Embed presentation

Download to read offline

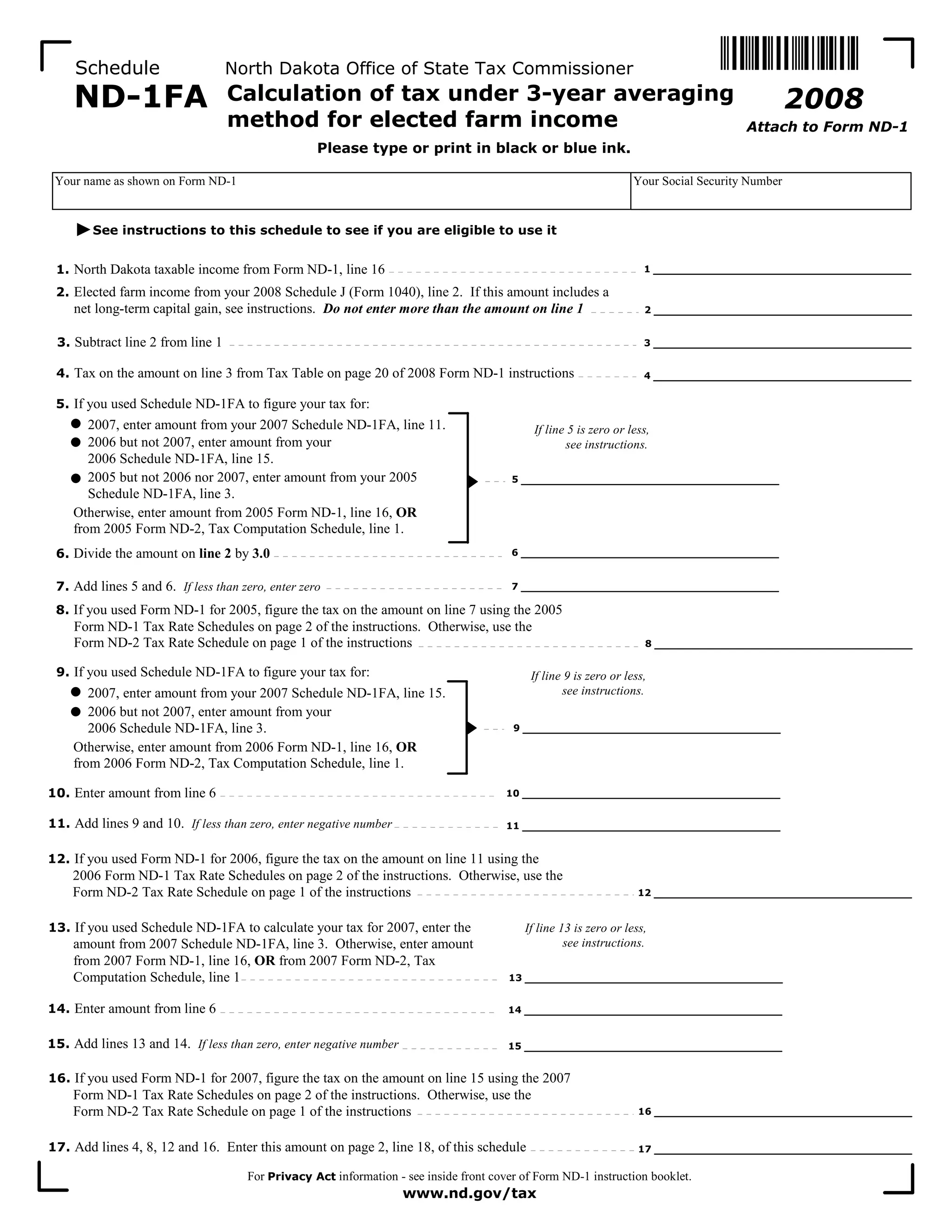

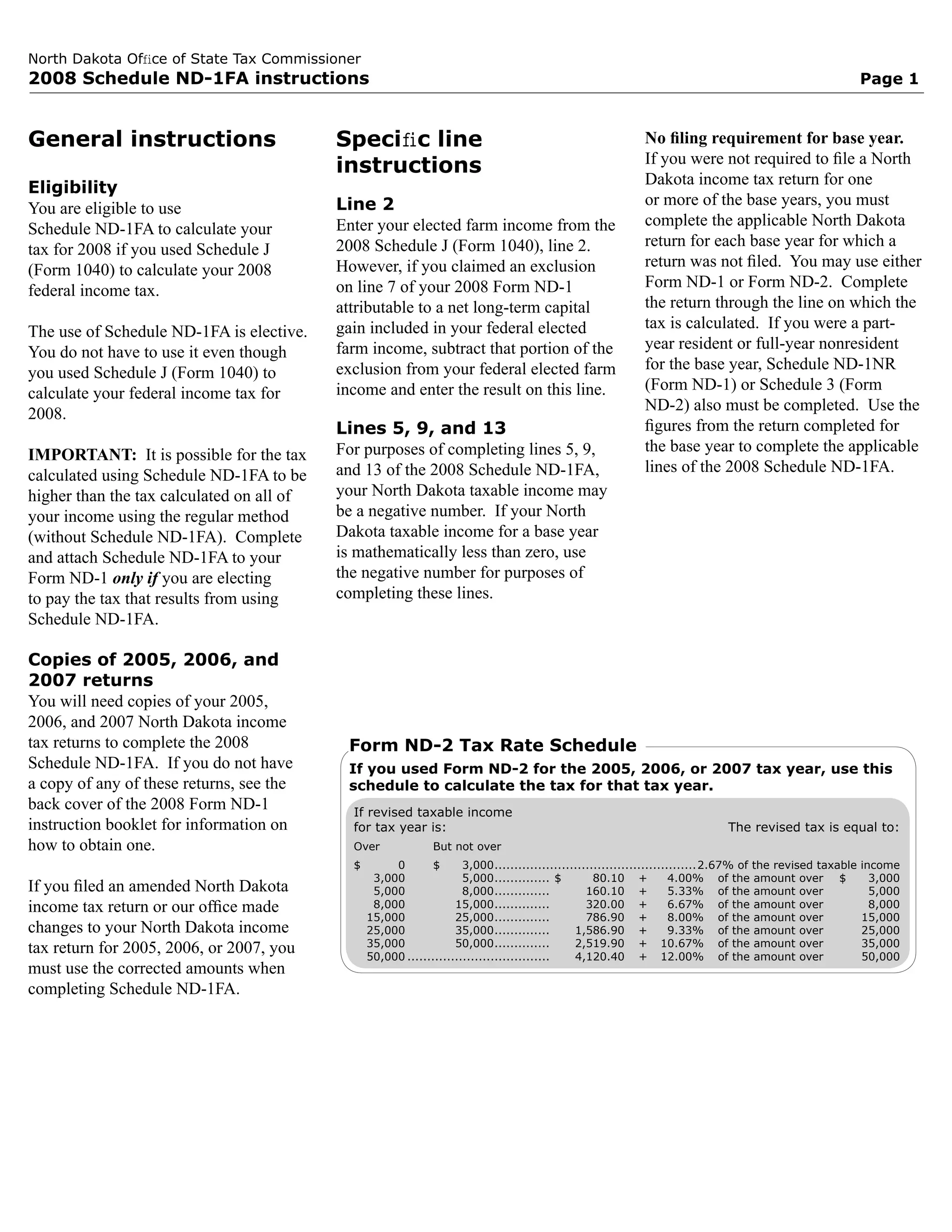

This document is instructions for calculating North Dakota state tax using a 3-year averaging method for elected farm income. It provides a multi-step worksheet to determine the taxpayer's tax liability. Key steps include: 1) Determining the taxpayer's North Dakota taxable income and elected farm income for the current year. 2) Calculating the tax on the portion of income not from farming. 3) Averaging the elected farm income over 3 years to smooth out variations from year to year. 4) Determining the tax amounts that would have applied in each of the previous 3 years based on the averaged income. 5) Adding the current and prior year tax amounts to determine the total tax using the