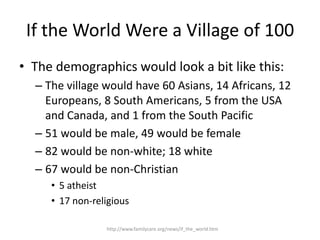

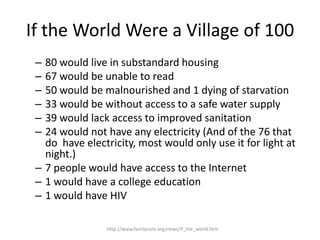

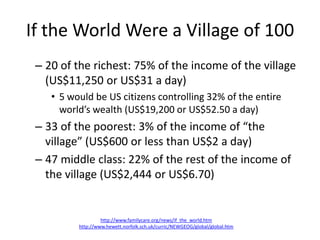

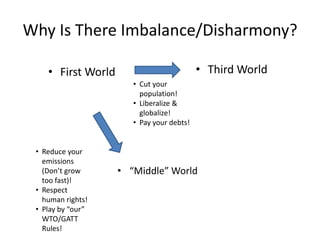

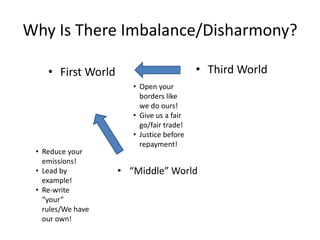

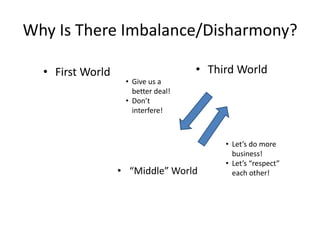

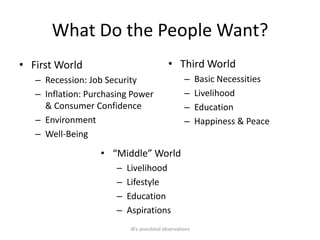

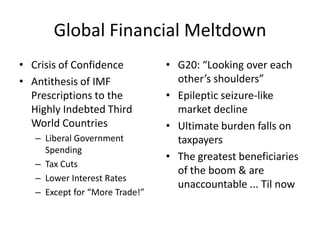

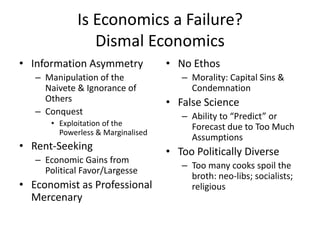

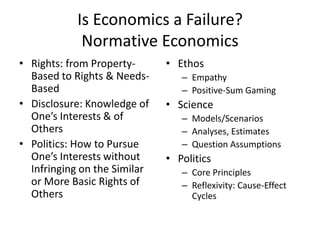

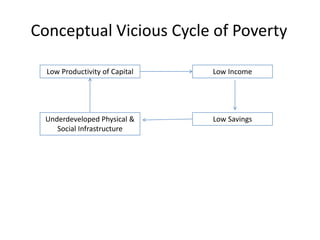

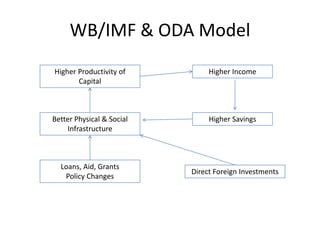

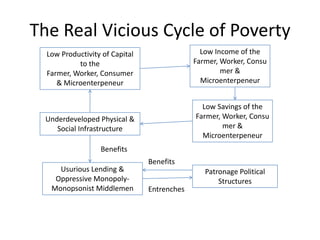

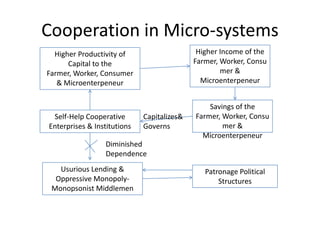

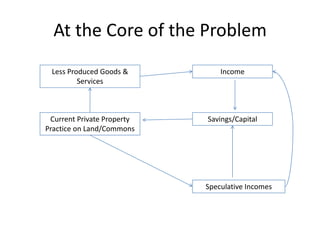

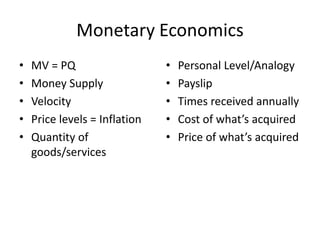

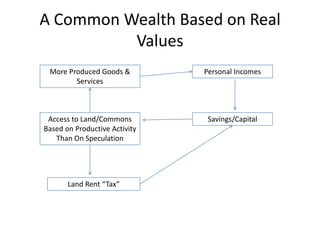

The document discusses the disparity between the first world, third world, and middle world economies, highlighting key issues such as poverty, income inequality, and philosophical perspectives on market structures and economics. It emphasizes the need for a reevaluation of economic paradigms to address fundamental inequalities and societal challenges. The author suggests that while philosophy might offer solutions to these market issues, the implementation is hindered by entrenched interests and a lack of political will.