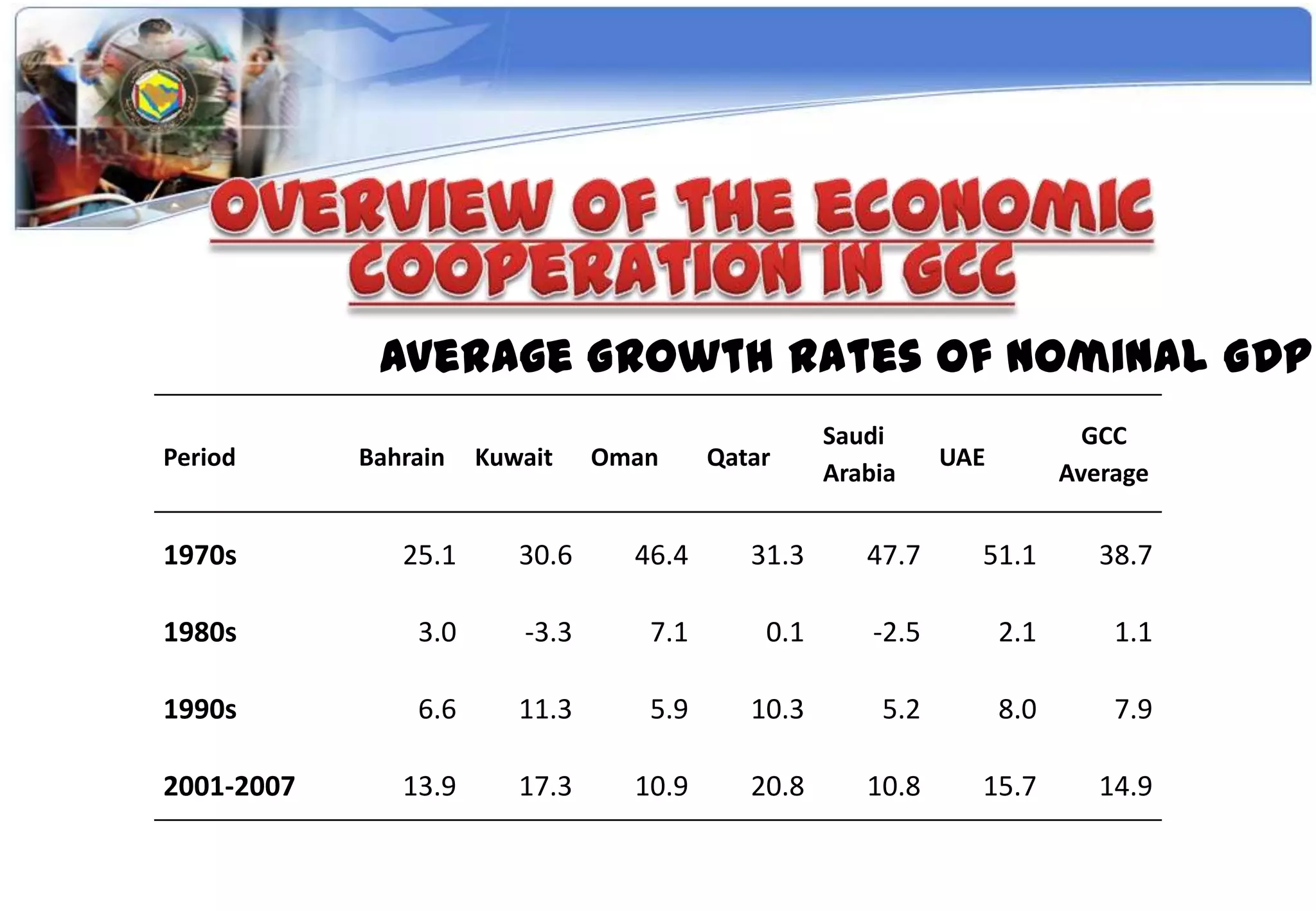

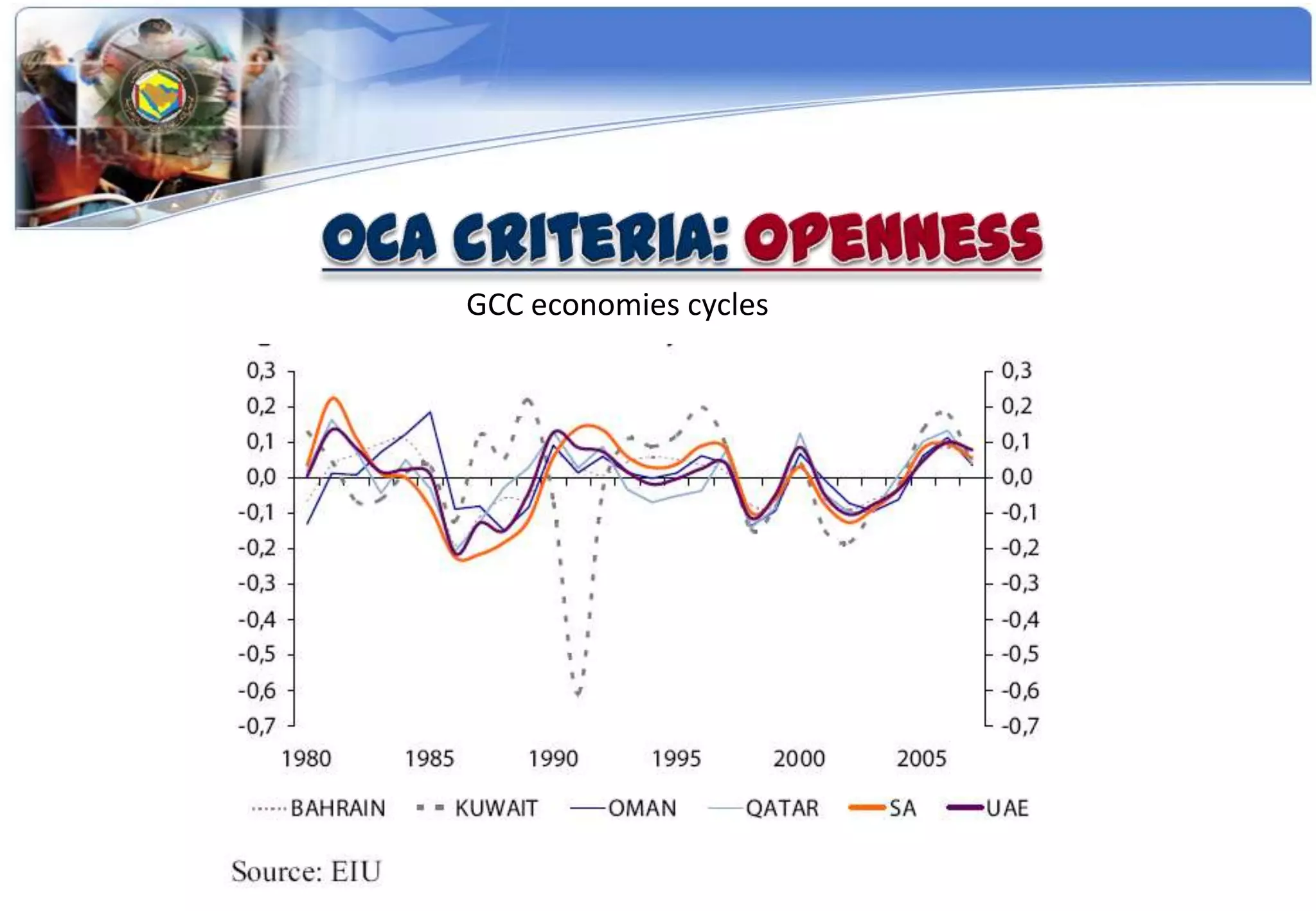

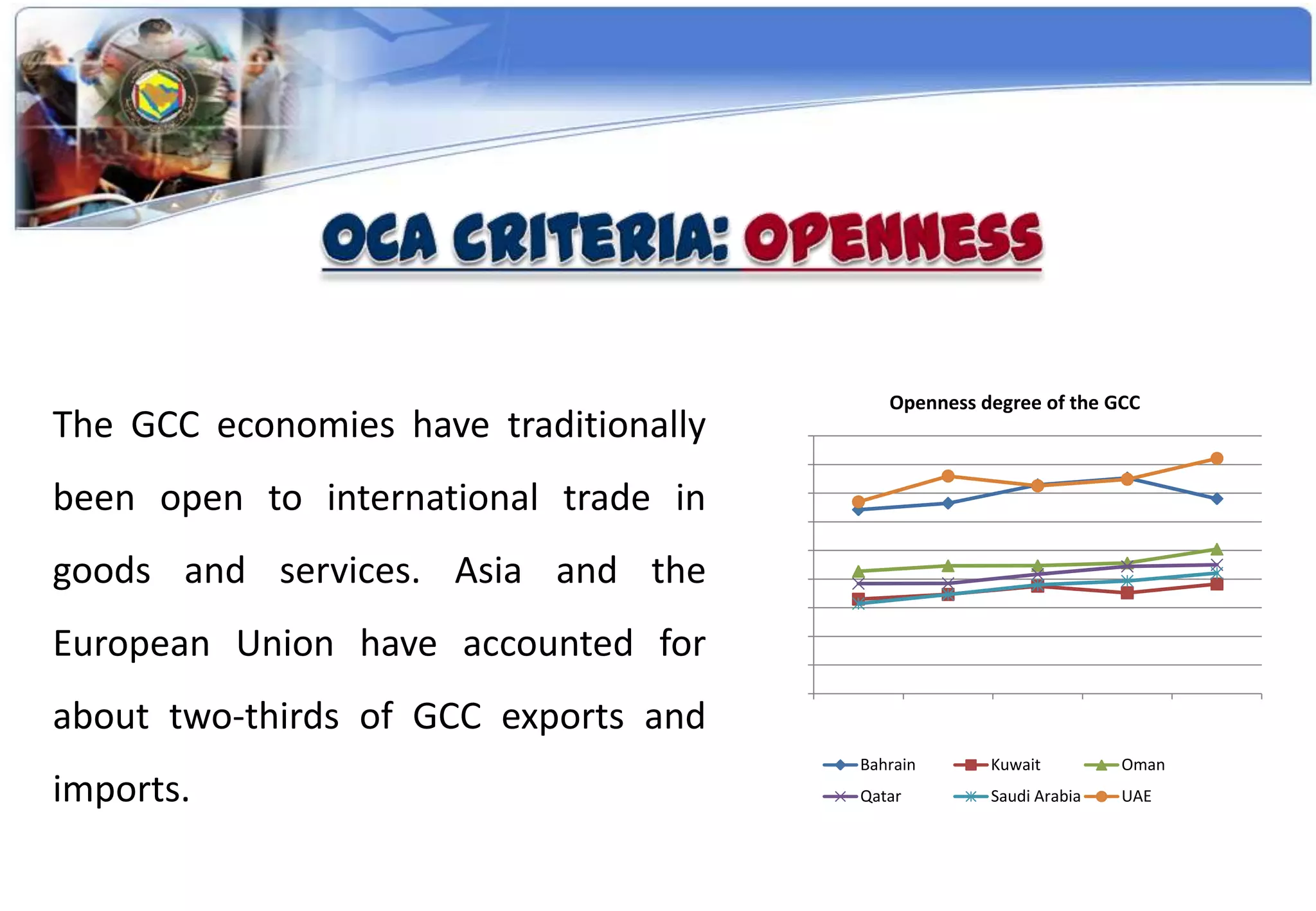

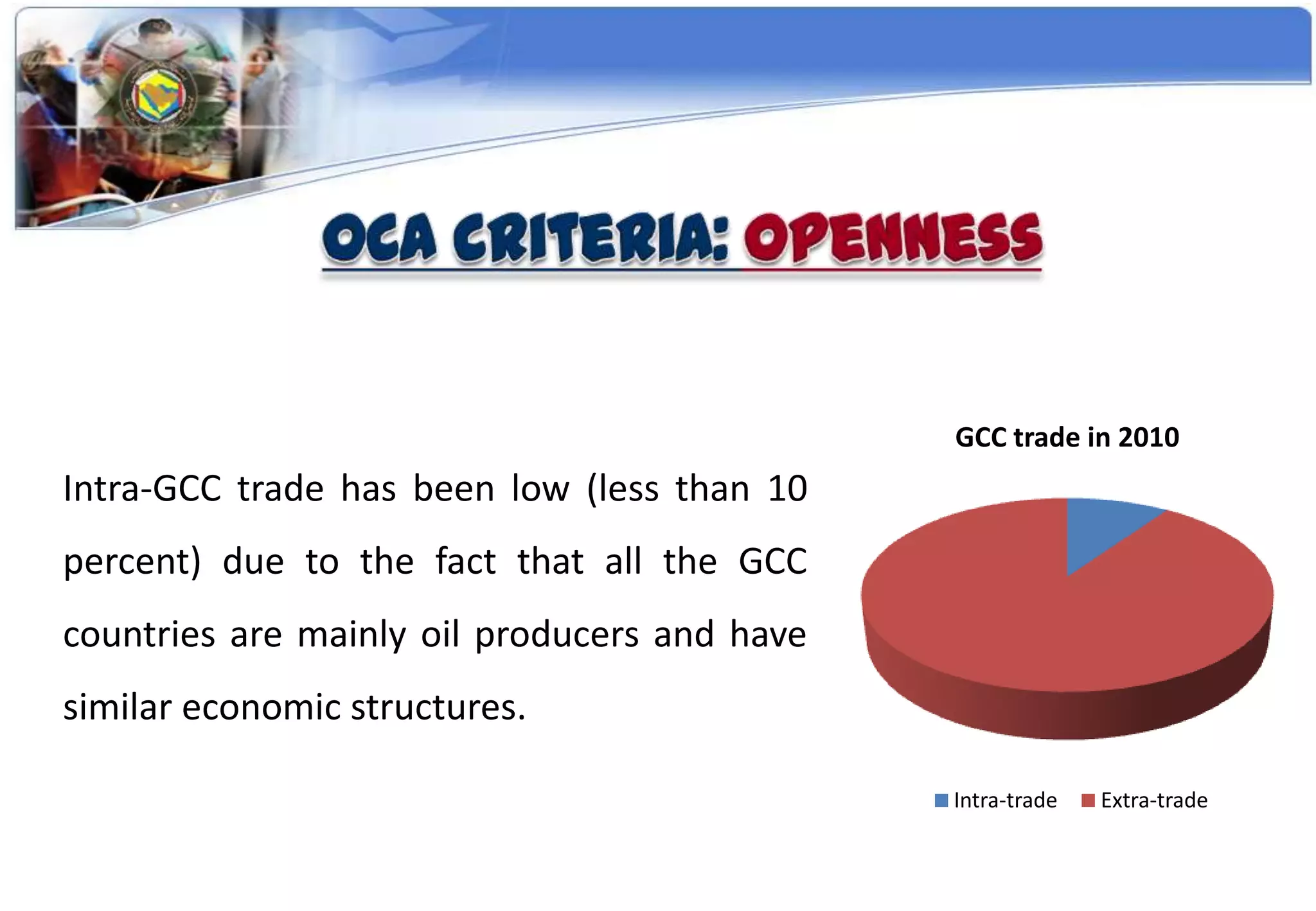

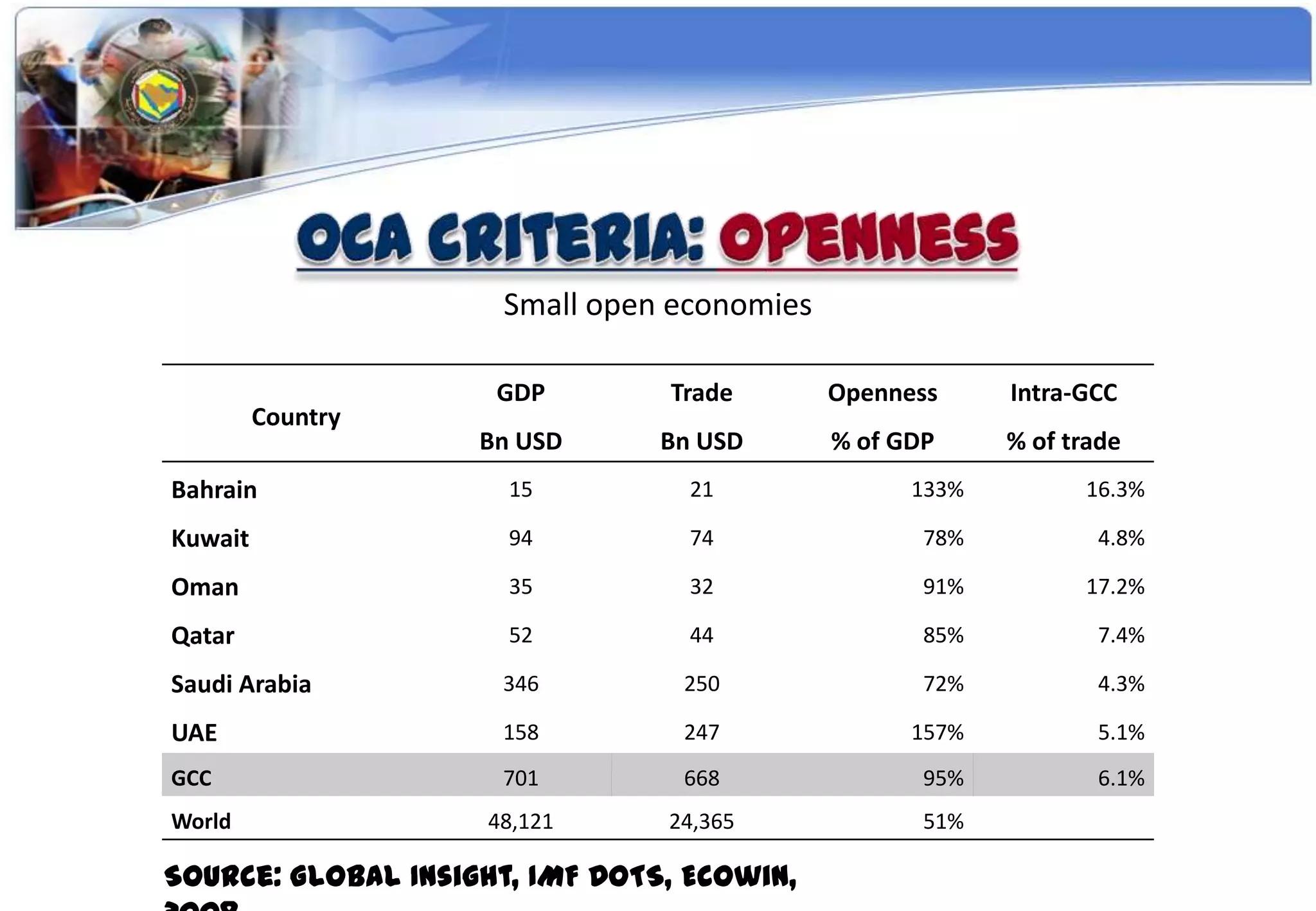

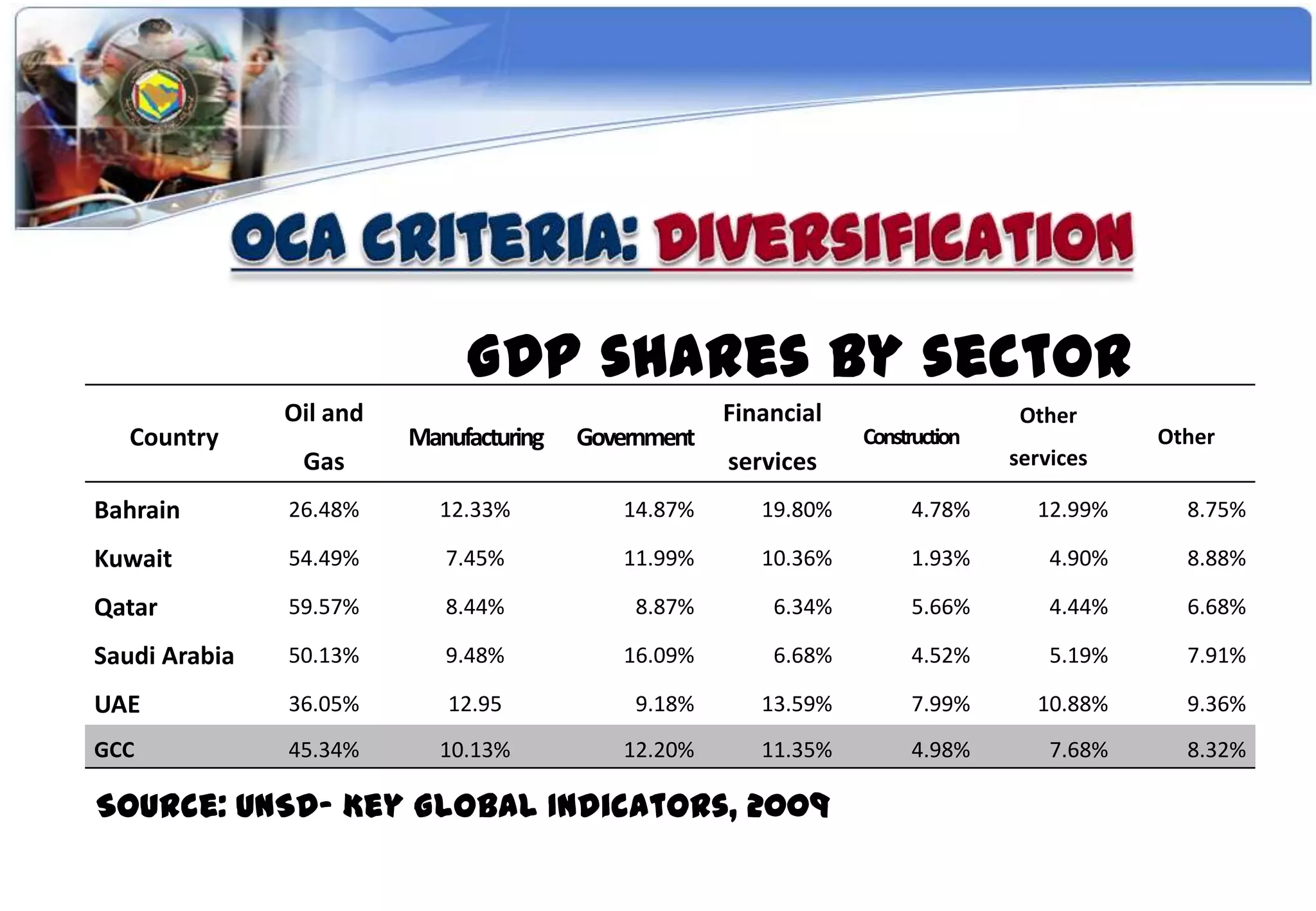

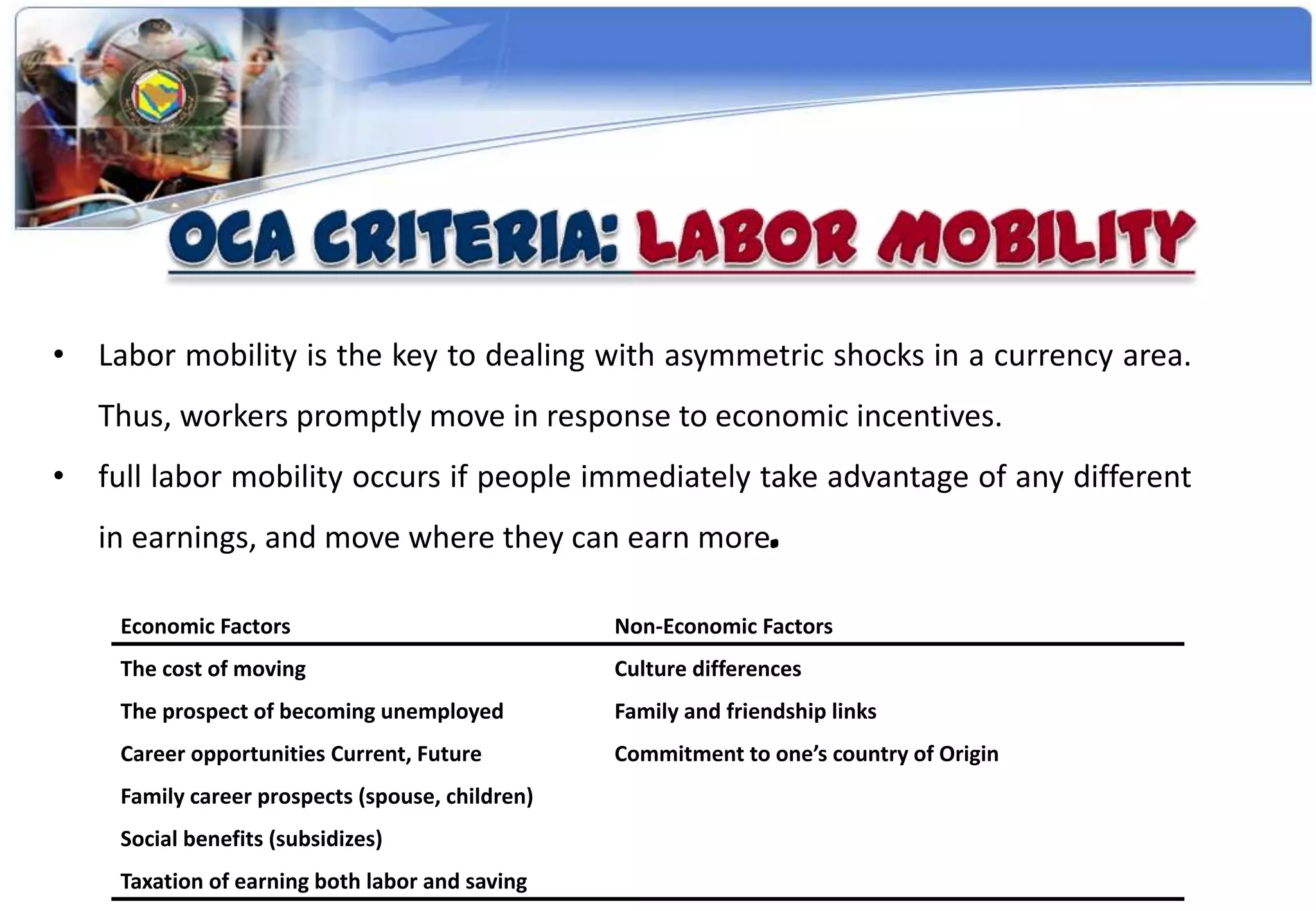

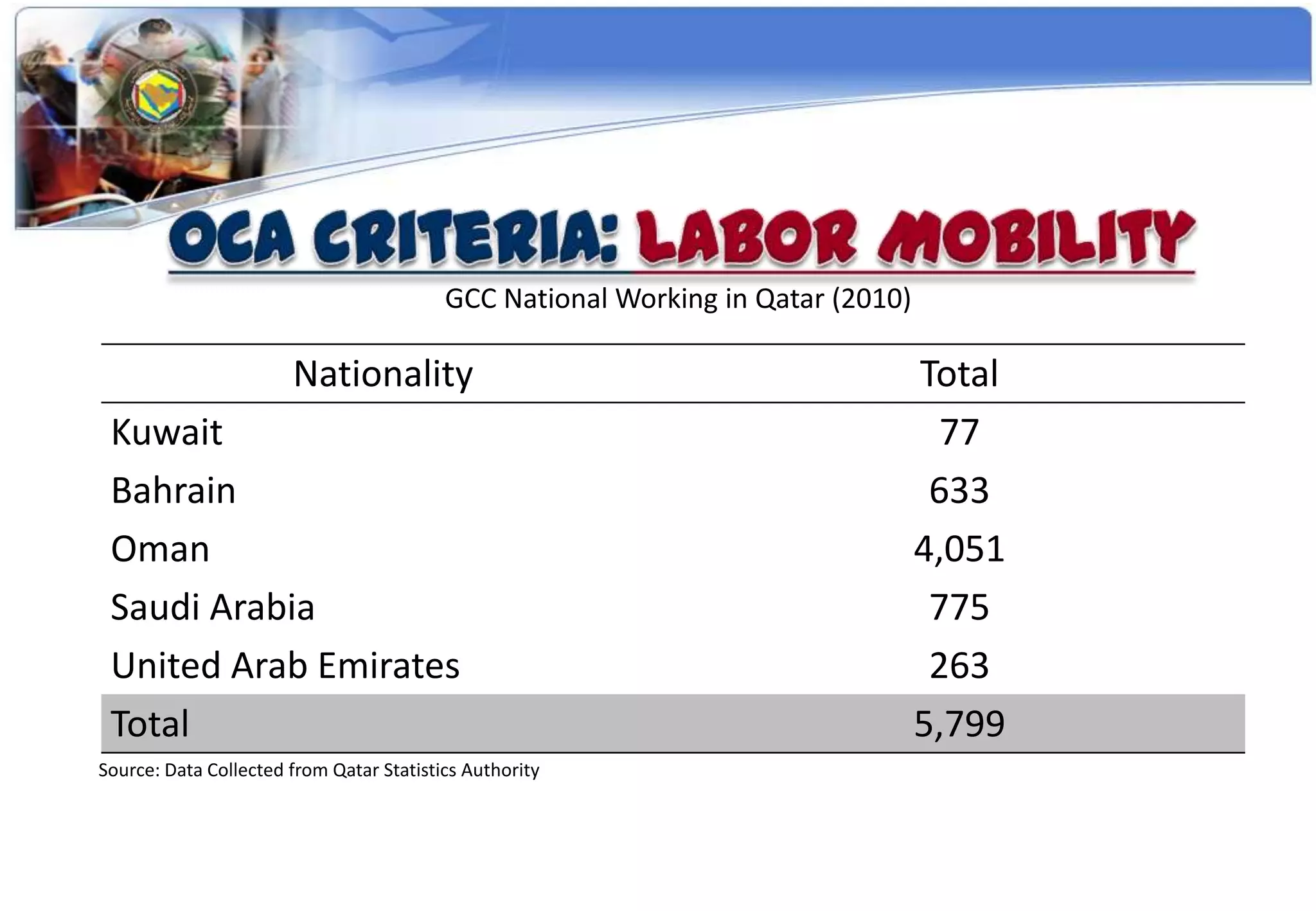

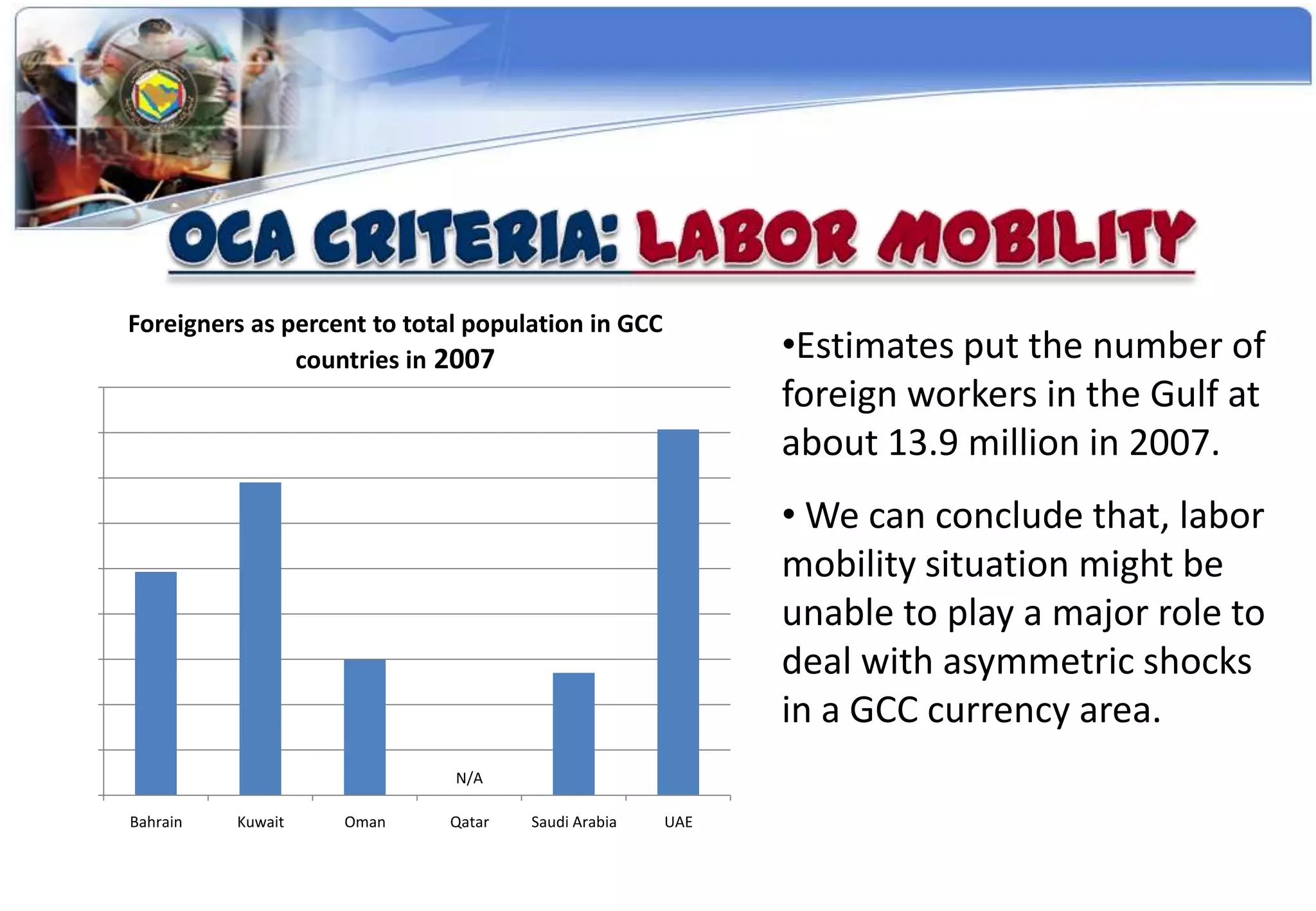

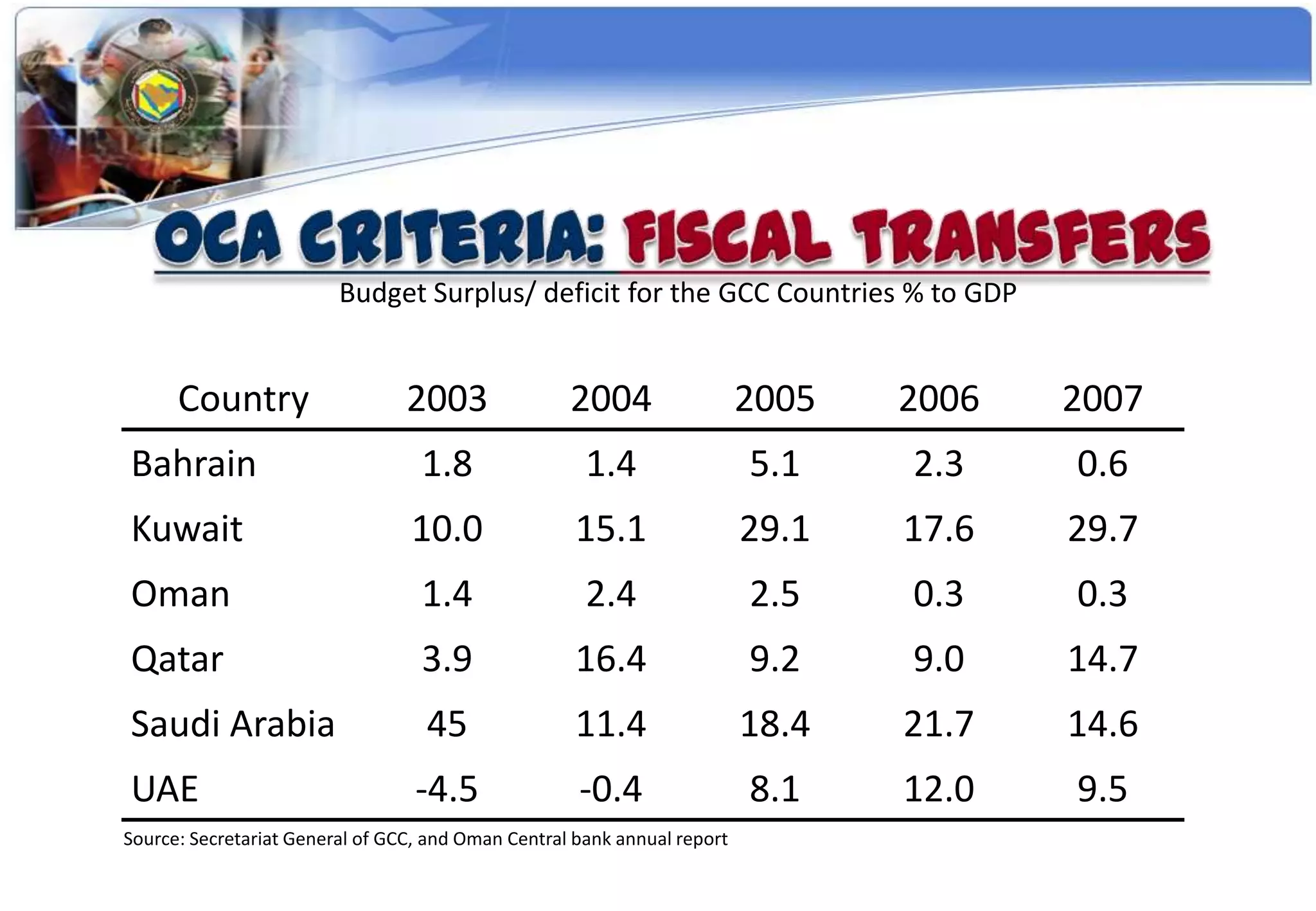

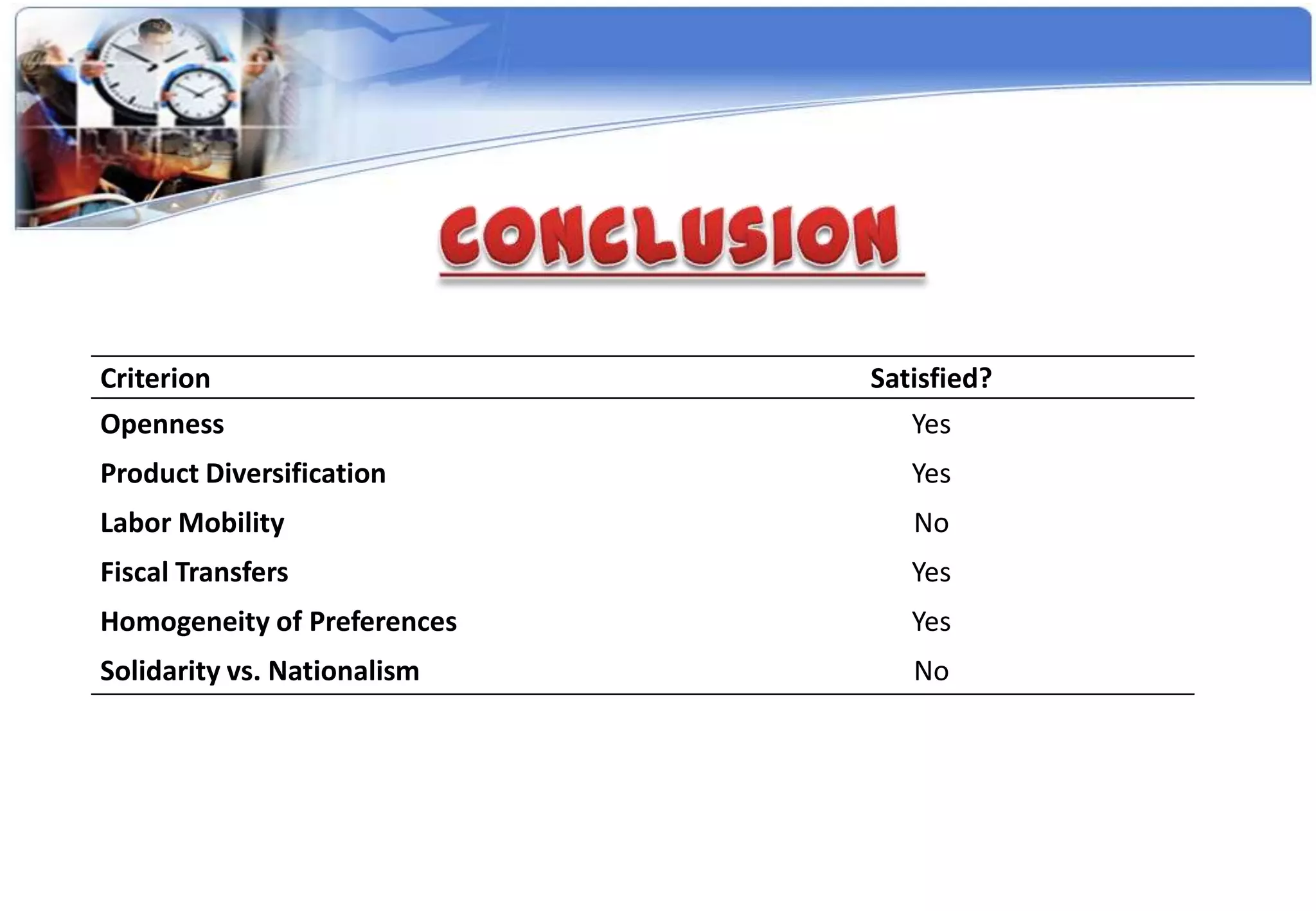

The document analyzes whether the Gulf Cooperation Council countries meet the criteria to form an optimal currency area by introducing a common currency. It discusses Mundell's theory of optimal currency areas and outlines the GCC's economic integration efforts over time. While the GCC countries meet some criteria like openness, fiscal transfers, and policy cooperation, they do not meet others like labor mobility and may lack a strong sense of solidarity due to nationalism. Overall, the document questions if the GCC is optimally suited for a currency union given its economic characteristics and political dynamics.