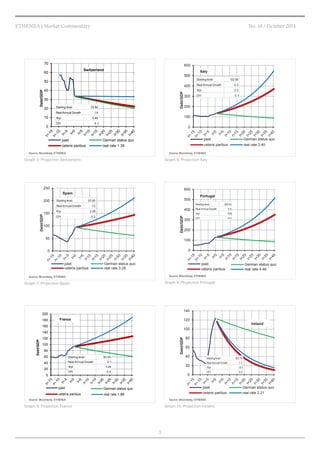

This document provides projections for public debt levels as a percentage of GDP for several European countries and the US through 2030. It finds that while Germany, the US and Switzerland should be able to maintain debt below concerning levels, other countries face significant challenges. Italy and Portugal are projected to have debt ratios over 200% of GDP within 15 years if current trends continue. France and Spain would also see rising debt, though not as extreme. The projections assume balanced budgets, but most countries currently run deficits. Structural reforms will be needed to reduce debt in troubled countries. Dividend payments from European companies are also discussed, which are expected to remain an important component of stock returns due to low interest rates and high corporate cash balances. However