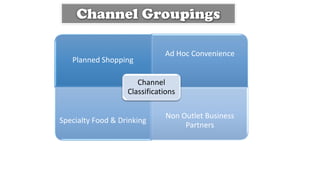

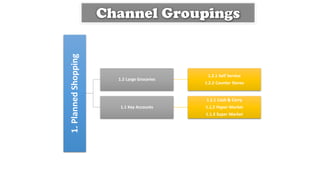

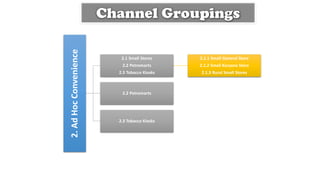

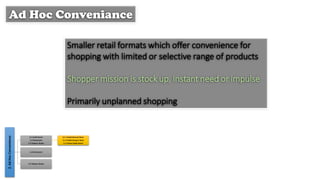

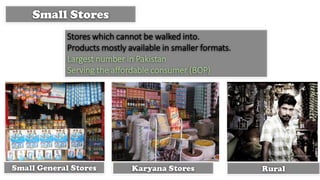

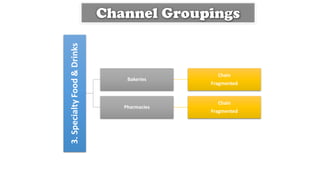

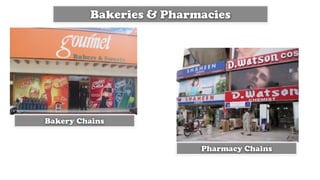

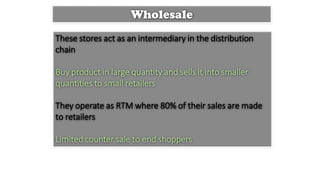

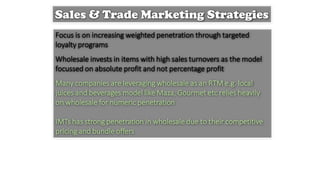

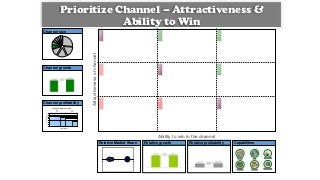

The document defines various retail channels and their classifications. It outlines 4 main channel groupings - Planned Shopping, Ad Hoc Convenience, Specialty Food & Drinks, and Non-Outlet Business Partners. Planned Shopping includes large groceries and key accounts like supermarkets and hypermarkets. Ad Hoc Convenience covers small stores, petromarts and tobacco kiosks. Specialty Food & Drinks includes bakeries and pharmacies. Non-Outlet Business Partners is defined as wholesale channels. For each channel, sales and trade marketing strategies are described with a focus on penetration, displays, and service levels.