Oei dec-15

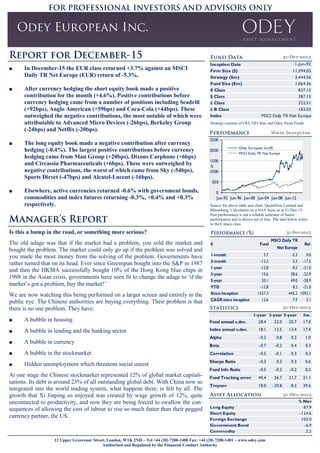

- 1. 12 Upper Grosvenor Street, London, W1K 2ND ~ Tel +44 (20) 7208-1400 Fax: +44 (20) 7208-1401 ~ www.odey.com Authorised and Regulated by the Financial Conduct Authority ■ In December-15 the EUR class returned +3.7% against an MSCI Daily TR Net Europe (EUR) return of -5.3%. ■ After currency hedging the short equity book made a positive contribution for the month (+4.6%). Positive contributions before currency hedging came from a number of positions including Seadrill (+92bps), Anglo American (+59bps) and Coca-Cola (+44bps). These outweighed the negative contributions, the most notable of which were attributable to Advanced Micro Devices (-26bps), Berkeley Group (-24bps) and Netflix (-20bps). ■ The long equity book made a negative contribution after currency hedging (-0.4%). The largest positive contributions before currency hedging came from Man Group (+20bps), Dixons Carphone (+6bps) and Circassia Pharmaceuticals (+6bps). These were outweighed by negative contributions, the worst of which came from Sky (-54bps), Sports Direct (-47bps) and Alcatel-Lucent (-16bps). ■ Elsewhere, active currencies returned -0.6% with government bonds, commodities and index futures returning -0.3%, +0.4% and +0.3% respectively. Source for above table and chart: Quintillion Limited and Bloomberg. Calculation on a NAV basis as at 31-Dec-15. Past performance is not a reliable indicator of future performance and is shown net of fees. The data below refers to the € share class. Is this a bump in the road, or something more serious? The old adage was that if the market had a problem, you sold the market and bought the problem. The market could only go up if the problem was solved and you made the most money from the solving of the problem. Governments have rather turned that on its head. Ever since Greenspan bought into the S&P in 1987 and then the HKMA successfully bought 10% of the Hong Kong blue chips in 1998 in the Asian crisis, governments have seen fit to change the adage to ‘if the market’s got a problem, buy the market!’ We are now watching this being performed on a larger screen and entirely in the public eye. The Chinese authorities are buying everything. Their problem is that there is no one problem. They have: ■ A bubble in housing ■ A bubble in lending and the banking sector ■ A bubble in currency ■ A bubble in the stockmarket ■ Hidden unemployment which threatens social unrest At one stage the Chinese stockmarket represented 12% of global market capitali- sations. Its debt is around 23% of all outstanding global debt. With China now so integrated into the world trading system, what happens there, is felt by all. The growth that Xi Jinping so enjoyed was created by wage growth of 12%, quite unconnected to productivity, and now they are being forced to swallow the con- sequences of allowing the cost of labour to rise so much faster than their pegged currency partner, the US. Strategy consists of OEI, OEI Mac and Odey Swan Funds. Inception Date Firm Size ($) 11,594.05 Strategy ($m) 2,444.56 Fund Size (€m) 1,064.36 € Class 837.15 $ Class 387.15 £ Class 322.51 £ B Class 183.03 Index MSCI Daily TR Net Europe 31-Dec-2015 1-Jun-92 Since Inception 0 500 1000 1500 2000 2500 Jun-92 Jun-96 Jun-00 Jun-04 Jun-08 Jun-12 % Odey European Inc(€) MSCI Daily TR Net Europe € Fund MSCI Daily TR Net Europe Rel. 1-month 3.7 -5.3 9.0 3-month -12.2 5.3 -17.5 1-year -12.8 8.2 -21.0 3-year 15.6 38.6 -22.9 5-year 20.1 49.0 -28.9 YTD -12.8 8.2 -21.0 Since Inception 1537.3 445.2 1092.1 CAGR since inception 12.6 7.5 5.1 31-Dec-2015 1-year 3-year 5-year Inc. Fund annual s.dev. 28.4 22.0 20.7 17.0 Index annual s.dev. 18.1 12.5 13.4 17.4 Alpha -0.2 0.8 0.2 1.0 Beta -0.7 -0.2 0.4 0.3 Correlation -0.5 -0.1 0.3 0.3 Sharpe Ratio -0.3 0.3 0.3 0.6 Fund Info Ratio -0.5 -0.2 -0.2 0.2 Fund Tracking error 40.4 26.7 21.7 21.1 Treynor 18.0 -20.8 8.3 39.6 31-Dec-2015 31-Dec-2015 % Nav Long Equity 87.9 Short Equity -124.6 Foreign Exchange 102.0 Government Bond -6.9 Commodity 2.2

- 2. 12 Upper Grosvenor Street, London, W1K 2ND ~ Tel +44 (20) 7208-1400 Fax: +44 (20) 7208-1401 ~ www.odey.com Authorised and Regulated by the Financial Conduct Authority For the rest of the world a sizeable devaluation of the RMB will be uncomfortable. With the world in overcapacity in al- most everything, the battle is on as to where that capacity gets junked. The Chinese would like everybody else’s to be that victim. Currency wars lead to trade wars. The fall in the oil price has been good news for the consumer in the west and last year saw a 34% increase in petrol demand in the US. Everybody filled their tanks to the brim. However the benefit has not been as great as expected. Perhaps because since 2009 most new employees have been denied private medical insurance by their employers, the savings ratio has been rising to temper the benefits of a lower oil price. Else- where the oil price decline has as yet not seen a commensurate tightening of belts by the oil producing countries. They have preferred to carry on producing the oil in large quantities and suffer commensurate losses. As a result the sovereign wealth funds, 70% of which were oil producers, have experienced large out flows. Saudi Arabia has seen $60 billion withdrawn from bond and equity investments over the last year, $37 bil- lion fled Russia in December alone! This sharp selling of as- sets into relatively illiquid markets has made these markets vulnerable to the downside. It has not been helped by individ- uals in the US becoming big sellers of shares and EM bonds in the last quarter. Governments can try and keep these markets up by buying like the Chinese are. But here again they are not buying cheap as- sets. The Chinese are buying shares on 4X book value, stock- markets globally are on P/Es of nearly 20X. Bonds have never been more expensive. No wonder that George Osborne has been visibly warning that a cocktail of dangers and headwinds are coming our way and that we appear to be facing them armed only with a sense of entitlement and a lack of financial discipline. And now we come to the crux of today’s events; central bankers have been worried since 2009, when they lowered interest rates to zero, that by getting rid of the cost of money they would encourage dangerous and speculative behaviour. However they were qui- etly happy that the near death experience for many borrowers in 2008 kept them disciplined in their borrowing and their be- haviour, even as the world recovered. However since 2012 there have been growing examples of dangerous behaviour. In banking there is always incipient bad behaviour in the form of what we, in Europe, call syndicated lending and in the US is called leveraged loans. The lending bank lends 100% against a development, usually involving property, in which the devel- oper puts up no equity. The loan is then syndicated between nine other banks, but it can be more or less, and the initiating bank collects a 5% upfront fee for the placing. The idea of a 5% fee for a 10% loan advance is just too appetising. However of course, the bank then has to take other banks’ loans so it never works out quite so sweetly. Typically the loss when the music stops on this kind of lending is 50% of the value of the loan. This type of lending arose like a weed in 2013 and 2014 but has recently been discouraged. Today central banks are worried in the US and UK by the growth of unsecured lending – 12% p.a. in the US, 9% in the UK. This is mostly auto loans but again with large risks attached. In areas of the world in which bank lending is the major source of credit, central banks can introduce ‘macroprudential measures’ which effectively cause interest rates to rise in those areas of lending regarded as being unwise. The Fed has a problem in this regard. Unlike its counterparts elsewhere, it cannot use ‘macroprudential measures’ to chas- tise the offending banks because in the US banks only repre- sent 40% of credit. Thus faced with ill-discipline the only an- swer is higher and rising interest rates. Quite separately from disciplining ill-disciplined lending, since 2012 Fischer and Bullard and several other Fed members have increasingly been of the view that higher interest rates overall may be the answer to creating a world of higher infla- tion. Higher interest rates, prices, wages and then higher rates is the cycle of the 1970s. Such a cycle is full of benefits for the Fed because rising interest rates stop borrowing growing, whilst higher wages can allow real not nominal interest rates to go negative even as nominal rates go higher. Such a policy is a reversal of everything that Greenspan instigated all those years ago and most importantly for markets, means that the Fed would raise interest rates into a falling stockmarket, pro- vided wages were responding by continuing to rise! Now it still remains to be seen just how many of the Fed mem- bers are in agreement with what is essentially a new policy. It is also important that Yellen is in agreement. But it rhymes with everything that Osborne is saying here about higher inter- est rates; and maybe their vision is that now, with the banks in good shape, the US could suffer a recession without too much trouble. They may also believe that the wealth effect of the lower oil price offsets the effect of a falling stockmarket. Meanwhile credit conditions continue to deteriorate in the US. High yield bonds continue to sell off, loan officers continue to insist on tighter covenants. All of this points to a more violent year than investors are expecting. With S&P profits already falling for 12 months, markets are fragile. Higher wages mean lower profit margins going forward. So how much could mar- kets fall by? Most bear markets take out the last five years’ of gain. Valuations are high. A 40% fall will bring the S&P back towards a 10X multiple, which will be good value but by then earnings will be difficult to measure. The bulls hope that the weak oil price will extend the cycle and China will close down all offending asset classes. They will hope that governments will support asset prices, having realised that there is no equality before the low for them. Ra- ther more ‘buy-di-buy’ than ‘hello a low’ has been their old refrain. However for those who trust not in princes, the future looks for now more bleak. Remember though, that these crises do provide opportunities. It just pays not to be too early.

- 3. 12 Upper Grosvenor Street, London, W1K 2ND ~ Tel +44 (20) 7208-1400 Fax: +44 (20) 7208-1401 ~ www.odey.com Authorised and Regulated by the Financial Conduct Authority Charts above shows non-base currency exposures through forward currency contracts 31-Dec-15 31-Dec-15 31-Dec-15 31-Dec-15 Comparative benchmark Primary: Cash, Secondary: MSCI Daily TR Net Europe (€) Fund inception date 1 June, 1992 Fund type Cayman Long-Short OEIC Listing Irish Stock Exchange Base currency € Share classes €, £ (A & B), $ Hedging Non-base currencies are unhedged Dealing 1st /15th of each month based on funds received the previous day forward to 5pm Dublin time / COB 14th & month end Front end fee Up to 5% Annual management fee 1% Performance fee 20% of the increase in the value per share of the fund between the beginning and the end of the year. Fees crystalise annually. Losses carried forward. Anti-dilution fee 0.5% NAV on subs/reds Exit fee 1% if held <1yr Min. investment €1,000,000 or £/$ equivalent Dividends Reporting & accumulation Price reporting Prices published daily in FT ISIN €-KYG6708H1157 £A-KYG6708H1645 US$-KYG6708H1496 £B-KYG6708H1728 SEDOL €-3110423 £A-B00VSM0 US$-3110434 £B-B2RGGH3 31-Dec-15 For the month ending 31-Dec-15 For the month ending 31-Dec-15 Enquiries: Sarah St. George Tel: +44 20 7208-1432 Email: s.stgeorge@odey.com US Clients - Tom Trowbridge Tel: +1 (917) 538-7838 Email: t.trowbridge@odey.com Crispin Odey Portfolio Manager All sources unless otherwise stated are Odey internal unaudited data and refer to the € share class. All data shown is as at 31-Dec-2015. -40 -20 0 20 40 ConsumerDiscretionary ConsumerStaples Energy Financials HealthCare Industrials InformationTechnology Materials Misc Telecommunication Services Utilities % Long % of NAV Short % of NAV -40 -30 -20 -10 0 10 20 30 40 50 Australia Austria Belgium Brazil Canada CaymanIslands Denmark Finland France Germany HongKong Hungary Ireland Italy Japan Jersey Luxembourg Mexico Netherlands Norway OtherGlobal Portugal Singapore SouthAfrica Spain Sweden Switzerland UK US % Long % of NAV Short % of NAV -300 -200 -100 0 100 200 300 400 Mar-05 Aug-06 Jan-08 Jun-09 Nov-10 Apr-12 Sep-13 Feb-15 % Long Equity Exposure Short Equity Exposure Net Equity Exposure Government Bond Exposure FX Exposure Rank Security Strategy Notional Exposure (%) 1 JPN 10Y Bond(Ose) Mar16 Short 20.4 2 ACGB 2 3/4 04/21/24 Long 13.5 3 Sky Long 12.5 4 Swatch Short 5.6 5 Las Vegas Sands Short 5.5 6 Odey Naver Long 5.3 7 Intu Properties Short 5.1 8 GOLD 100 OZ FUTR Feb16 Long 4.6 9 Ashmore Short 4.4 10 Lancashire Holdings Limited Short 4.4 -44.6 -30.7 -6.7 -5.2 -0.5 -0.2 -0.2 0.1 0.1 101.6 -60 -40 -20 0 20 40 60 80 100 120 AUD HKD SAR GBP CNH CHF SEK JPY NOK USD % Rank Security Strategy Notional Exposure (Ave %) 1 Seadrill Short 1.6 2 Anglo American Short 1.4 3 Coca-Cola HBC Short 4.0 4 Lancashire Holdings Short 4.2 5 Lafarge Holcim Short 3.6 Rank Security Strategy Notional Exposure (Ave %) 1 Sky Long 11.7 2 Sports Direct International Long 1.6 3 Advanced Micro Devices Short 1.5 4 Berkeley Group Short 1.4 5 Netflix Short 0.9

- 4. 12 Upper Grosvenor Street, London, W1K 2ND ~ Tel +44 (20) 7208-1400 Fax: +44 (20) 7208-1401 ~ www.odey.com Authorised and Regulated by the Financial Conduct Authority This communication is for information purposes only and not intended to be viewed as a piece of independent investment research. © 2015 Odey Asset Management LLP (“OAM”) has approved this communication which is for private circulation only, and in the UK is directed to persons who are professional clients or eligible counterparties for the purposes of the FCA’s Conduct of Business Sourcebook and it is not intended for and must not be distributed to retail clients. It does not constitute an offer to sell or an invitation to buy or invest in any of the securities or funds mentioned herein and it does not constitute a personal recommendation or investment taxation or any other advice. The information and any opinions have been obtained from or are based on sources believed to be reliable, but accuracy cannot be guaranteed. Past performance does not guarantee future results and the value of all investments and the income derived therefrom can decrease as well as increase. Investments that have an exposure to currencies other than the base currency of the fund may be subject to exchange rate fluctuations. This communication and the information contained therein may constitute a financial promotion for the purposes of the Financial Services and Markets Act 2000 of the United Kingdom (the “Act”) and the rules of the FCA. This communication is not subject to any restrictions on dealing ahead. The distribution of this communication may, in some countries, be restricted by law or regulation. Accordingly, anyone who comes into possession of this communication should inform themselves of and observe these restrictions. OAM is not liable for a breach of such restrictions or for any losses relating to the accuracy, completeness or use of information in this communication, including any consequential loss. Please always refer to the fund’s prospectus. OAM whose company No. is OC302585 and whose registered office is at 12 Upper Grosvenor Street, London, W1K 2ND, is authorised and regulated by the Financial Conduct Authority. The investment objective of the Fund is capital appreciation. The Investment Manager seeks to achieve this objective principally through managing a portfolio of securities, bonds and currencies and related financial instruments. The Investment Manager expects that the Fund's investments will tend, over time, to be weighted towards European securities with investments in non-European securities subject to the limits set out in the Investment Objective and Policy section of the prospectus. Past performance is not a reliable indicator of future performance and is shown net of fees. Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec YTD 1992 -3.6 0.2 1.4 5.7 12.0 -3.8 0.9 12.5 1993 0.7 2.5 5.4 1.8 3.6 5.7 3.6 6.4 -2.5 9.1 1.3 11.6 60.4 1994 5.7 -9.8 -11.7 -2.3 -9.8 5.9 -4.9 -7.2 0.9 -8.0 -6.6 -5.9 -43.4 1995 1.0 -1.8 7.1 2.1 0.7 -14.1 -1.7 6.3 3.0 3.5 6.3 1.5 12.6 1996 1.7 -6.4 1.8 9.0 1.7 7.5 -2.7 6.4 3.0 8.0 11.2 4.1 53.9 1997 6.3 10.6 -5.0 4.9 9.6 5.9 2.5 -1.5 6.7 1.9 -3.3 5.3 51.8 1998 5.4 4.0 16.7 -2.4 6.3 -4.2 2.4 -6.3 0.3 2.7 -1.8 2.4 26.3 1999 -0.2 -0.2 -0.4 3.1 -0.5 -0.4 1.3 0.3 -2.4 -2.9 2.8 5.5 5.9 2000 0.1 -0.1 -1.8 2.2 3.6 0.9 2.3 1.4 0.1 3.4 3.8 1.5 18.7 2001 0.2 3.2 -0.4 -1.4 -0.7 0.6 0.0 1.0 1.1 -1.4 2.8 1.3 6.3 2002 0.3 2.8 1.4 4.2 0.7 1.6 -1.1 1.1 -0.2 1.5 1.9 -1.8 12.9 2003 -0.1 -0.7 0.4 3.2 3.0 0.3 0.8 1.3 1.9 0.3 -0.9 0.5 10.2 2004 0.6 -0.2 -1.5 -3.2 1.6 -0.4 1.7 0.9 -0.5 1.1 1.7 -1.8 0.0 2005 -0.3 3.1 0.4 0.0 -1.0 -0.1 1.1 1.8 3.2 -2.8 -0.9 2.4 7.0 2006 3.7 -2.1 2.7 2.5 -4.6 -0.7 2.2 -1.8 -4.5 1.3 0.1 0.2 -1.5 2007 -0.2 -0.8 5.3 4.4 8.3 5.5 1.6 2.0 7.4 1.4 3.5 6.7 54.8 2008 -0.4 6.6 -0.5 1.8 2.6 4.6 -5.0 -0.7 -2.7 -2.6 4.2 3.0 10.9 2009 -3.0 -4.5 5.3 27.7 8.3 -2.7 5.0 6.5 1.9 -10.2 -1.7 1.3 33.7 2010 -0.6 1.1 1.9 -1.1 -10.9 -2.0 3.2 -6.3 4.9 2.9 1.6 6.6 -0.1 2011 3.4 2.2 -2.8 3.5 -2.5 0.1 -5.3 -13.5 -8.3 10.3 -5.1 -2.8 -20.6 2012 8.1 7.6 2.9 -1.0 -5.6 1.2 -3.0 5.1 3.6 3.1 2.8 3.2 30.7 2013 9.2 2.0 3.5 1.3 5.1 -7.1 2.3 -2.5 2.2 1.8 3.4 2.8 25.8 2014 -1.7 4.6 -7.3 -7.9 0.3 -0.6 -1.6 0.5 9.8 -5.6 5.3 11.7 5.5 2015 3.6 -6.4 4.6 -19.3 5.2 0.2 0.3 6.7 7.6 -14.9 -0.5 3.7 -12.8