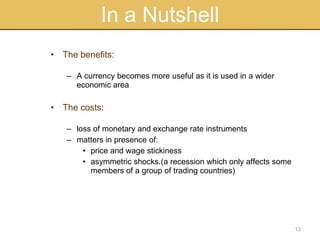

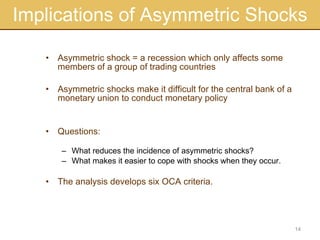

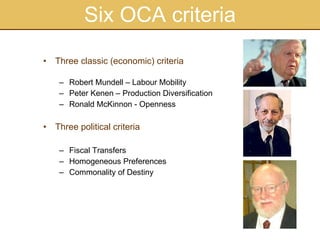

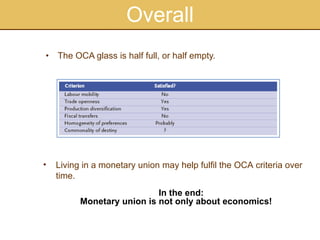

The document discusses the concept of optimum currency areas (OCA) and the challenges faced in implementing a single currency across different economic regions. It highlights the trade-offs between the benefits of a wider economic area and the risks associated with asymmetric shocks that can impact nations differently. The text outlines six criteria for successful currency unions, which include labor mobility, production diversification, openness, fiscal transfers, homogeneous preferences, and shared destiny among member countries.