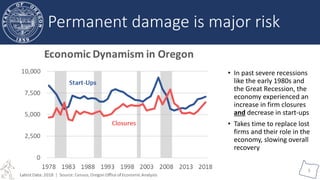

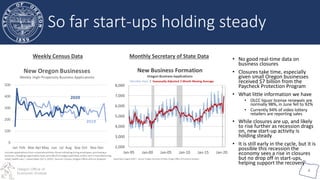

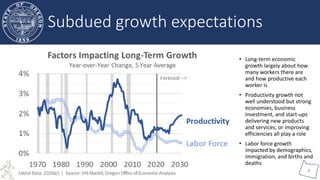

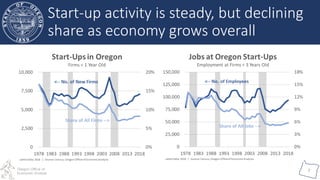

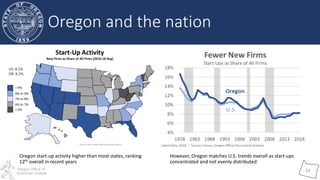

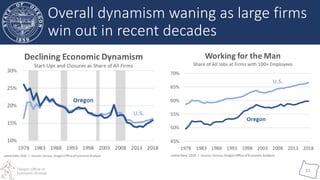

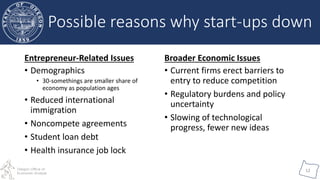

Oregon's economy faces challenges with an increase in firm closures and a low rate of new business start-ups, which could hinder recovery from the recession. Despite these trends, start-up activity remains steady, indicating potential resilience in the entrepreneurial landscape. Long-term growth concerns include demographic shifts, reduced immigration, and barriers to entry for new firms, emphasizing the importance of supporting local businesses to foster economic dynamism.