Embed presentation

Download to read offline

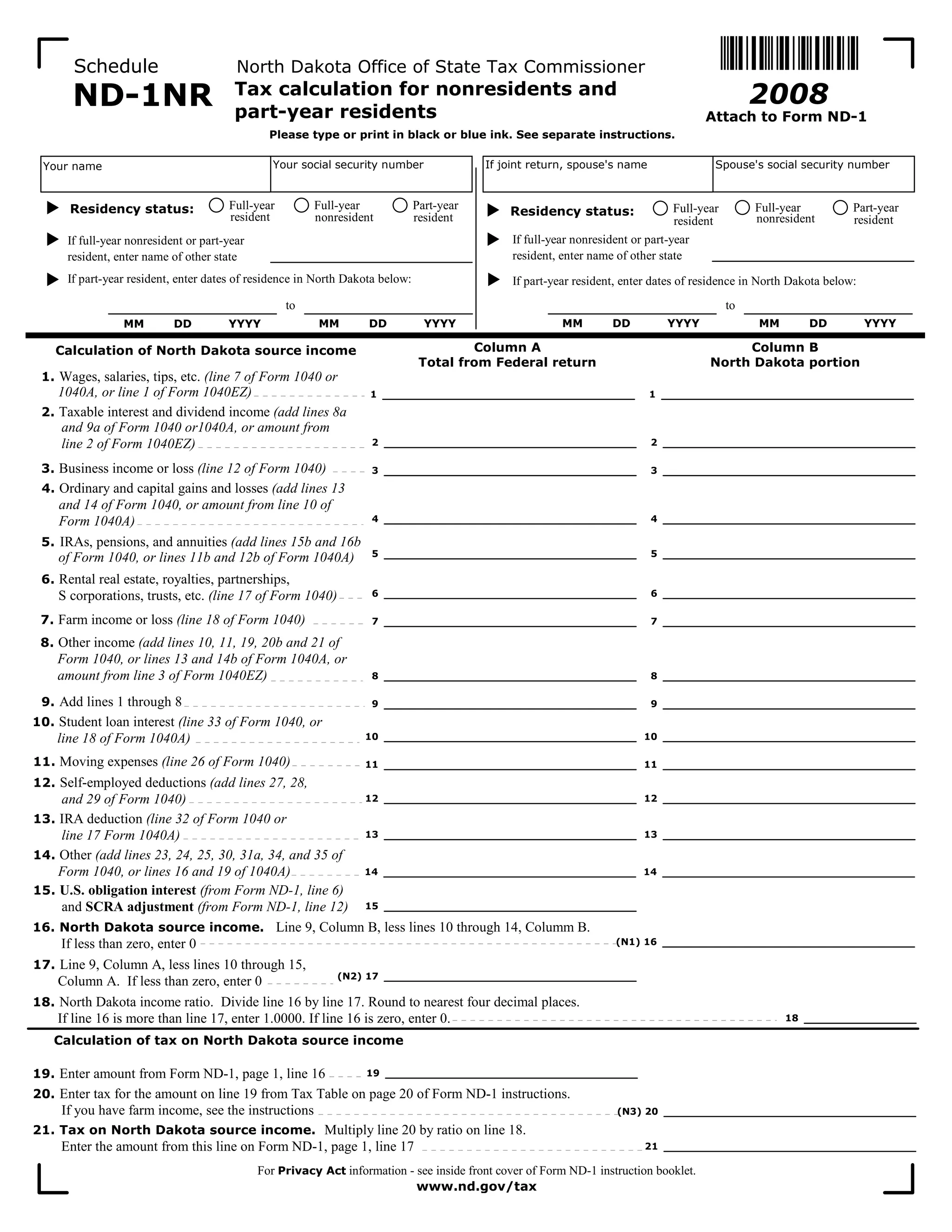

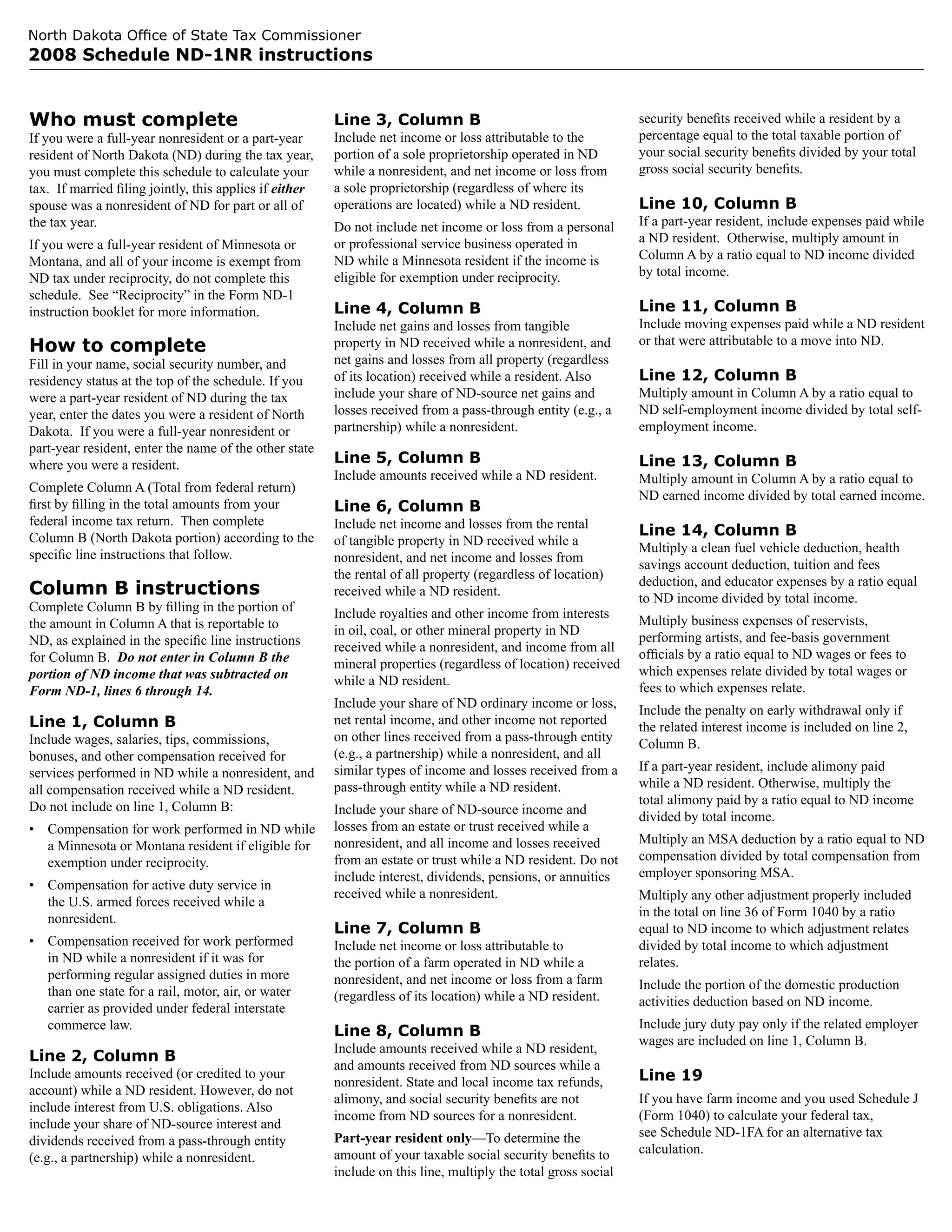

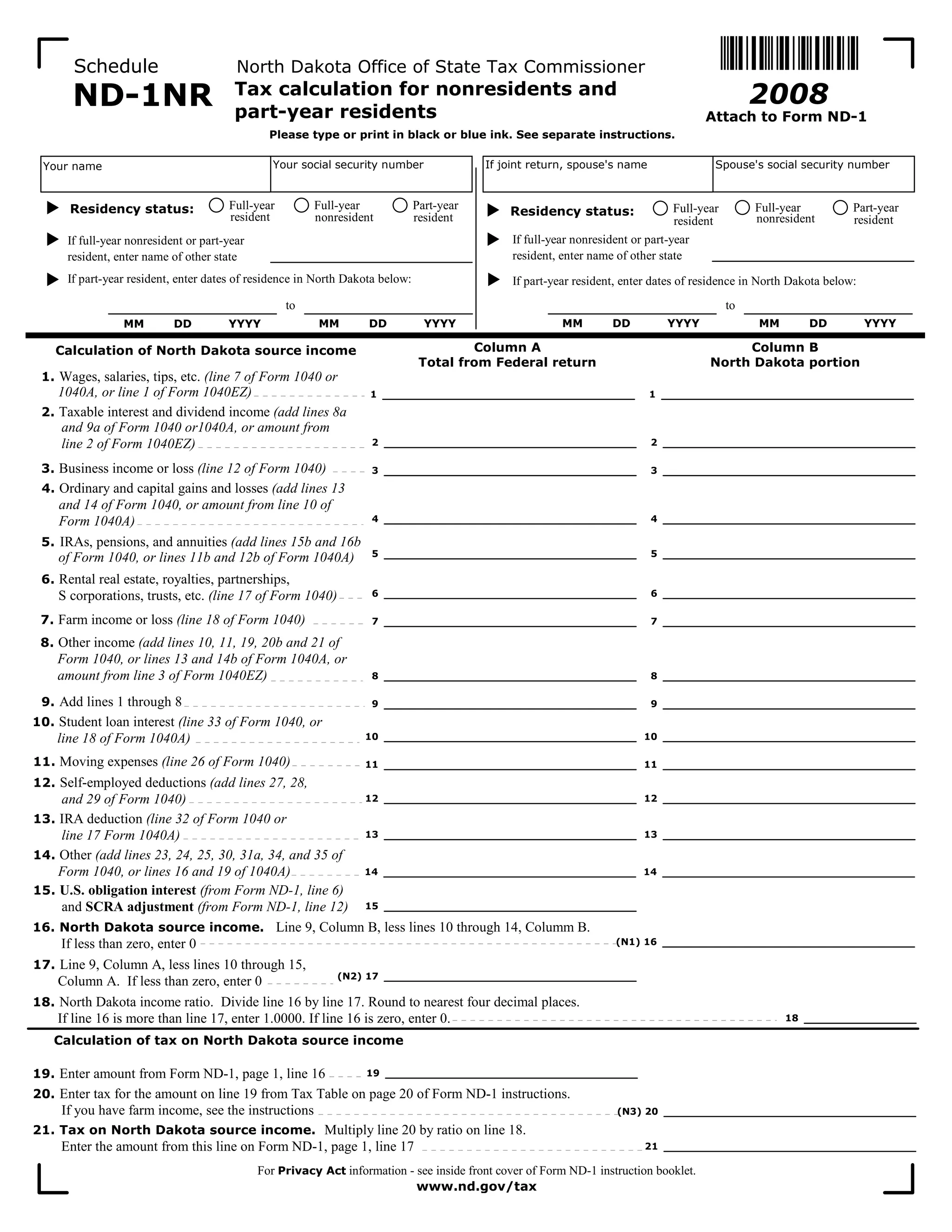

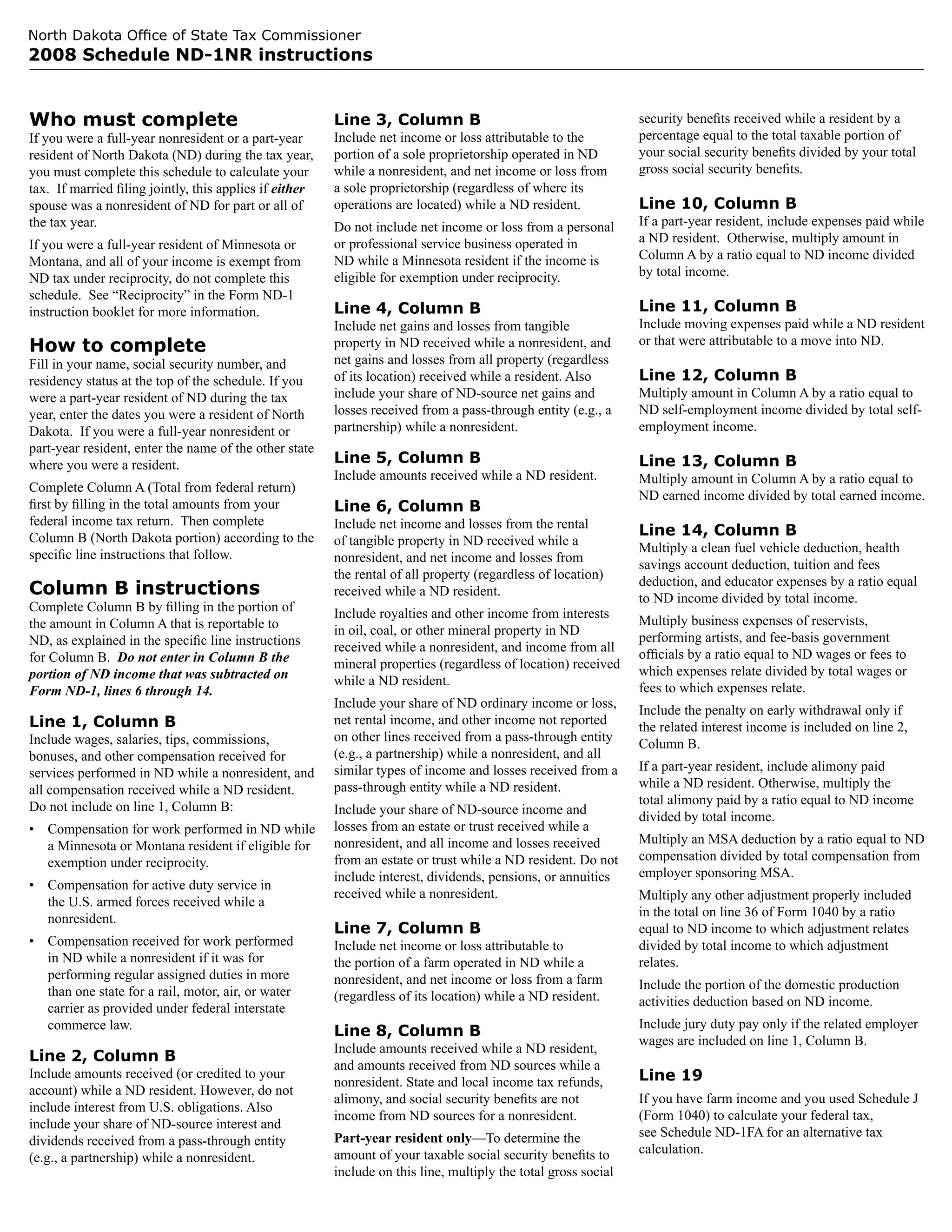

This document provides instructions for a North Dakota tax form for nonresidents and part-year residents to calculate their North Dakota tax liability. It explains who needs to complete the schedule and how to calculate income and deductions sourced to North Dakota. Line items include wages, business income, capital gains, pensions, rental income, and adjustments for student loan interest and moving expenses. The schedule is used to determine the portion of total federal adjusted gross income and deductions that relates to North Dakota and calculates the North Dakota tax amount.