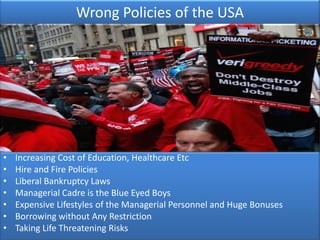

The document discusses the Occupy Wall Street movement in the United States and its causes. It notes high unemployment, bankruptcy cases, foreclosure rates in many US cities, and policies seen as favoring corporate and managerial elites. It argues that Wall Street has come to symbolize perceived corporate excesses like huge bonuses, accounting manipulation, environmental pollution and excessive advertising. However, it says the movement has less relevance in India where the stock market benefits the government and promoters are often the same as managers. It advocates long-term, studied investment in shares rather than speculation.