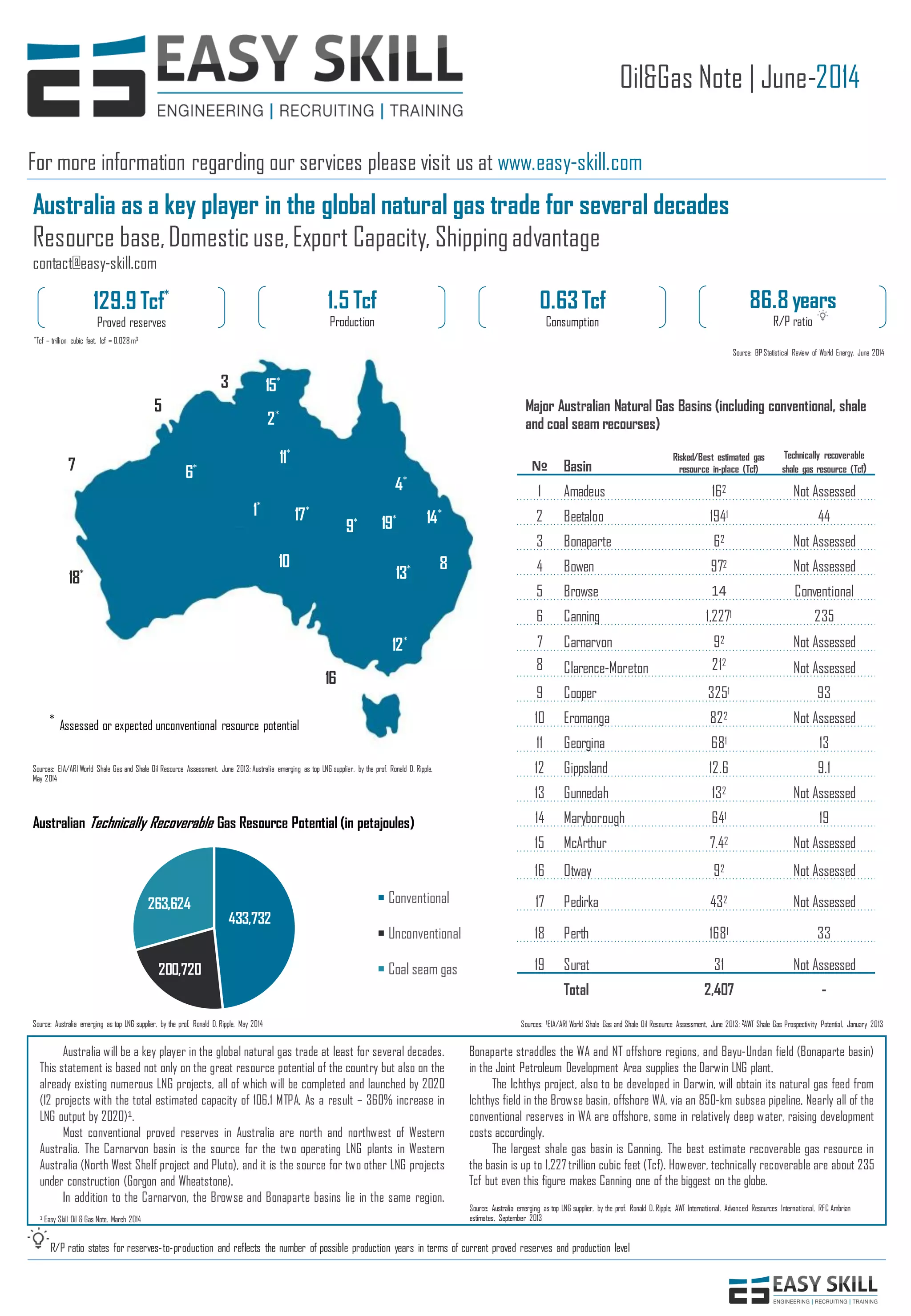

Australia has significant natural gas resources and is well positioned to be a major global exporter of LNG. It has proven reserves of 129.9 Tcf and production of 1.5 Tcf annually. By 2020, Australia will have increased its LNG export capacity by 360% through 12 new projects totaling 106.1 MTPA. Australia has a competitive advantage in shipping distances to key Asian markets like Japan and China, which helps offset its relatively high production costs. Major gas basins include Carnarvon, Browse and Bonaparte in Western Australia and the large Canning basin containing up to 1,227 Tcf of potential resource.