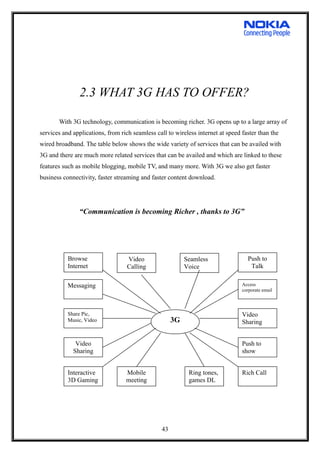

This document summarizes a market research report submitted to Nokia India Pvt. Ltd. evaluating the potential of end-user services on India's 3G/WCDMA platform and possible revenue models. The report assesses which 3G services Indian consumers are interested in and willing to pay for. It identifies the main services consumers want and the preferred tariff plans through surveys and statistical analysis. The goal is to help Nokia convince mobile operators to adopt 3G/WCDMA technology by demonstrating which applications will be accepted by Indian users.