily in developing markets, and maintaining its financial strength.