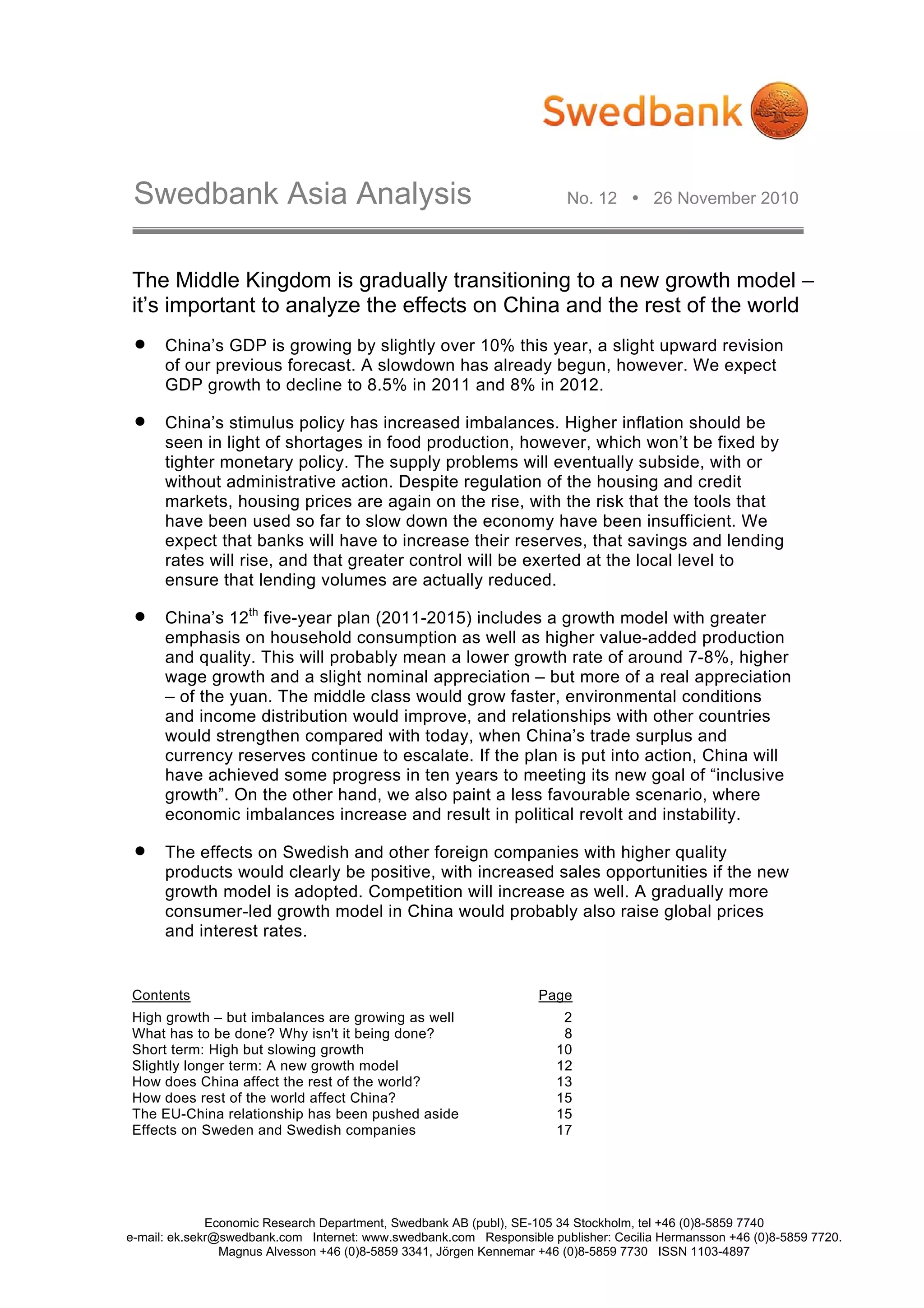

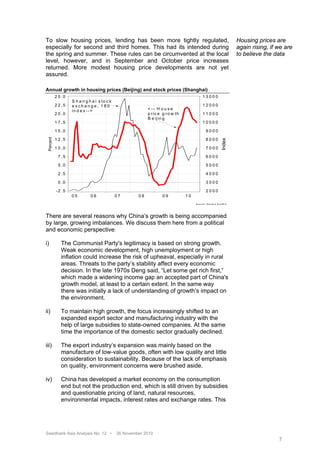

China's GDP growth is projected to slow from over 10% in 2010 to around 8% by 2012, driven by government stimulus policies that have increased economic imbalances and inflation issues. The country is aiming to transition to a new growth model emphasizing household consumption and higher quality production as outlined in its 12th five-year plan, which may lead to a more sustainable and inclusive economy. However, the potential for increased political instability looms if these imbalances worsen, affecting both domestic and global markets.