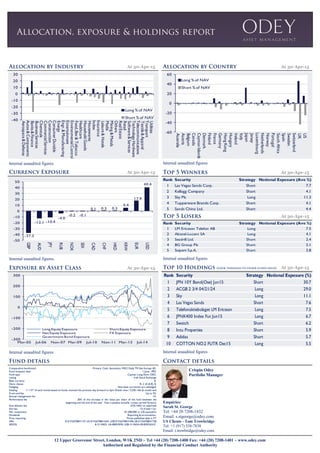

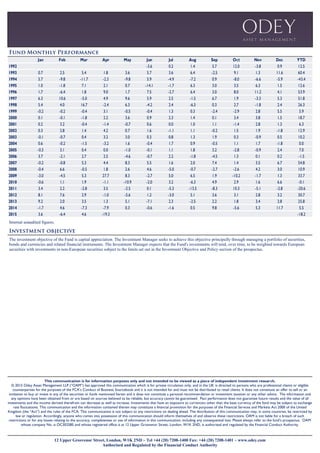

The fund lost money significantly in April (-19.3%) due to losses from its long USD position (-11.6%), short equity book (-7%), and Australian government bond positions (-0.9%). Positive individual stock positions such as Las Vegas Sands Corp. and Kellogg Company were outweighed by losses from stocks like Seadrill Ltd. and BG Group Plc. The document discusses challenges faced by the fund, changes made to reduce risk, and the manager's views on current market conditions and outlook.