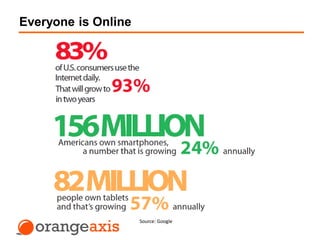

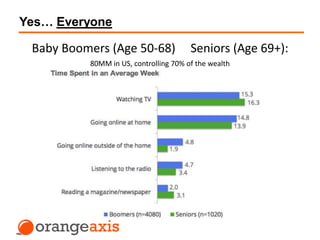

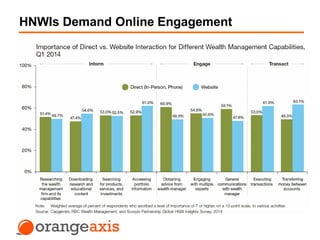

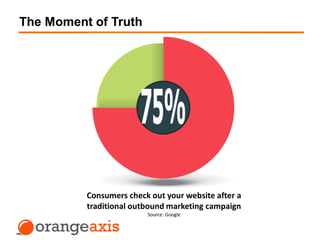

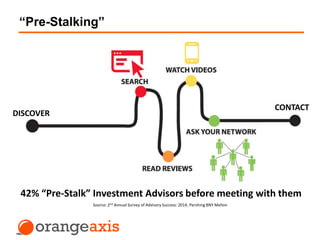

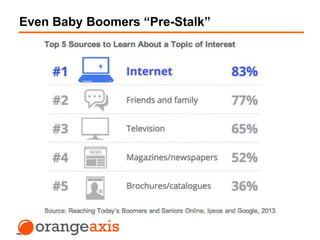

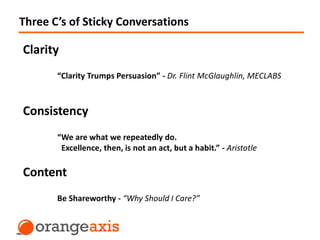

Digital marketing is important for investment professionals to engage with clients. Many clients now research advisors online before meeting them. While 30% of advisors use social media, those without an online presence are at a disadvantage since 49% of clients can't find their advisor online. Advisors need an online strategy that provides clarity, consistency and relevant content to clients to build their brand and maintain engagement. They must also ensure compliance by monitoring social media discussions and documenting all posts and approvals. An effective digital presence can help demonstrate ongoing value and connect advisors to younger clients.