Embed presentation

Download to read offline

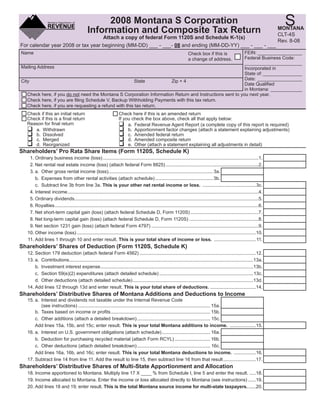

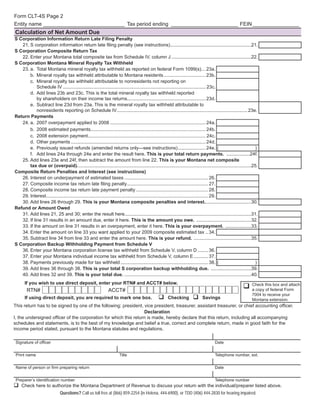

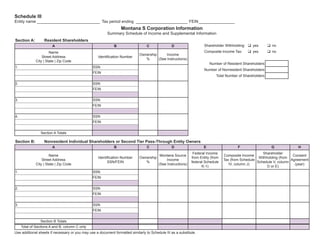

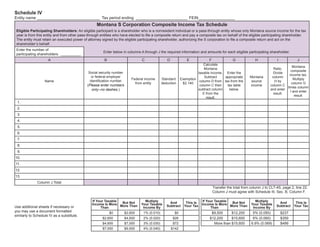

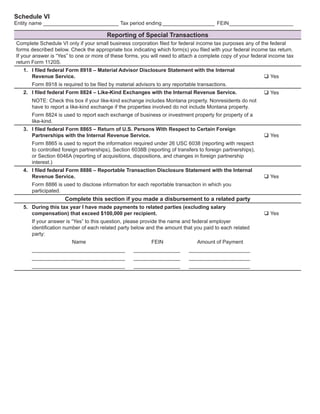

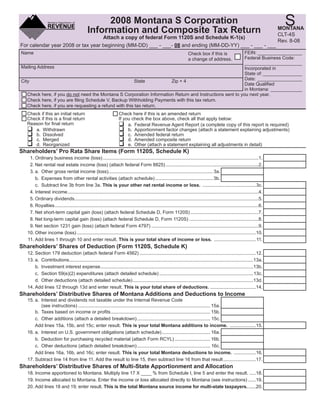

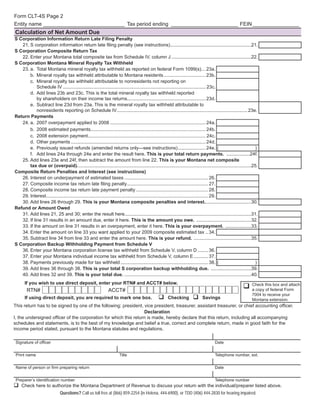

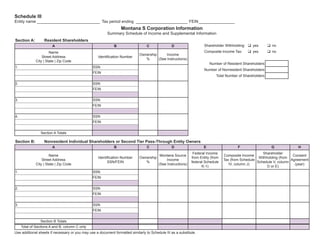

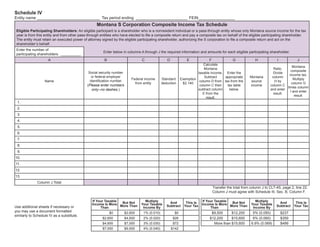

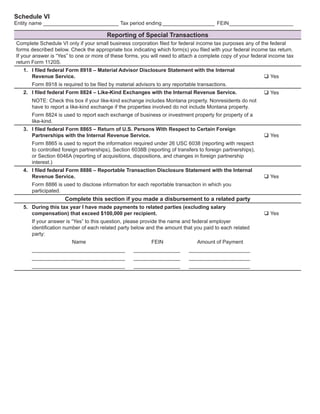

This document is a 2008 Montana S Corporation Information and Composite Tax Return form. It includes sections for shareholders' pro rata share items from federal Form 1120S Schedule K, shareholders' distributive shares of Montana additions and deductions to income, shareholders' distributive shares of multi-state apportionment and allocation, calculation of net amount due including taxes and penalties, and two schedules - Schedule I for apportionment factors for multi-state S corporations and Schedule II for Montana S corporation tax credits.