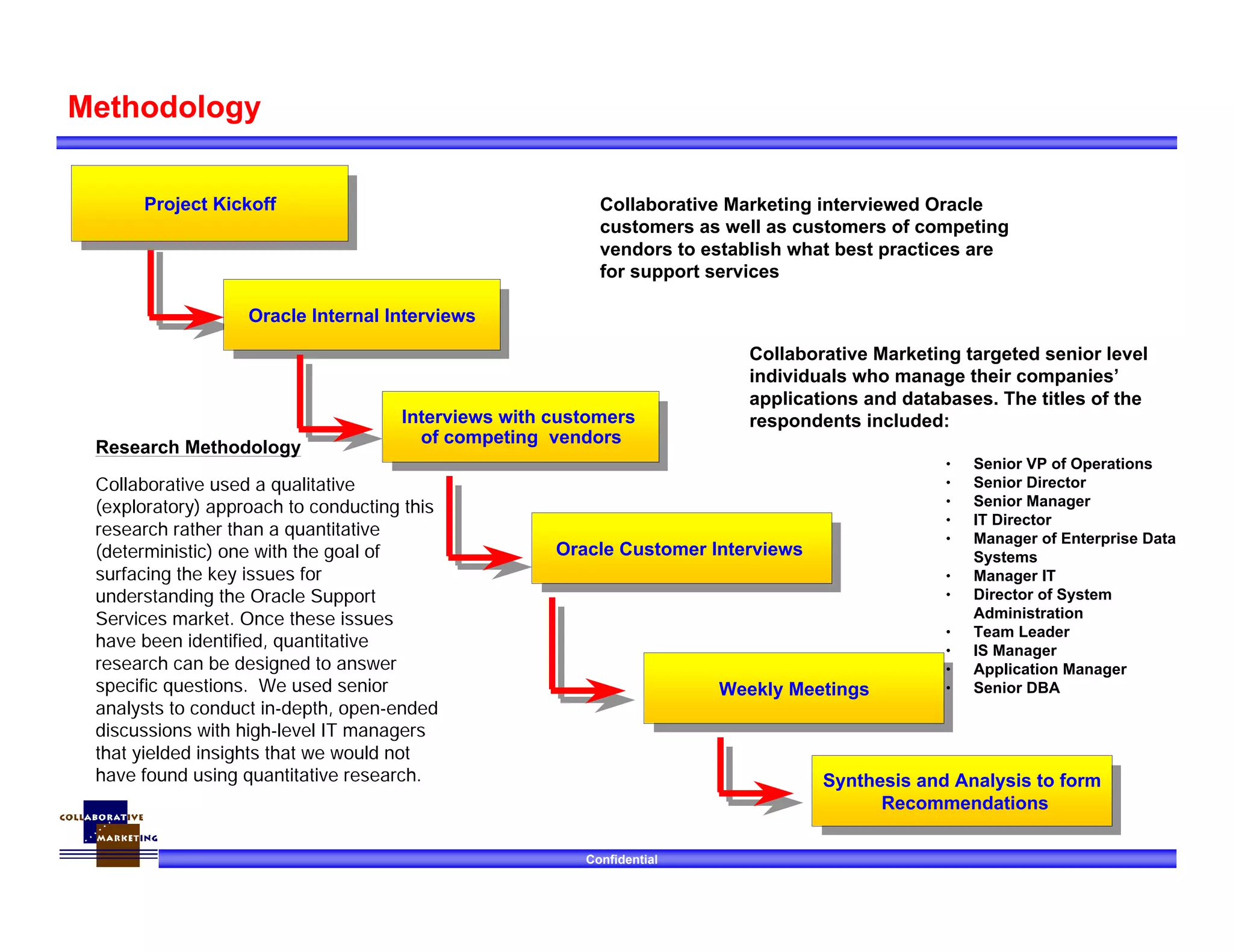

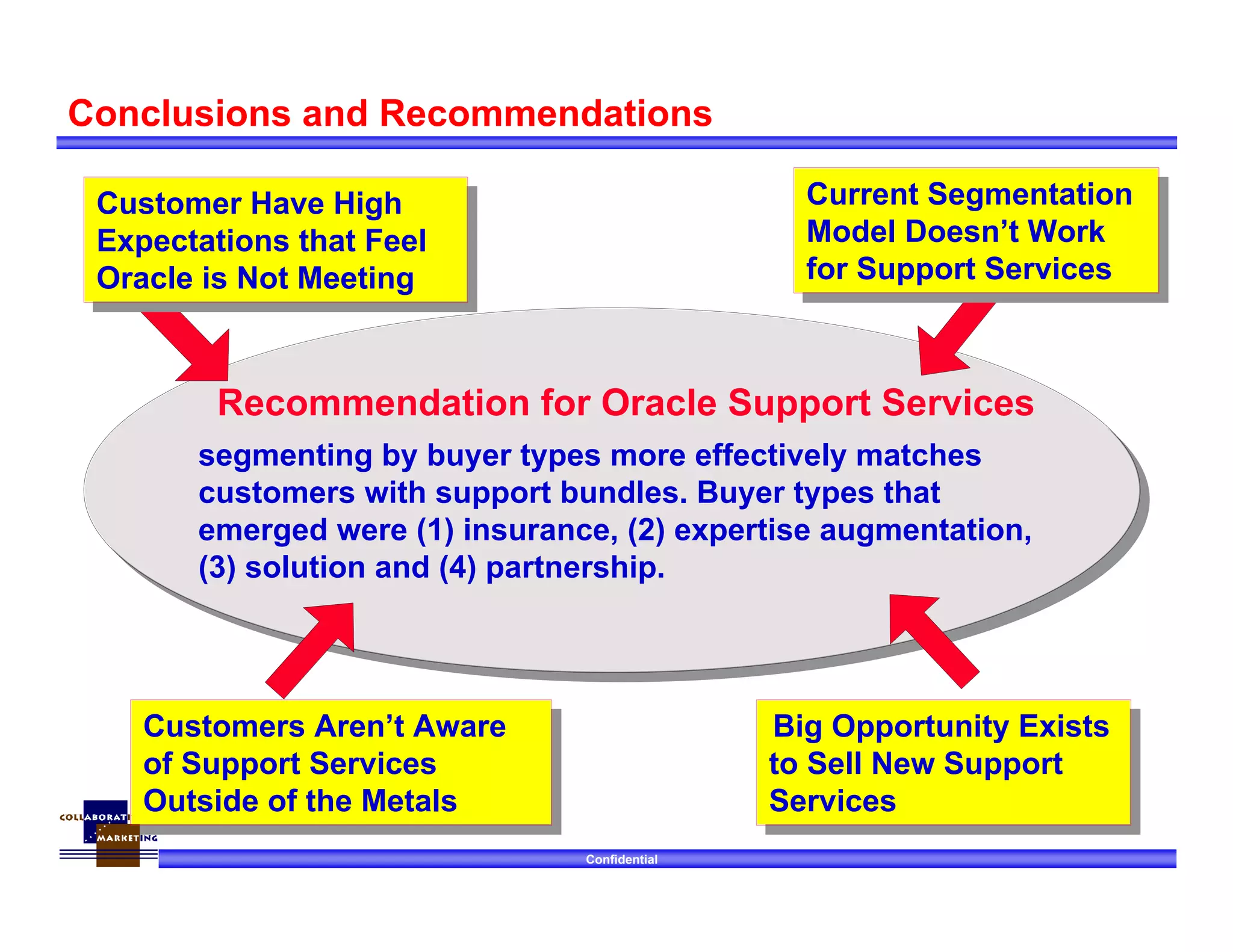

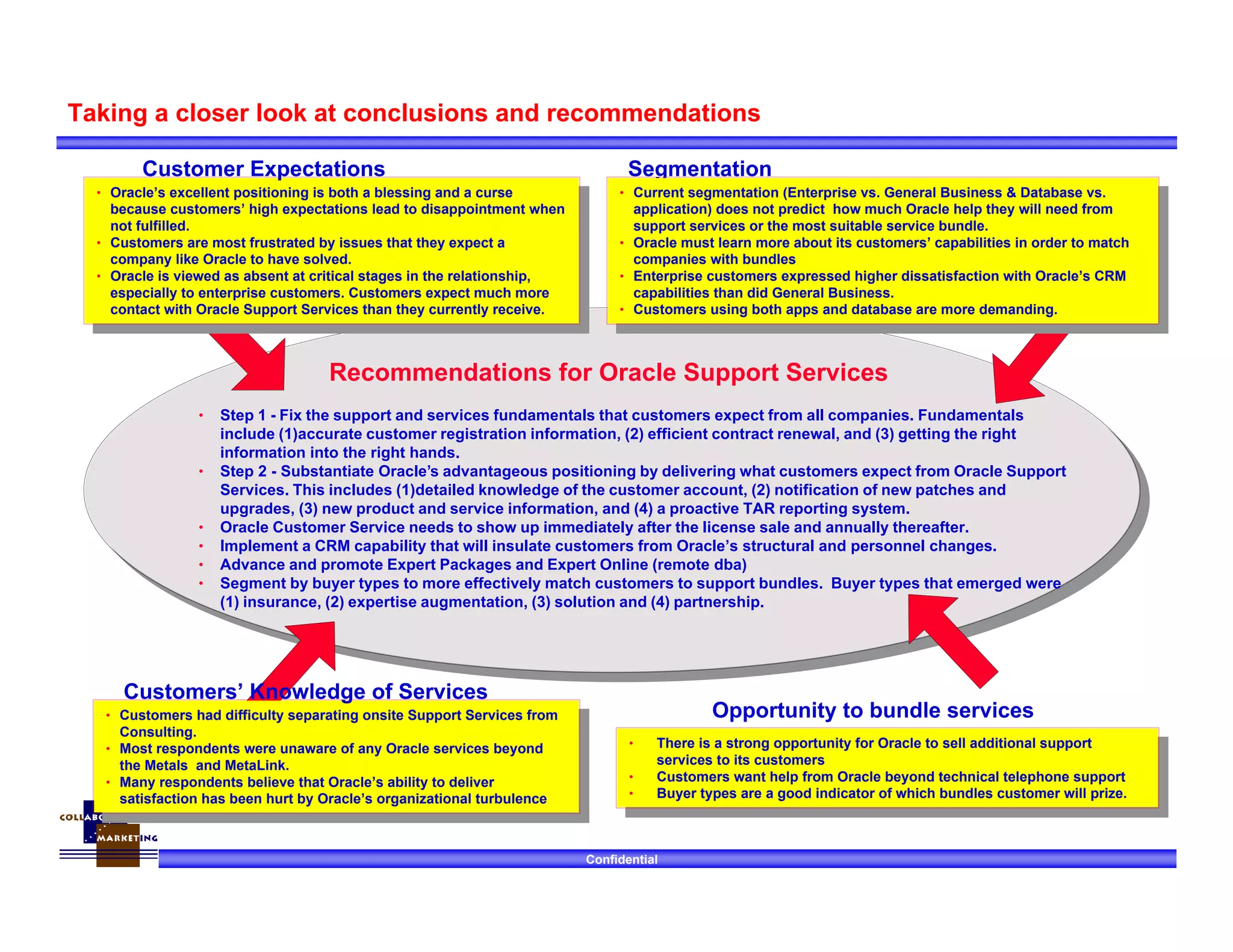

Oracle commissioned a study to understand customer support needs and identify opportunities to improve services. The research found:

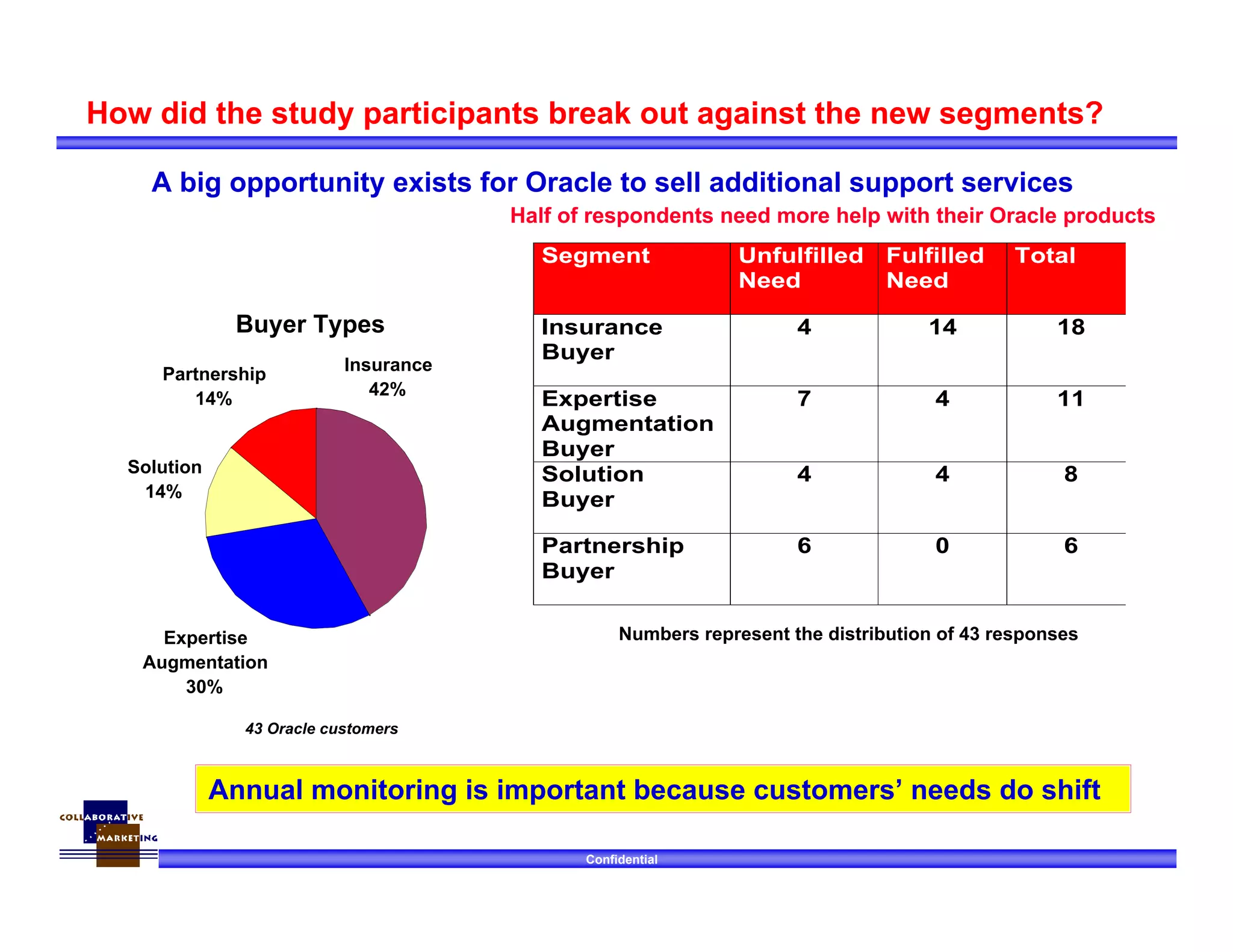

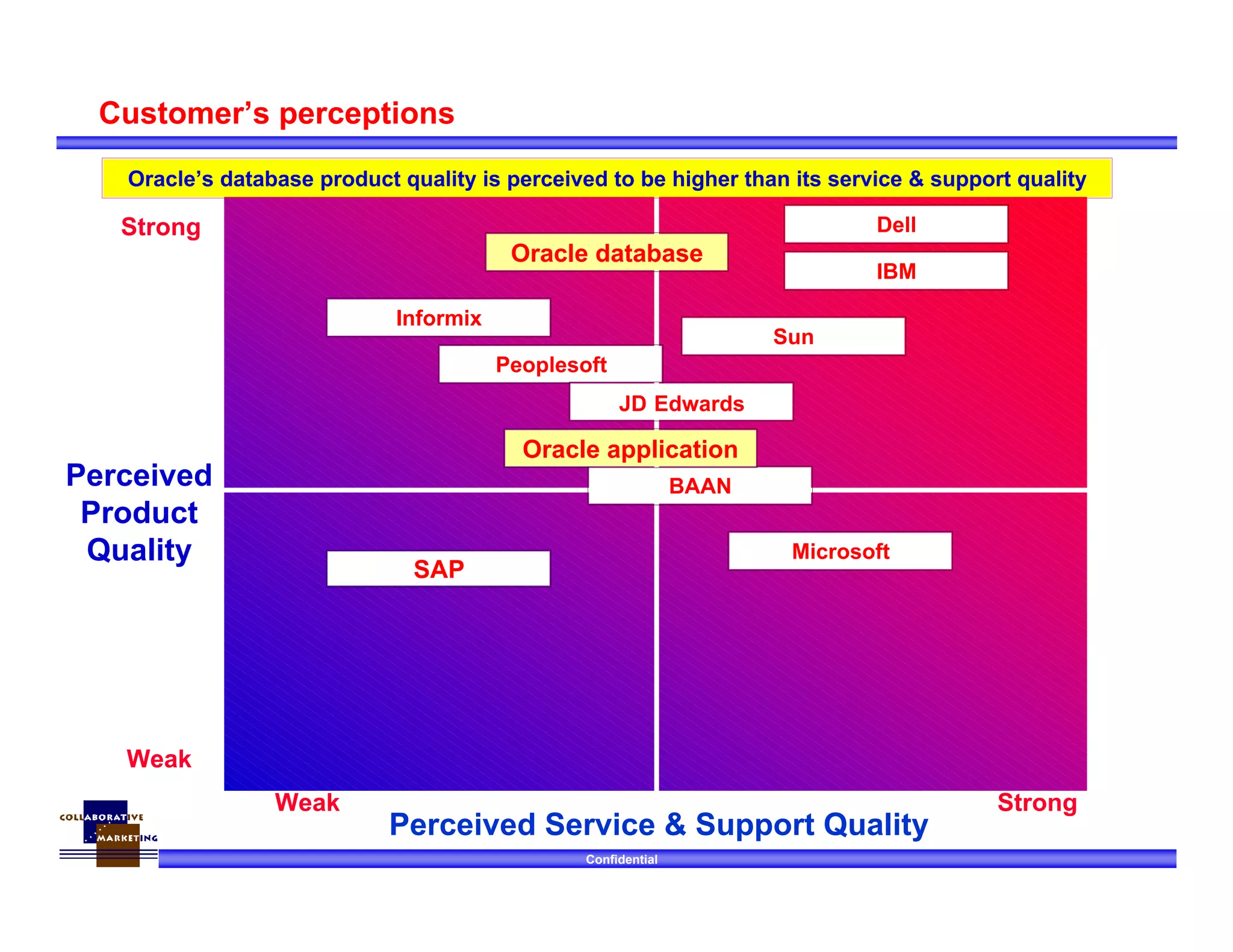

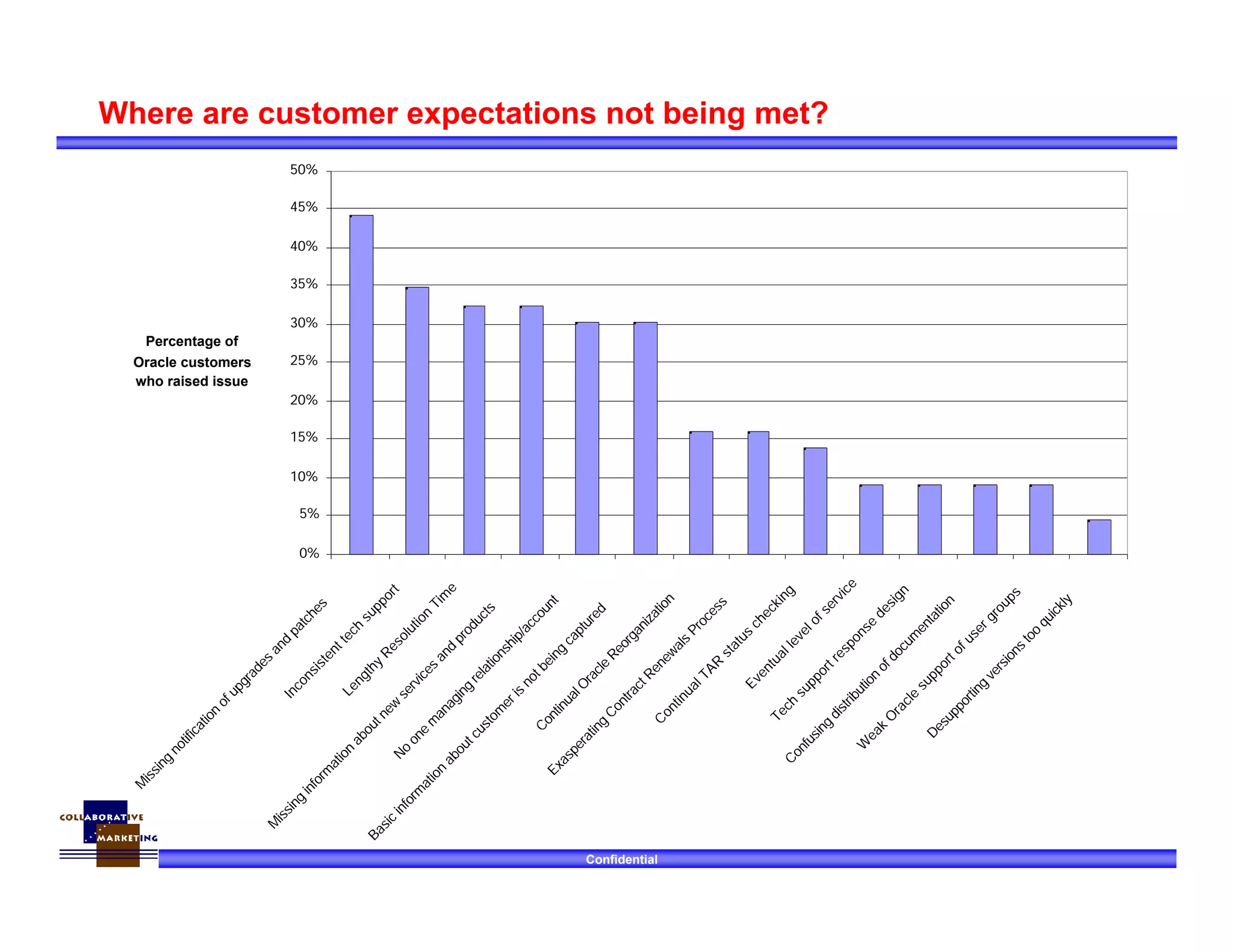

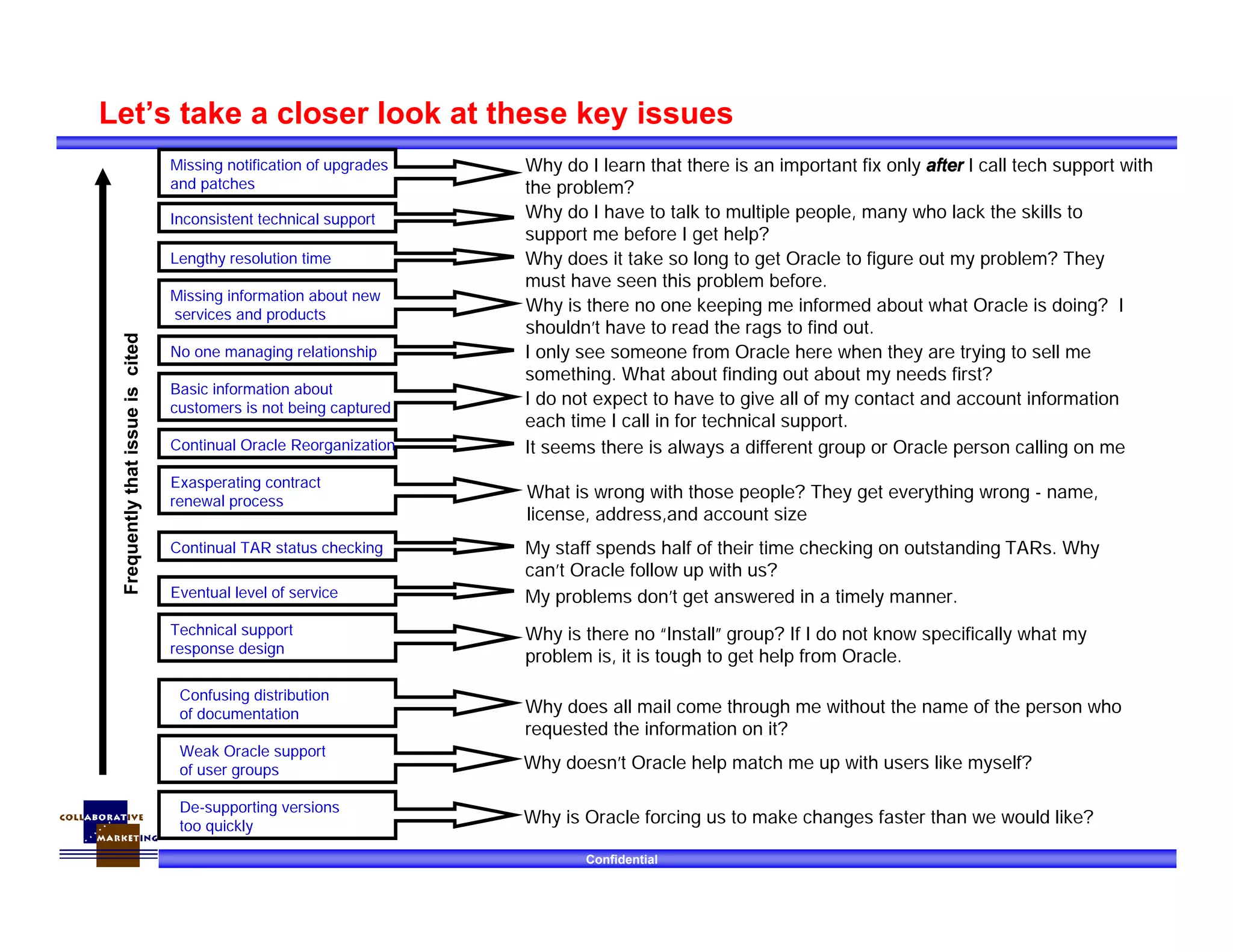

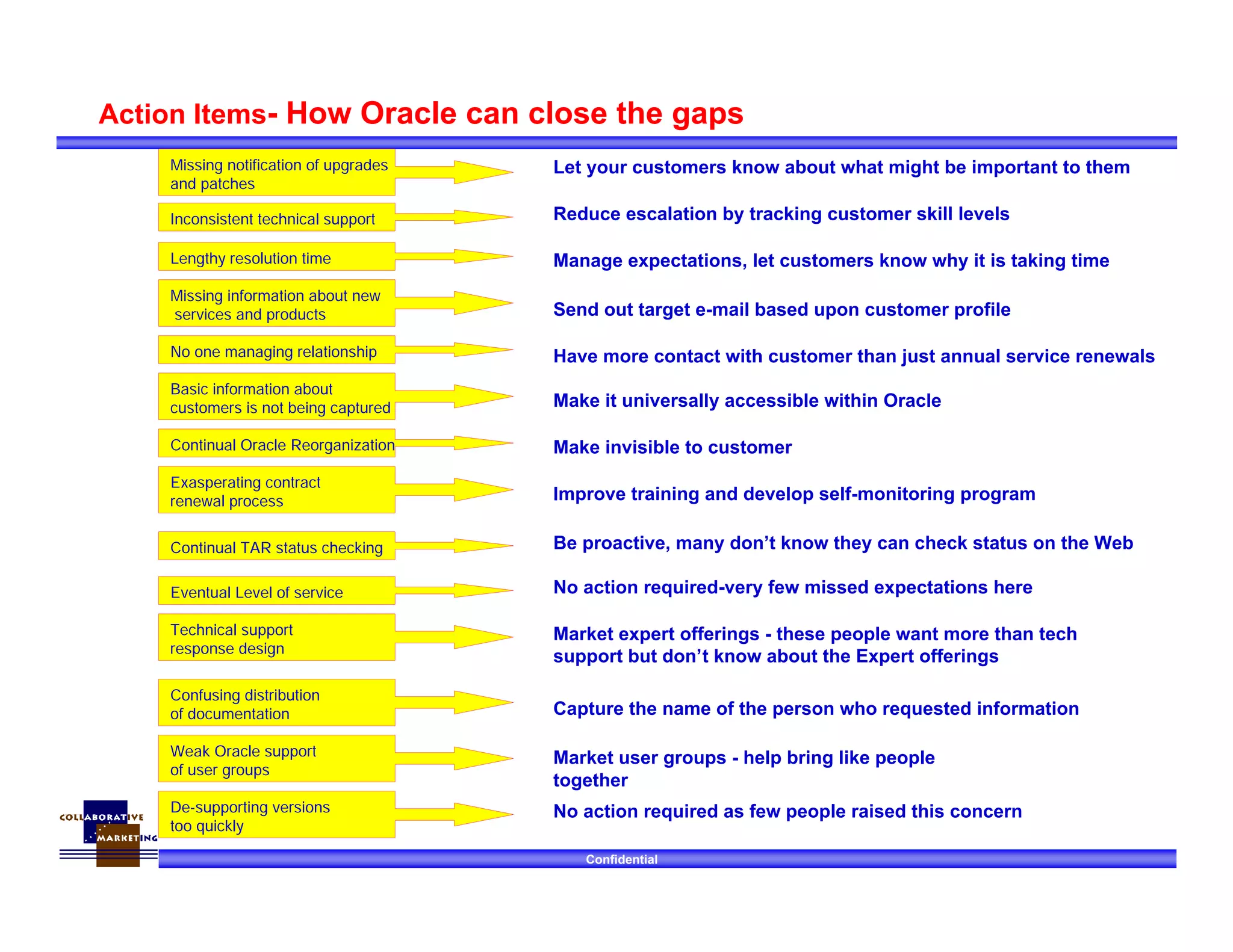

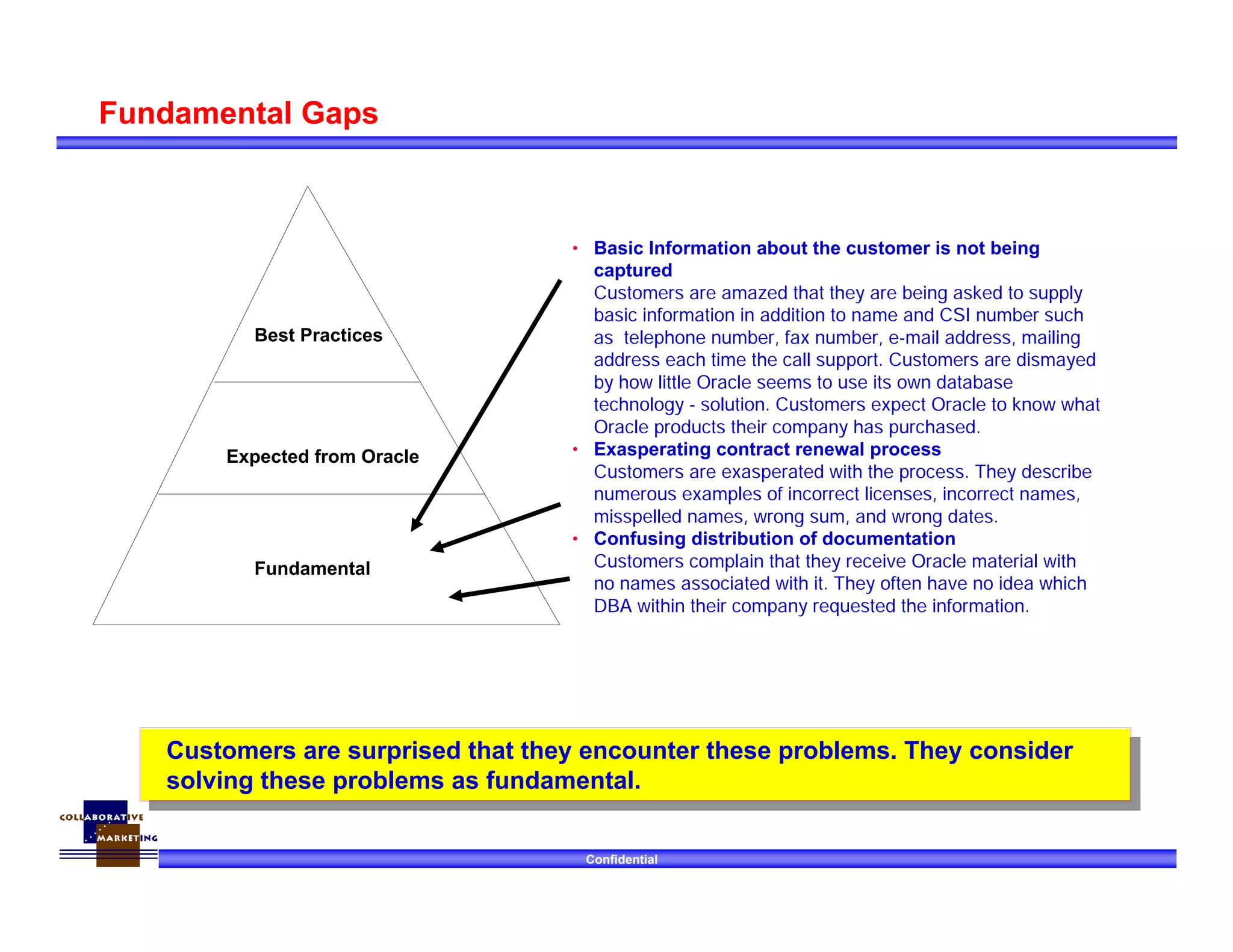

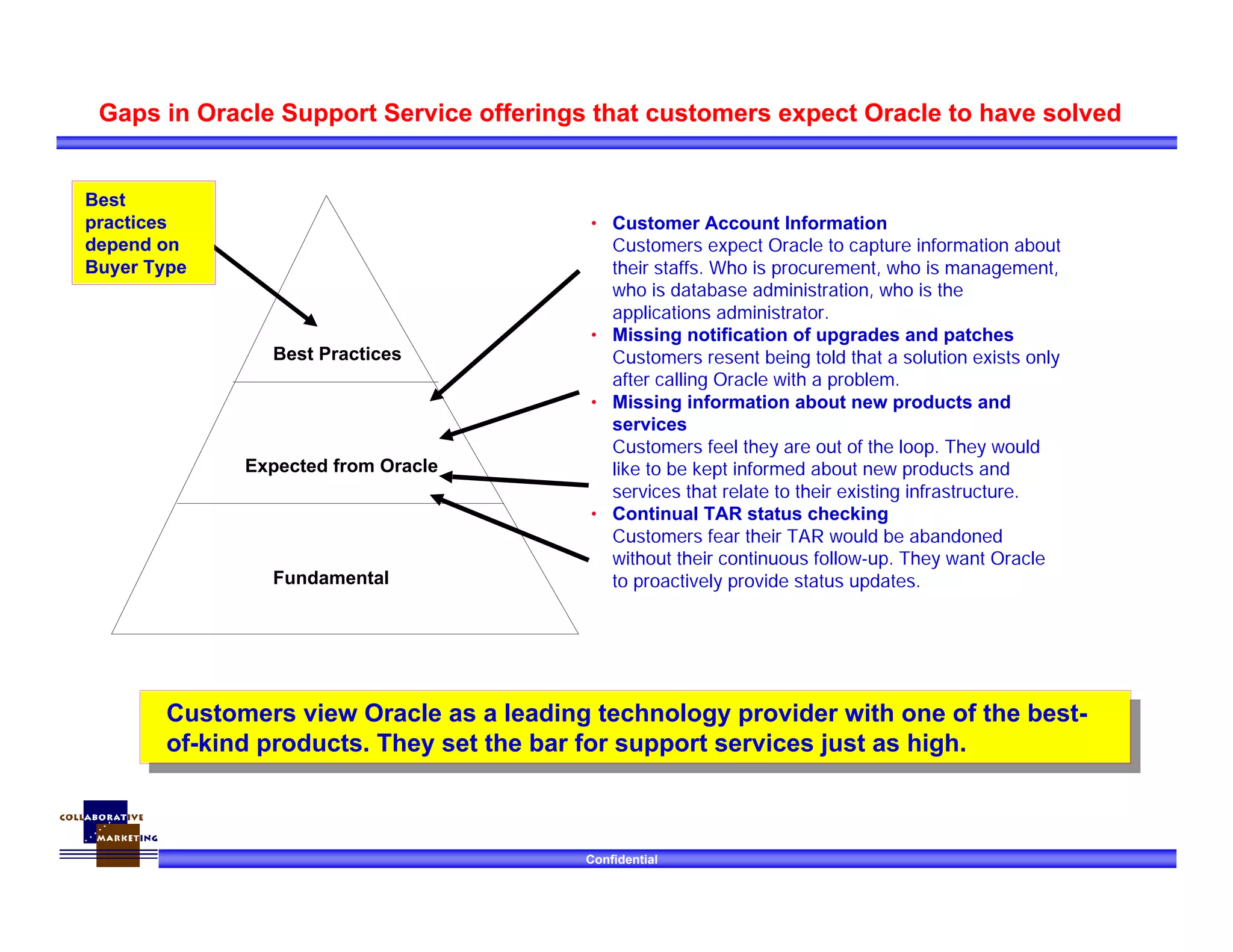

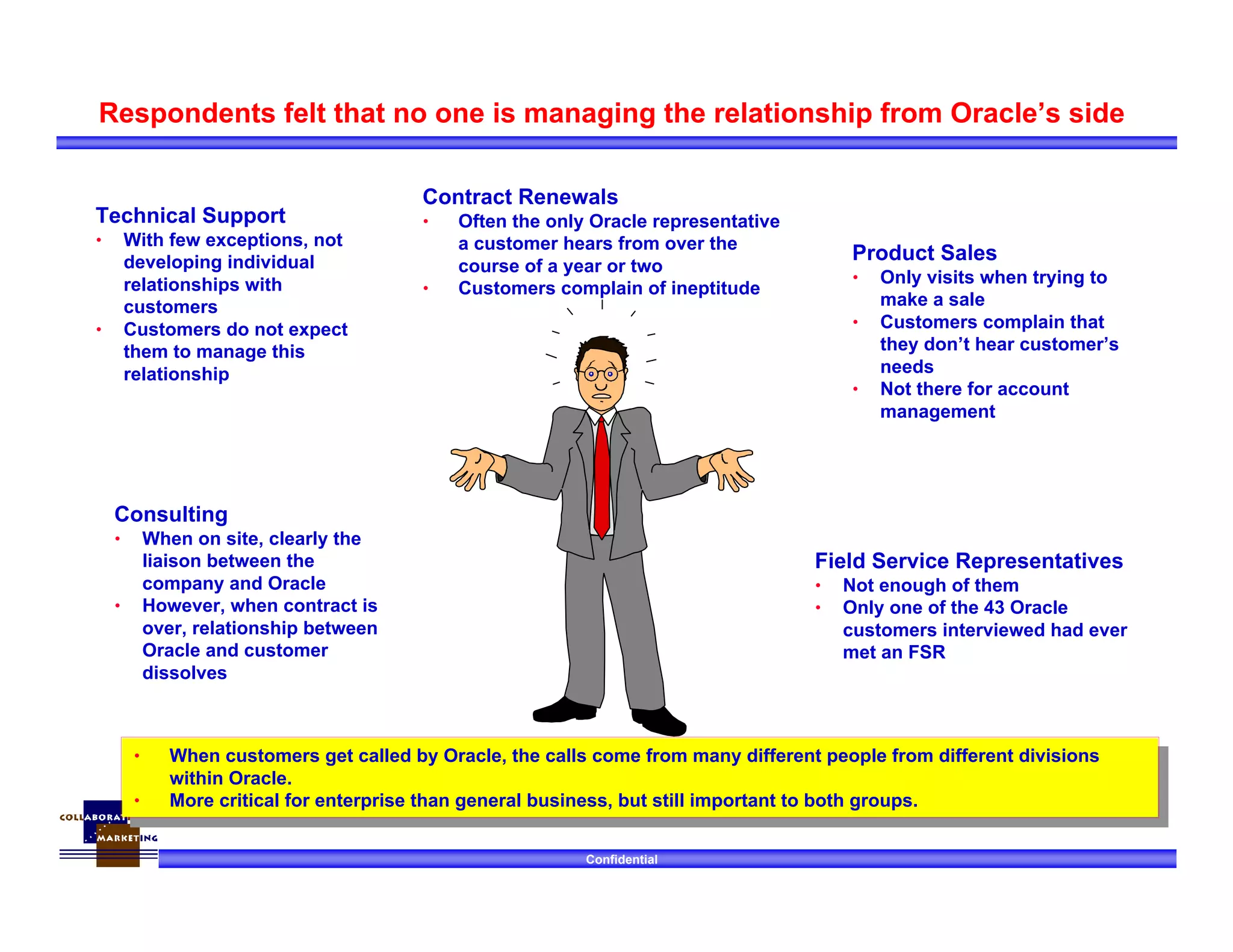

1) Oracle is not meeting high customer expectations for support quality. There is an opportunity to sell additional support services.

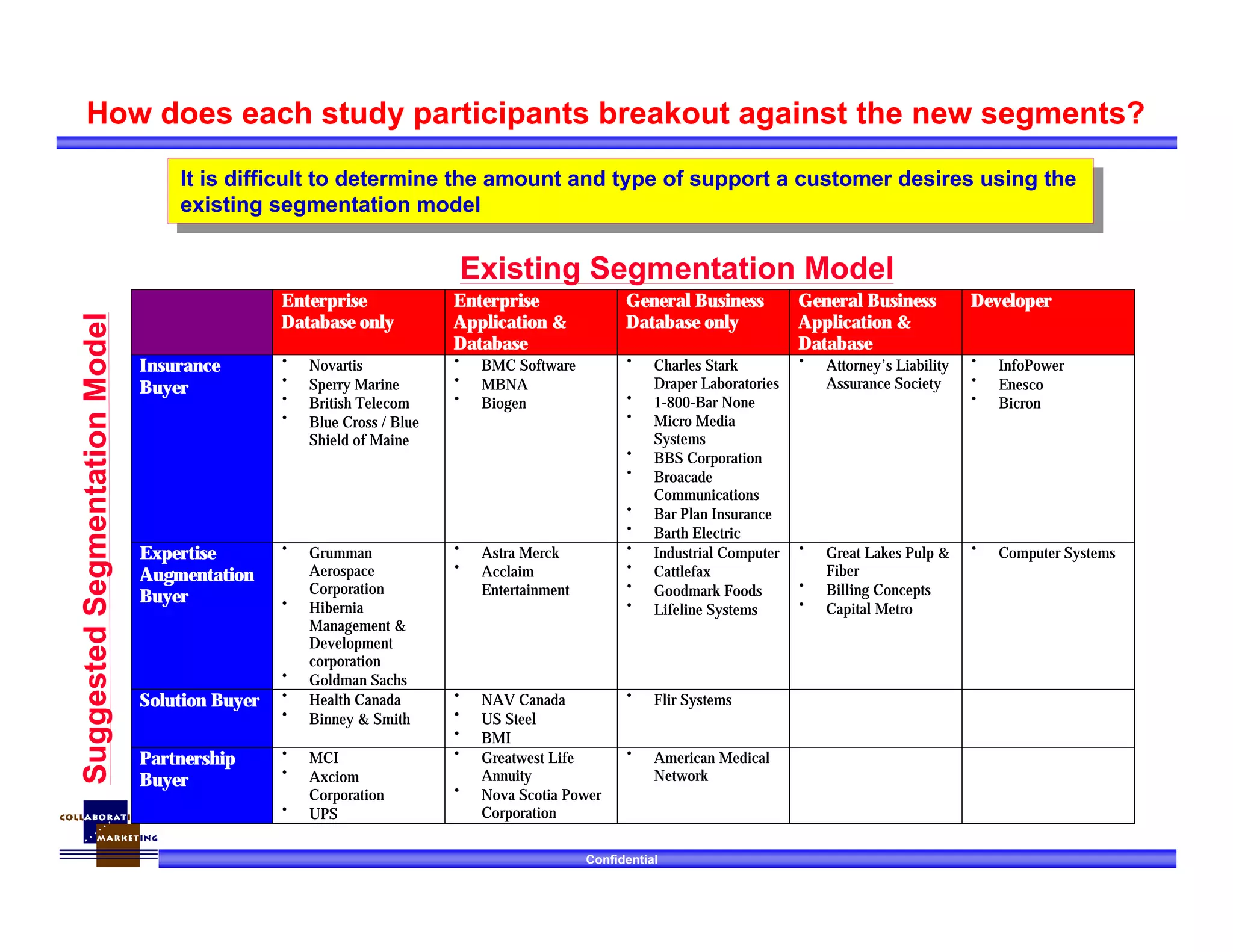

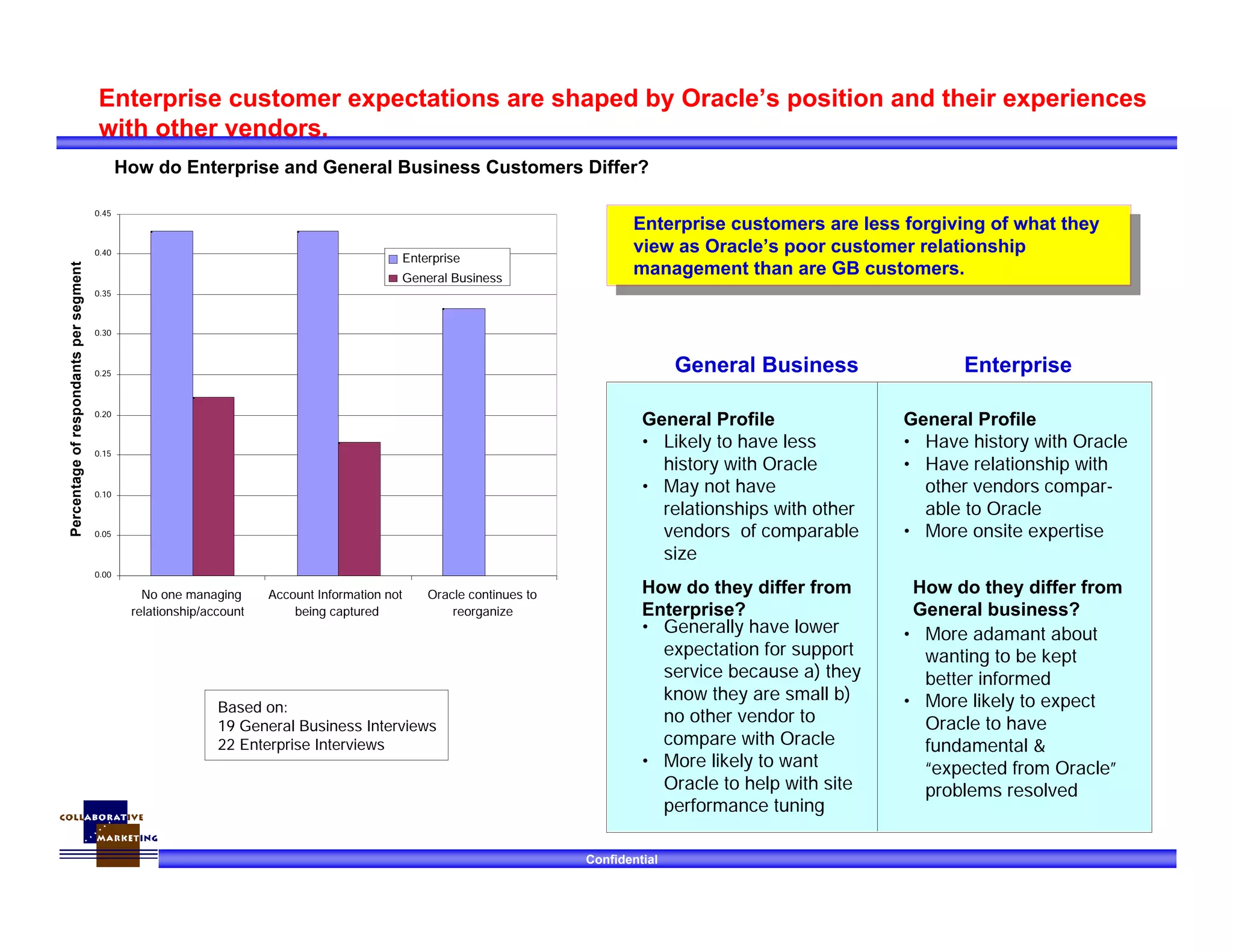

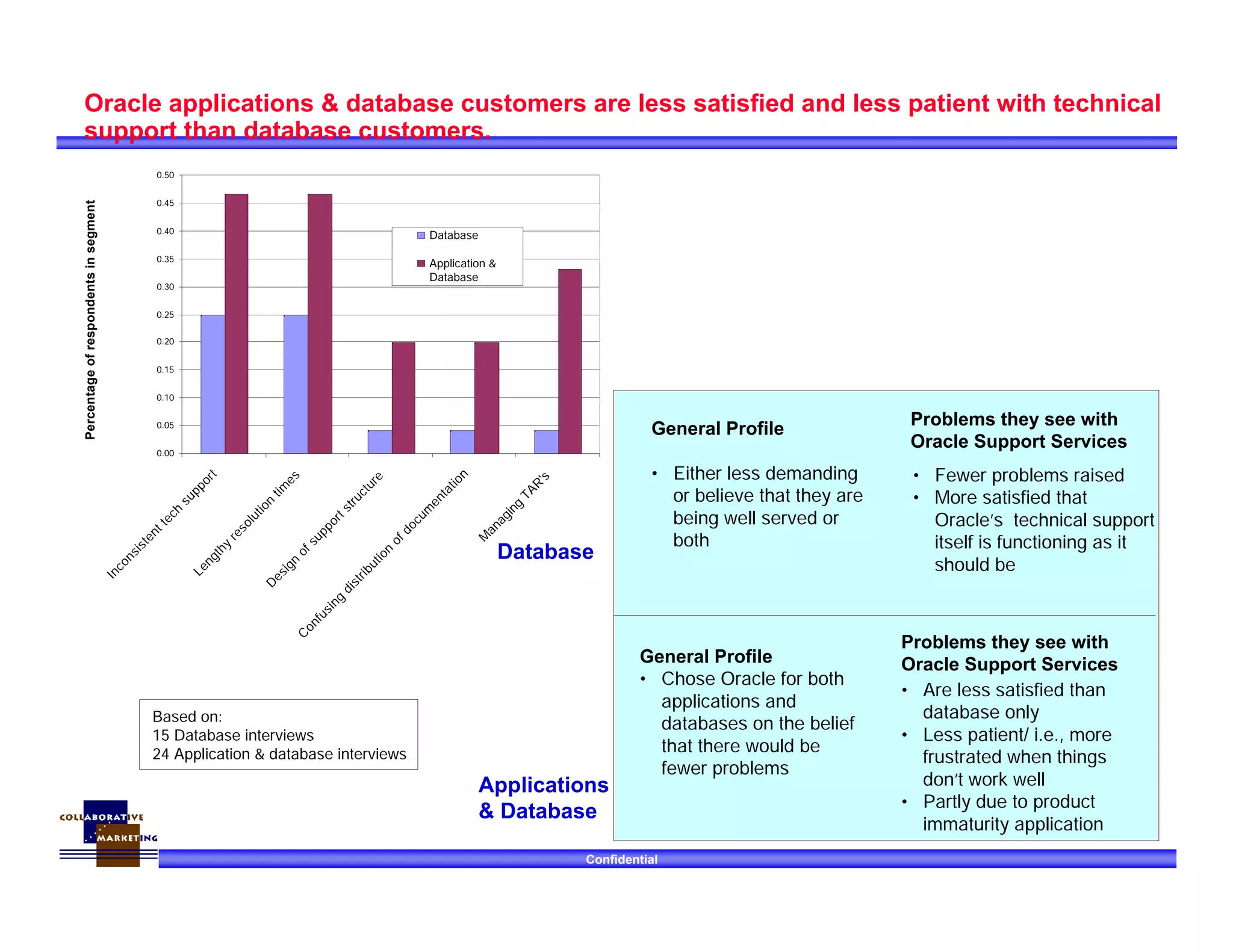

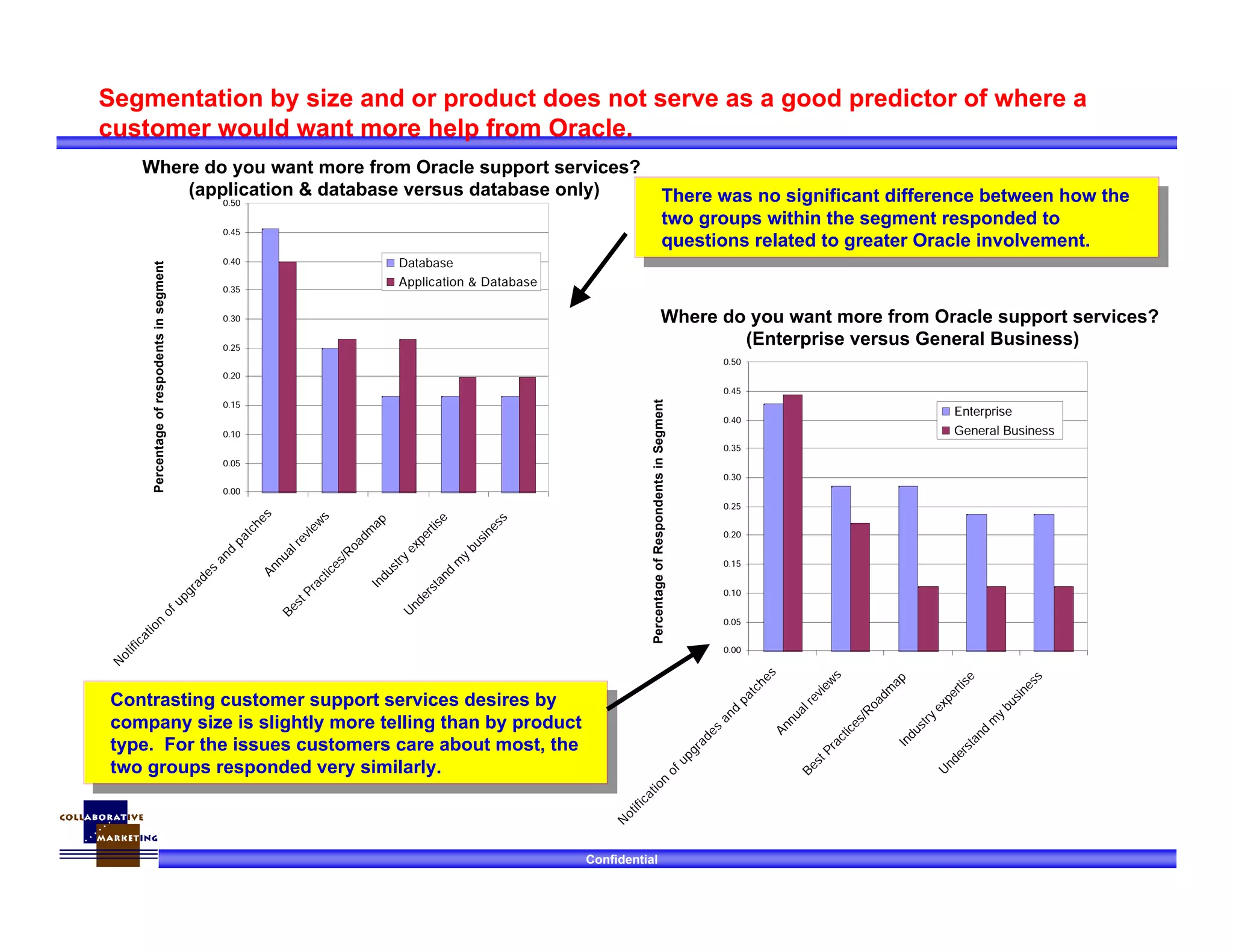

2) The current segmentation model (enterprise vs general business, database vs applications) does not accurately predict support needs.

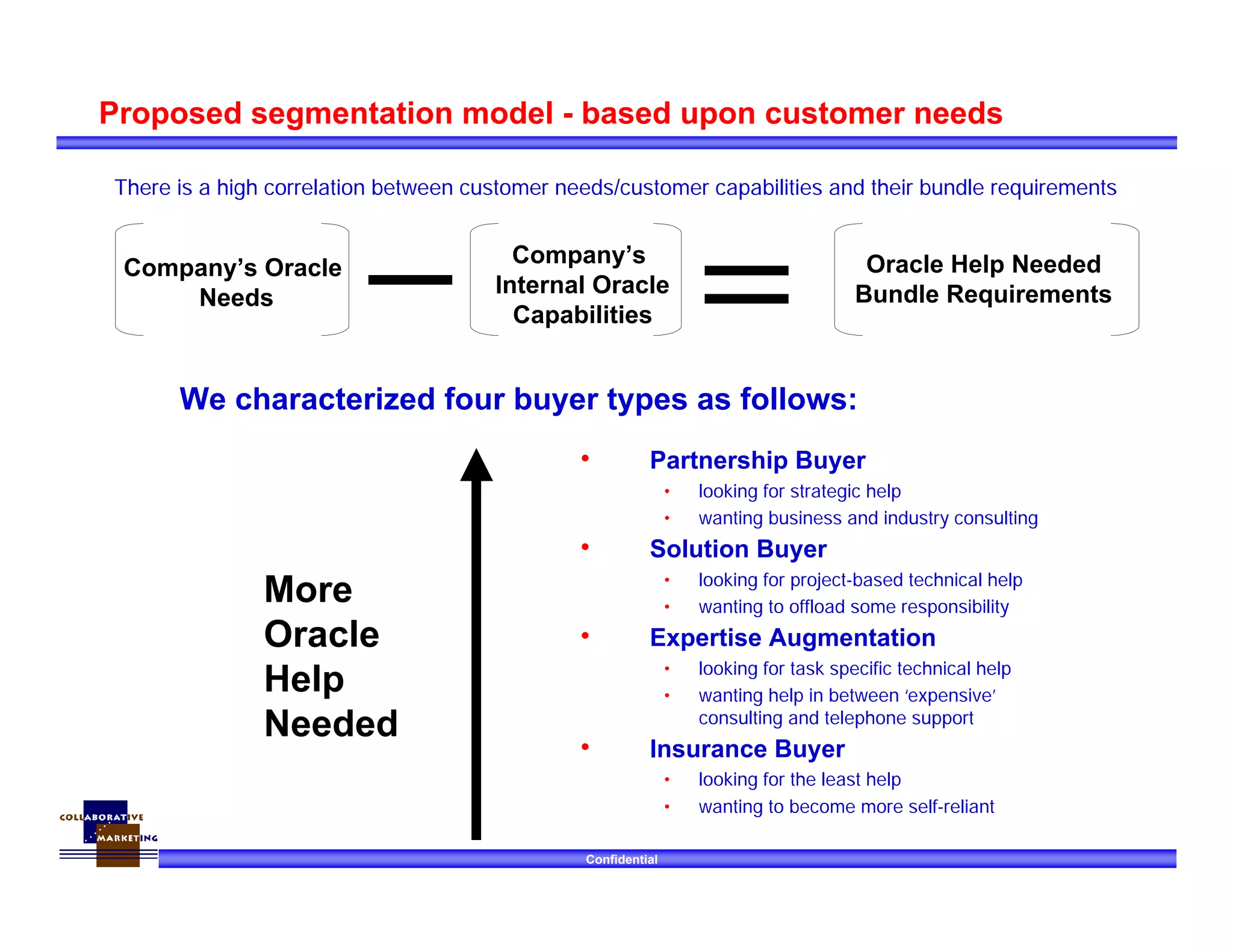

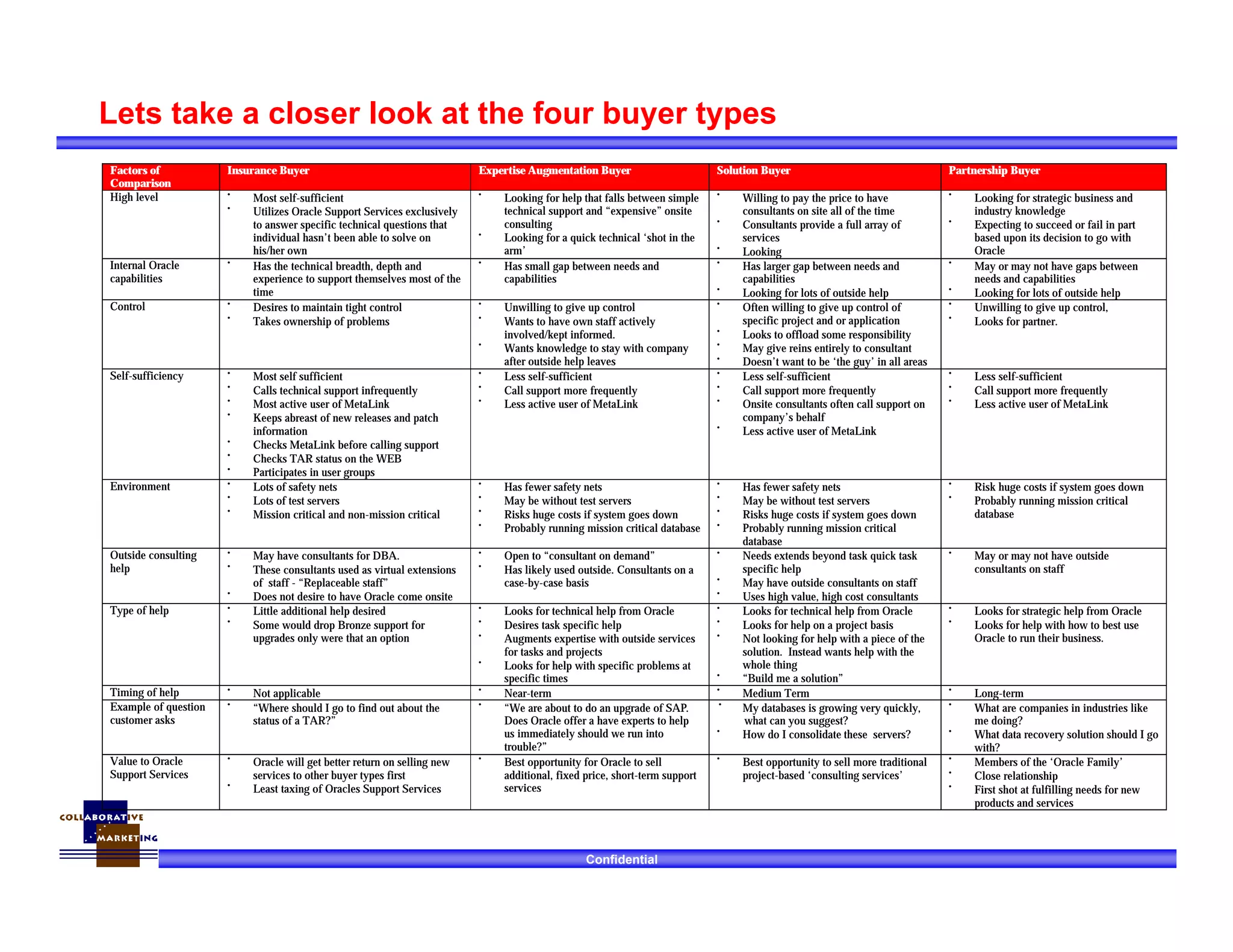

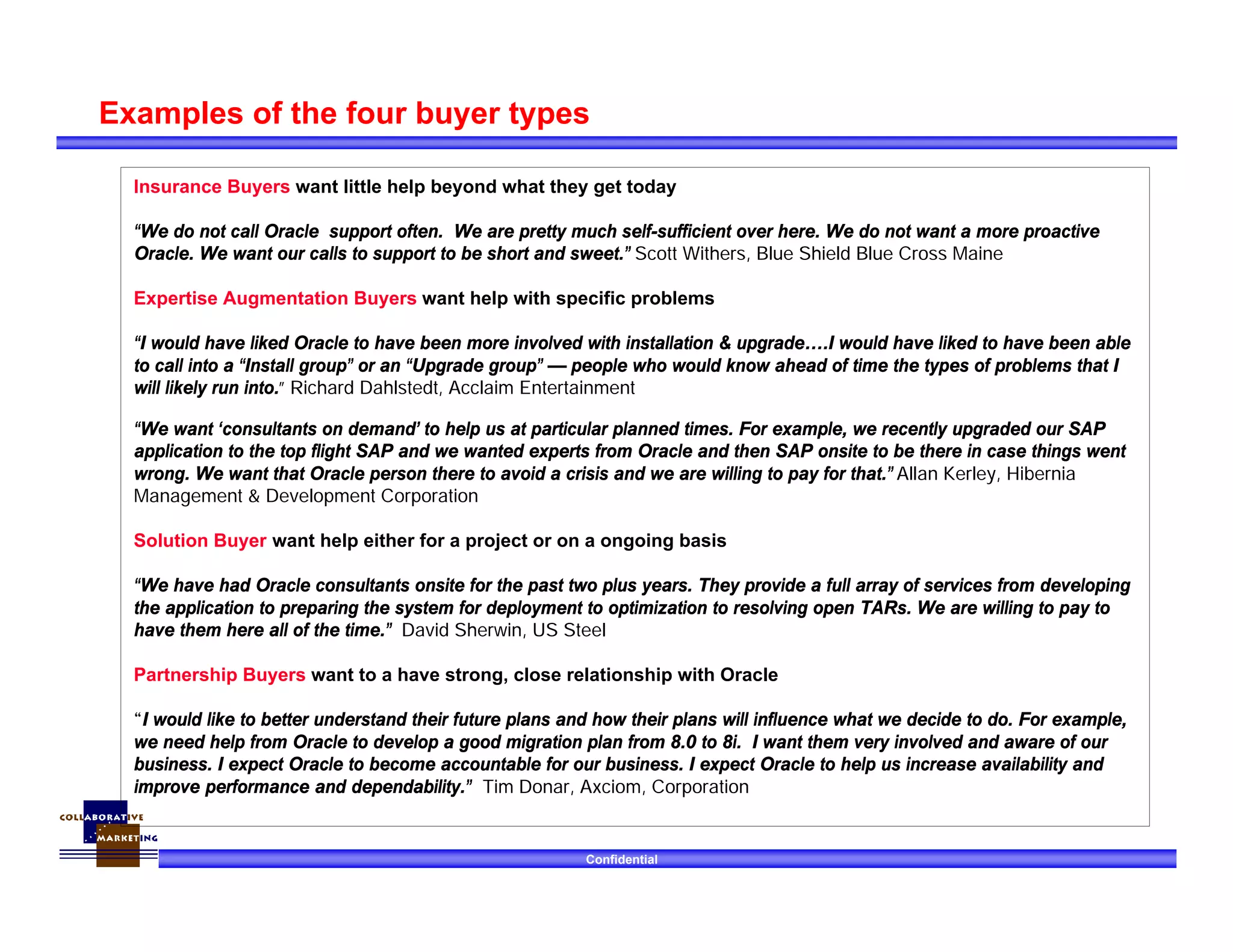

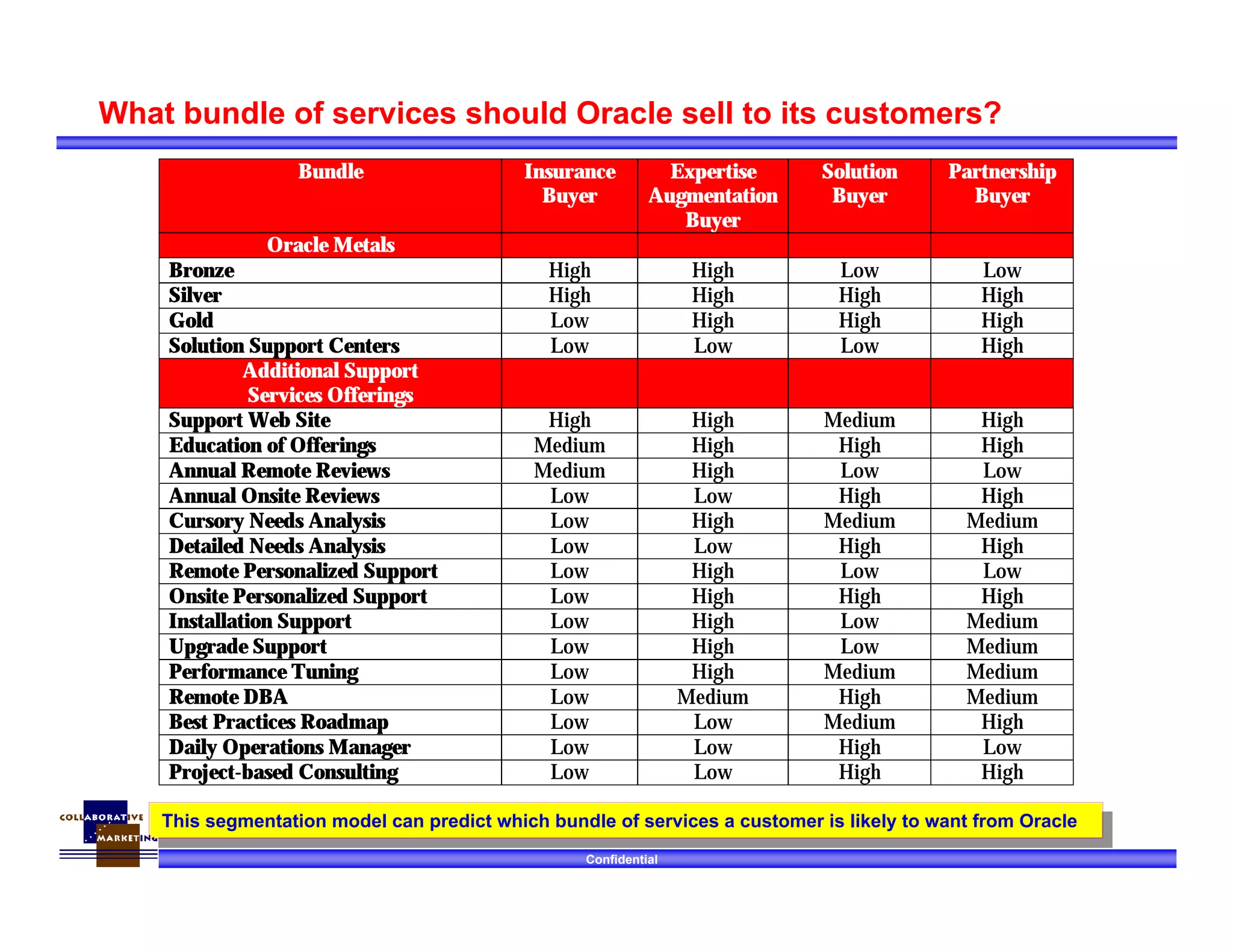

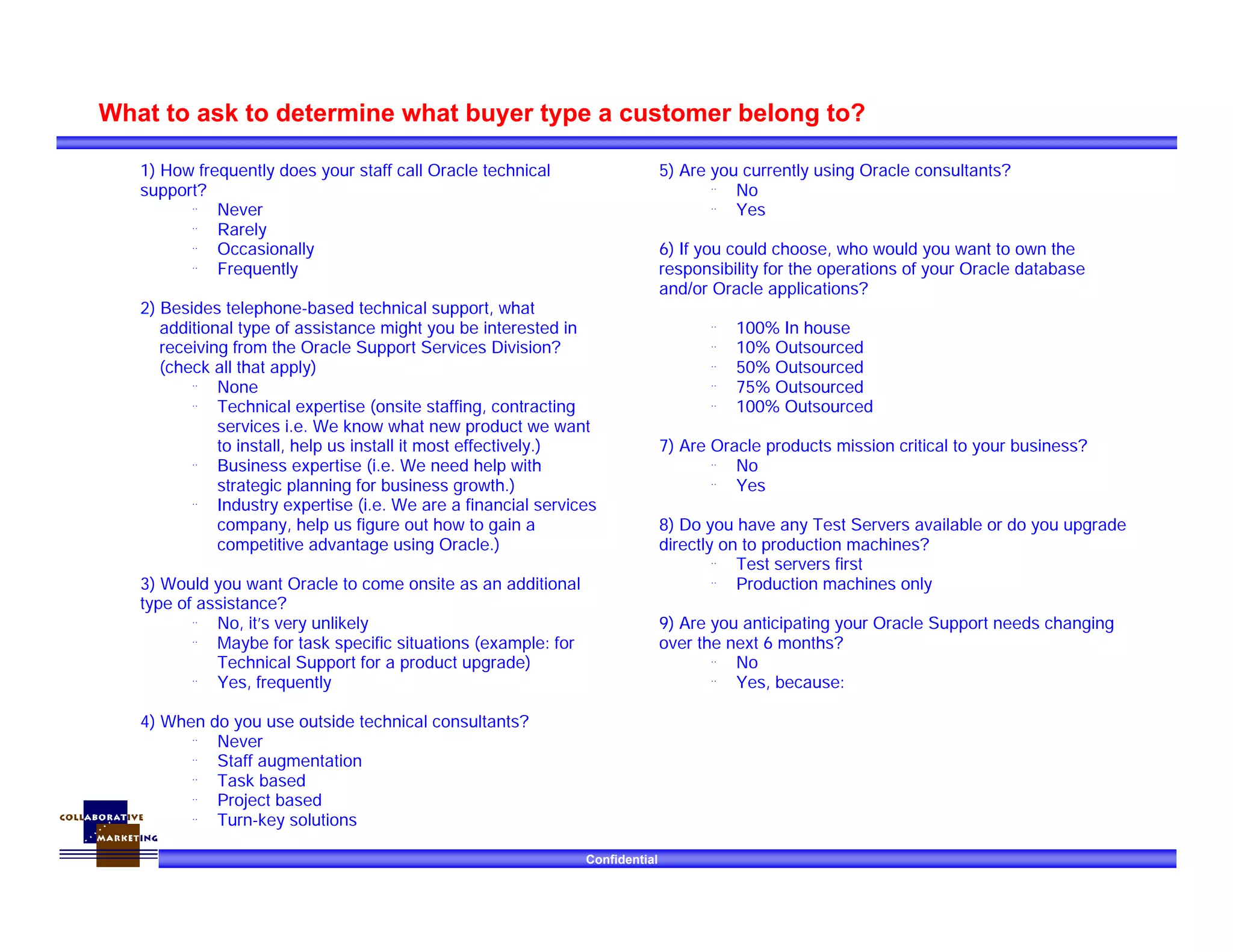

3) A better model segments customers based on their internal capabilities and support needs into: Insurance Buyers wanting minimal help; Expertise Augmentation Buyers wanting task-specific help; Solution Buyers wanting project help; and Partnership Buyers wanting strategic help.

4) Half of interviewed customers were identified as needing more support than what Oracle currently provides. The