Embed presentation

Download to read offline

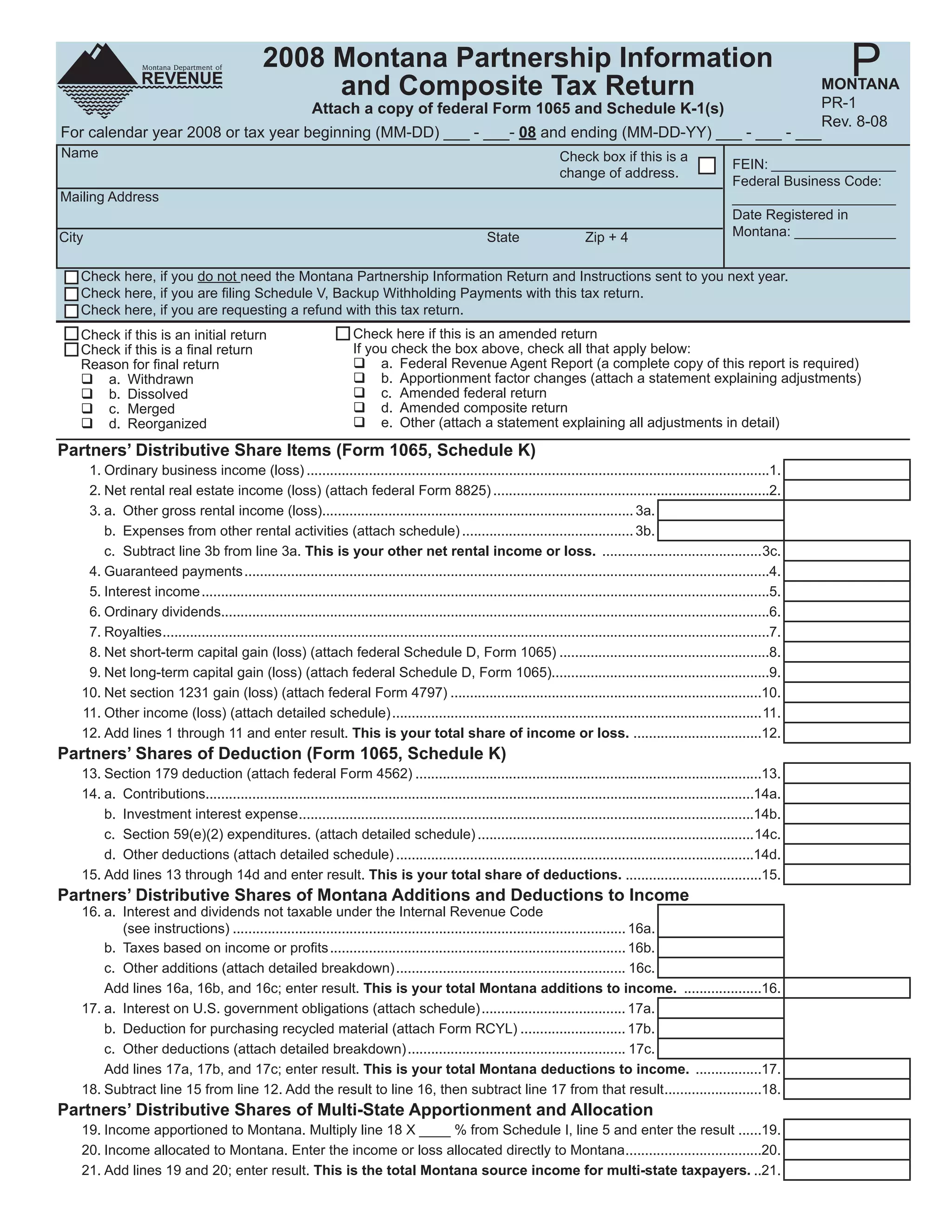

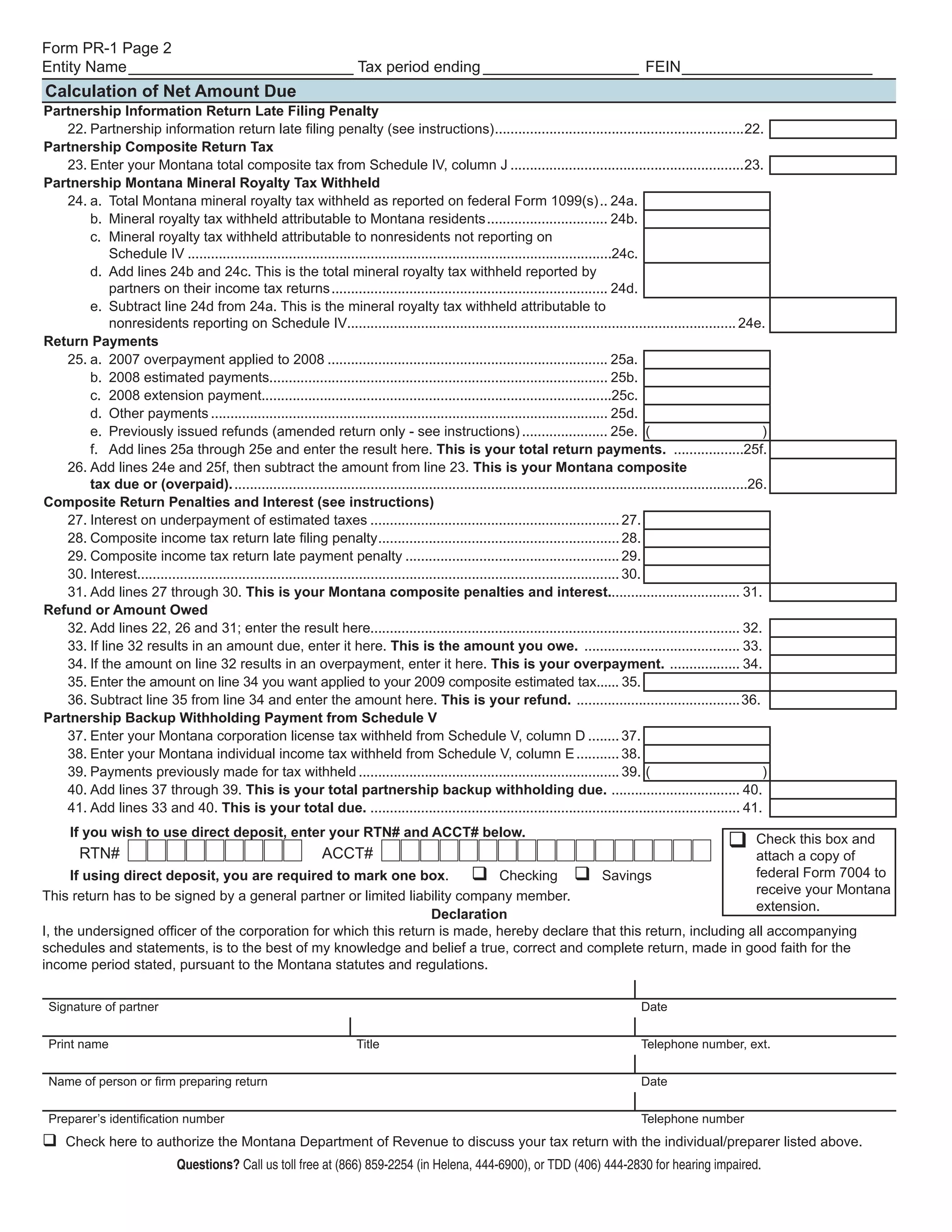

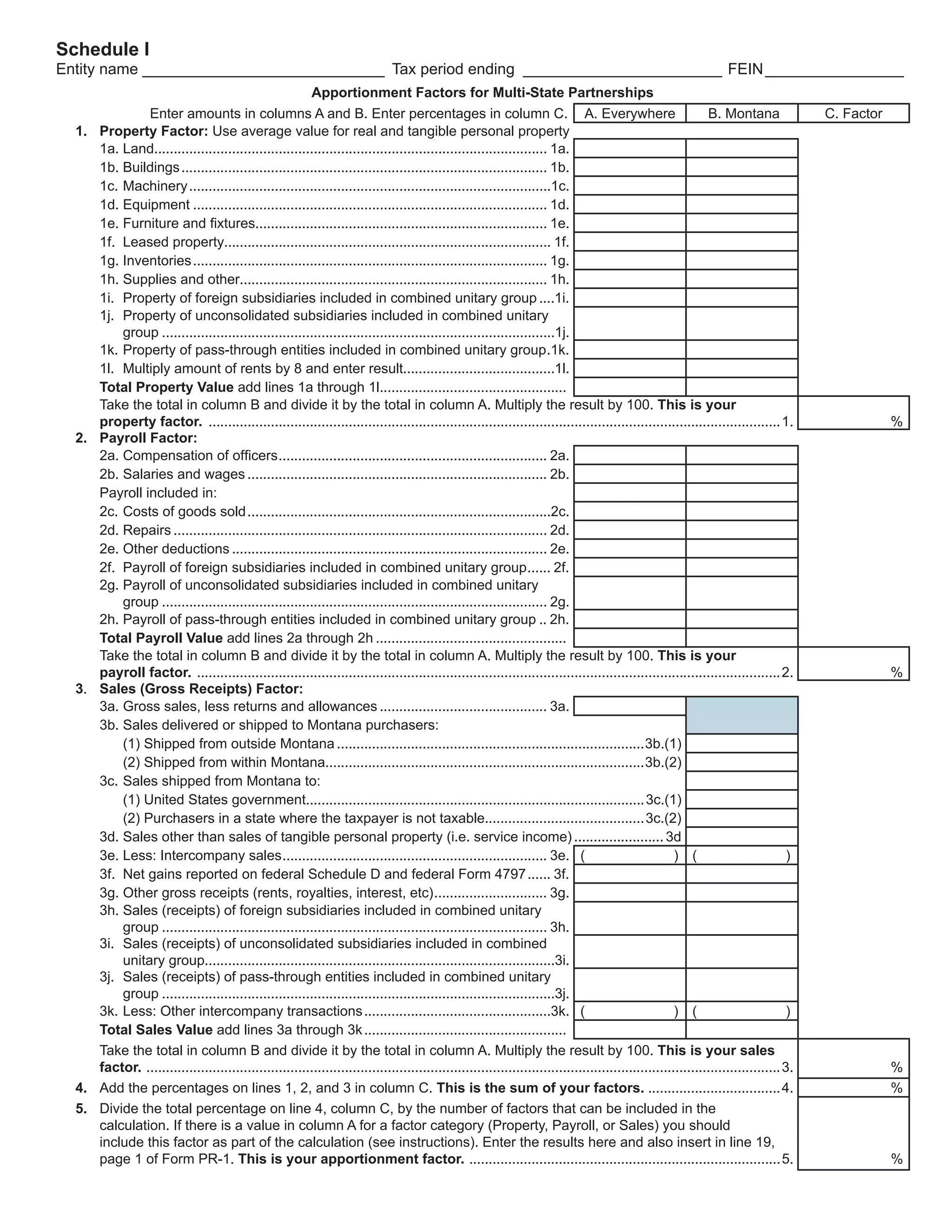

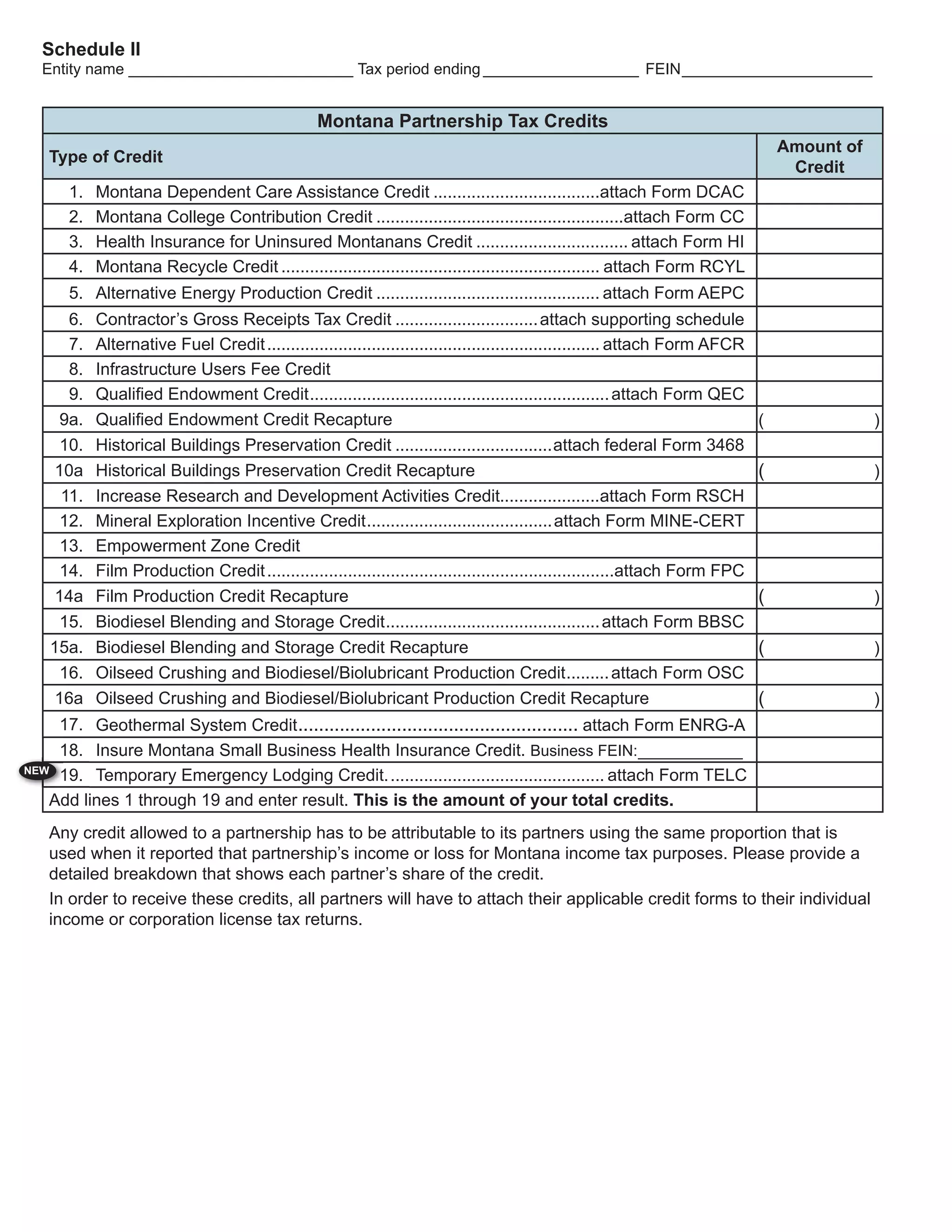

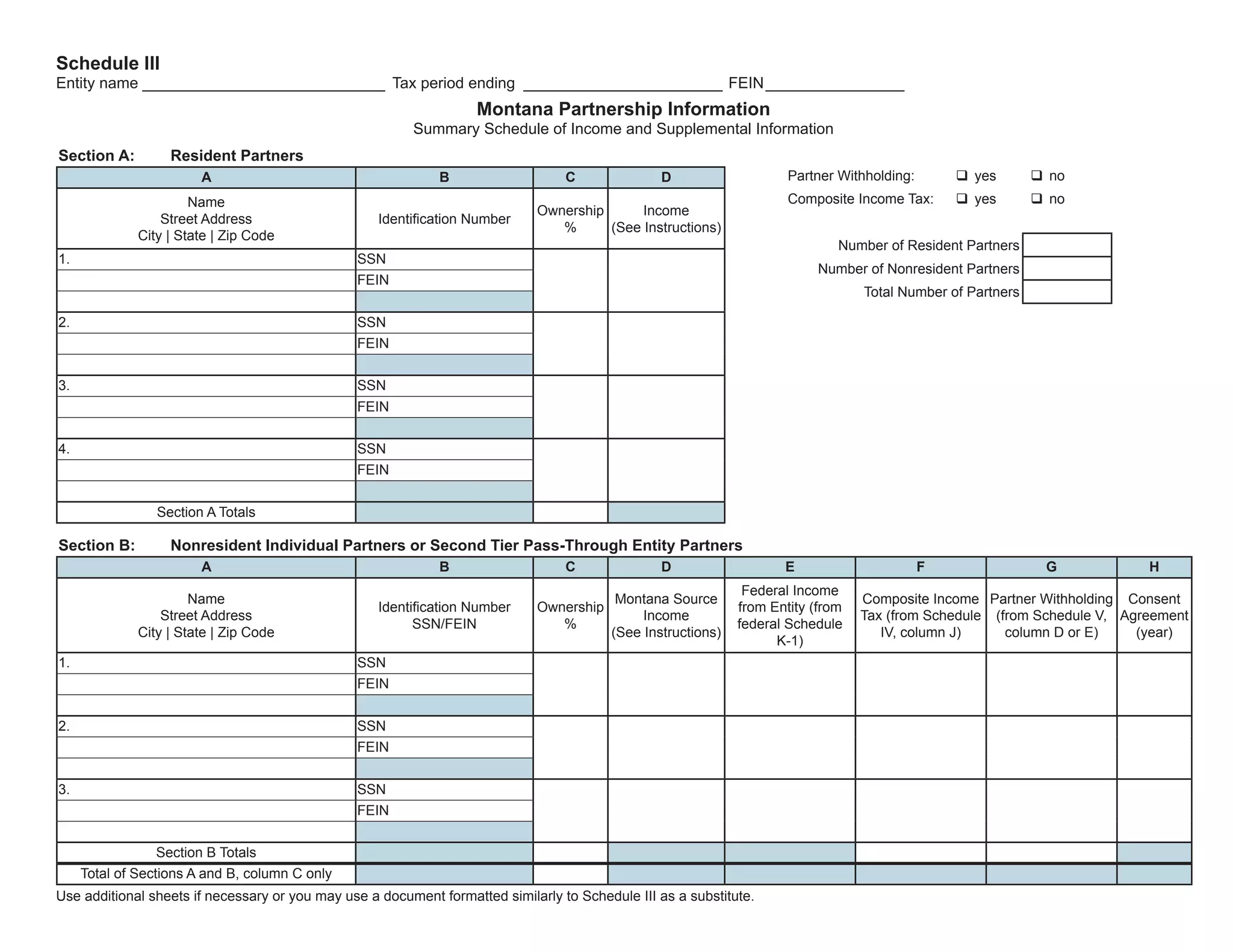

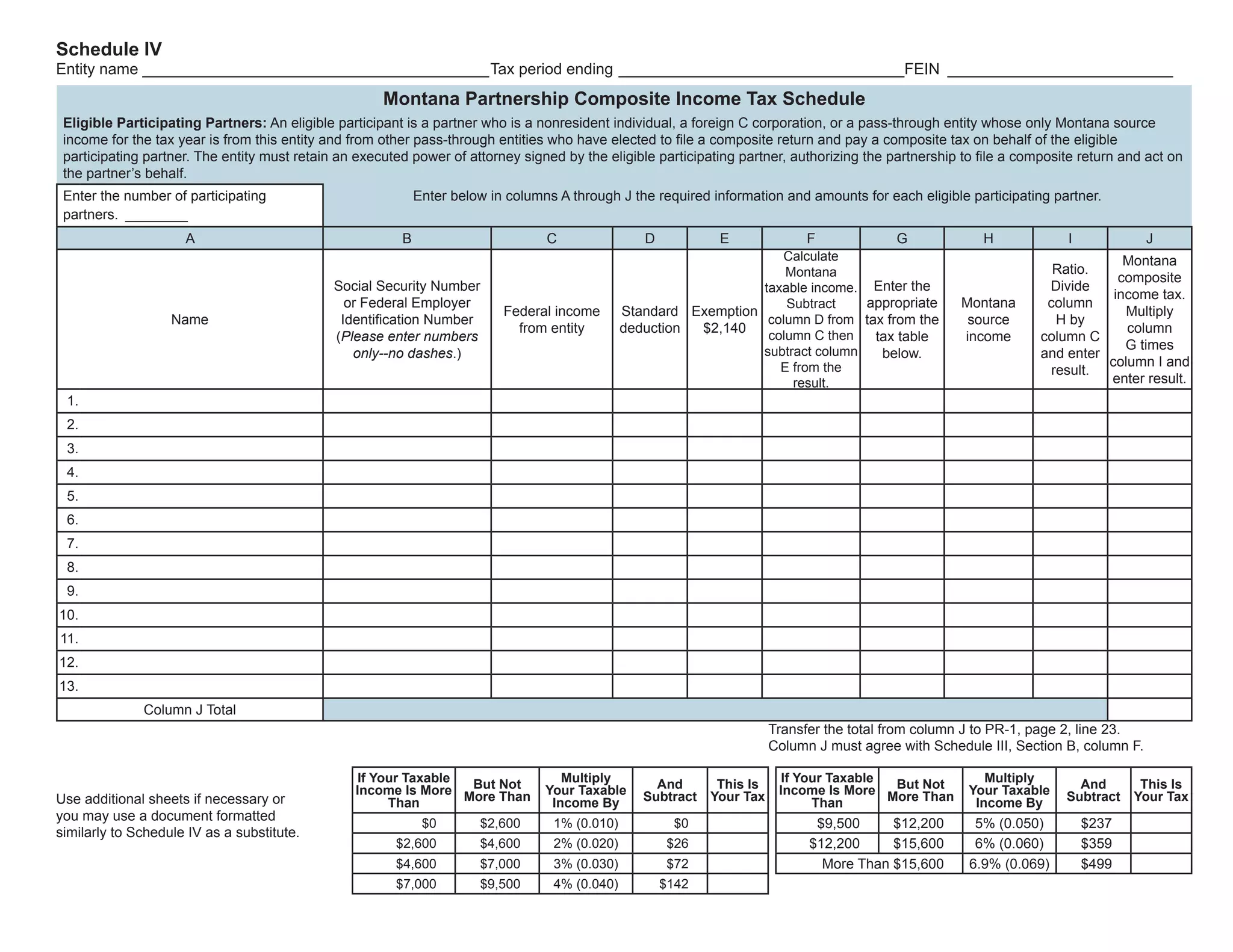

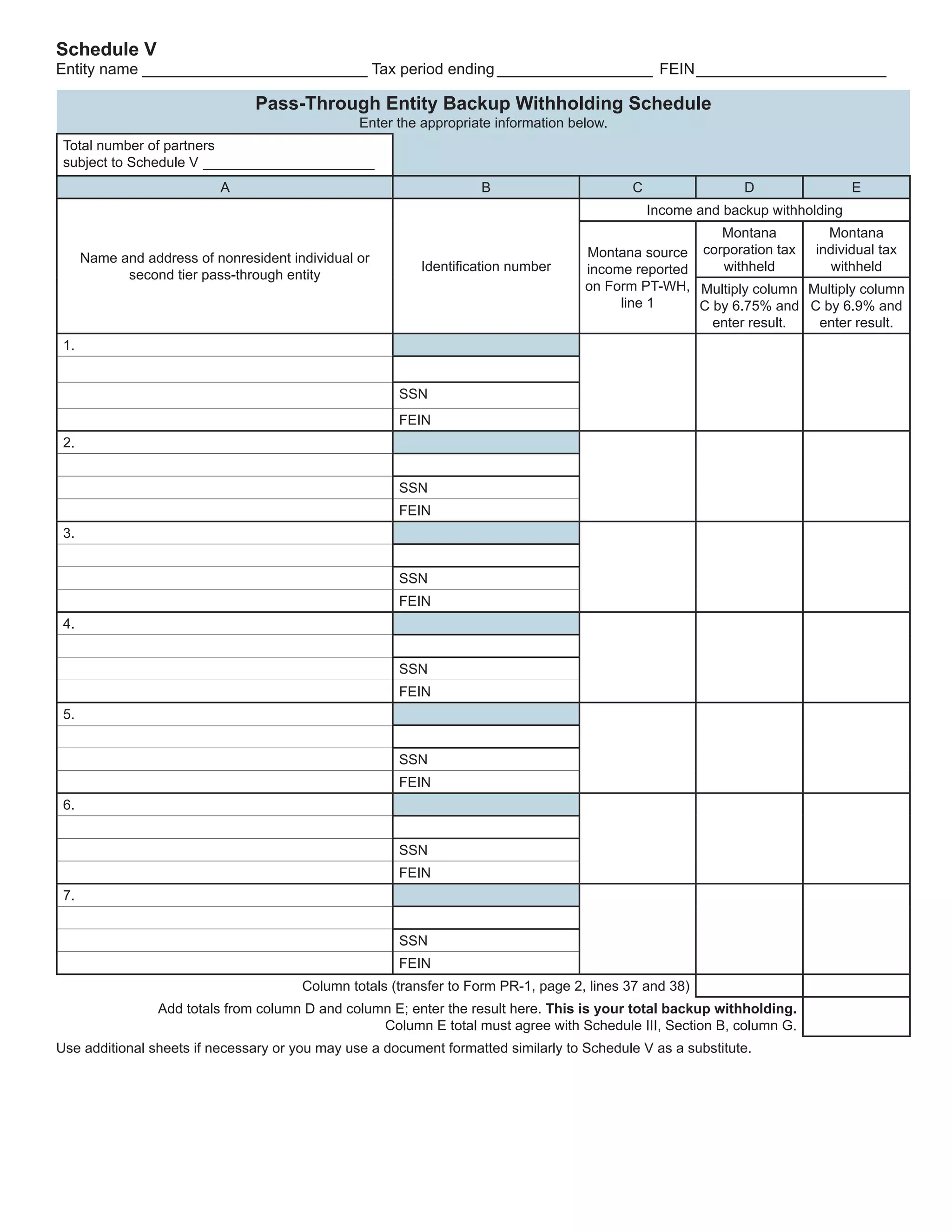

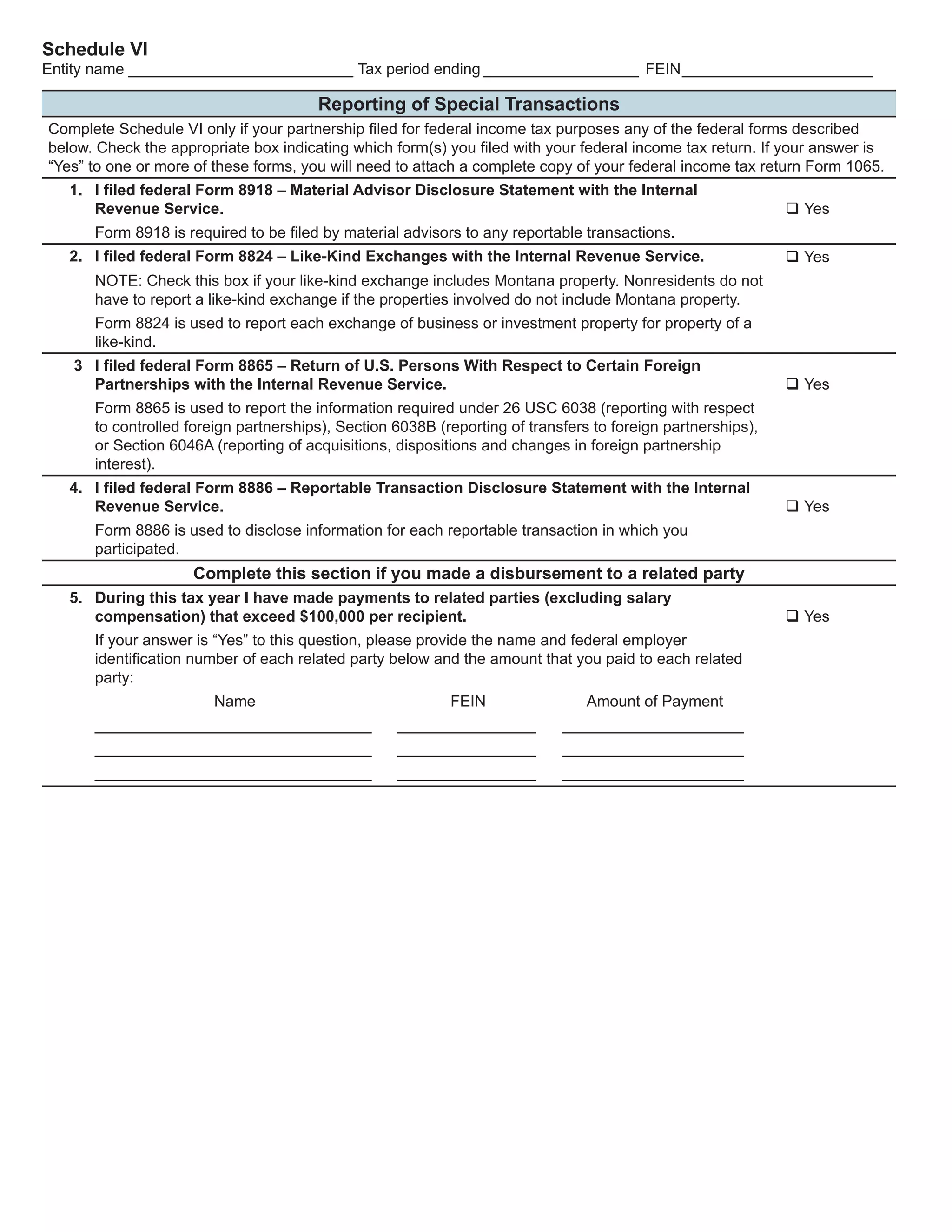

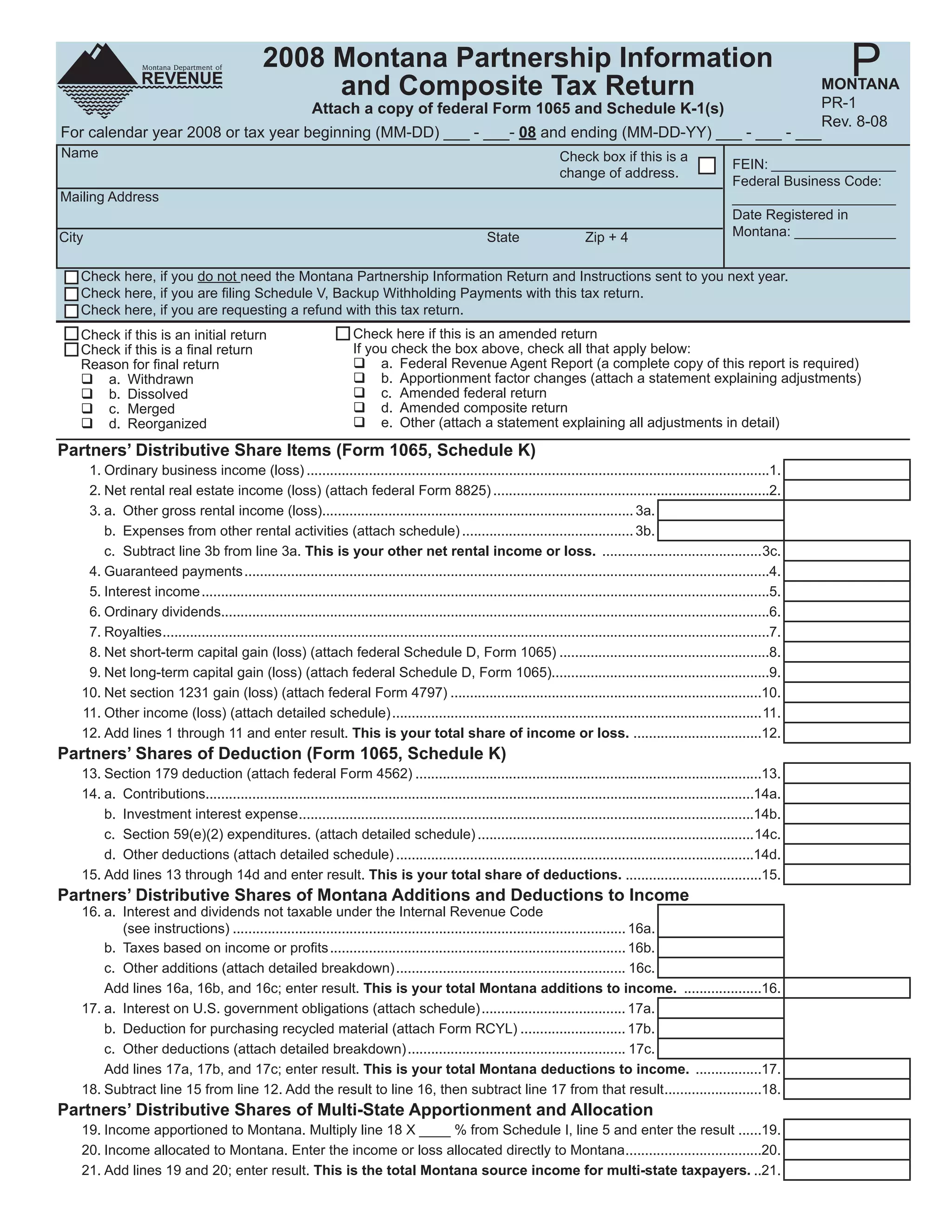

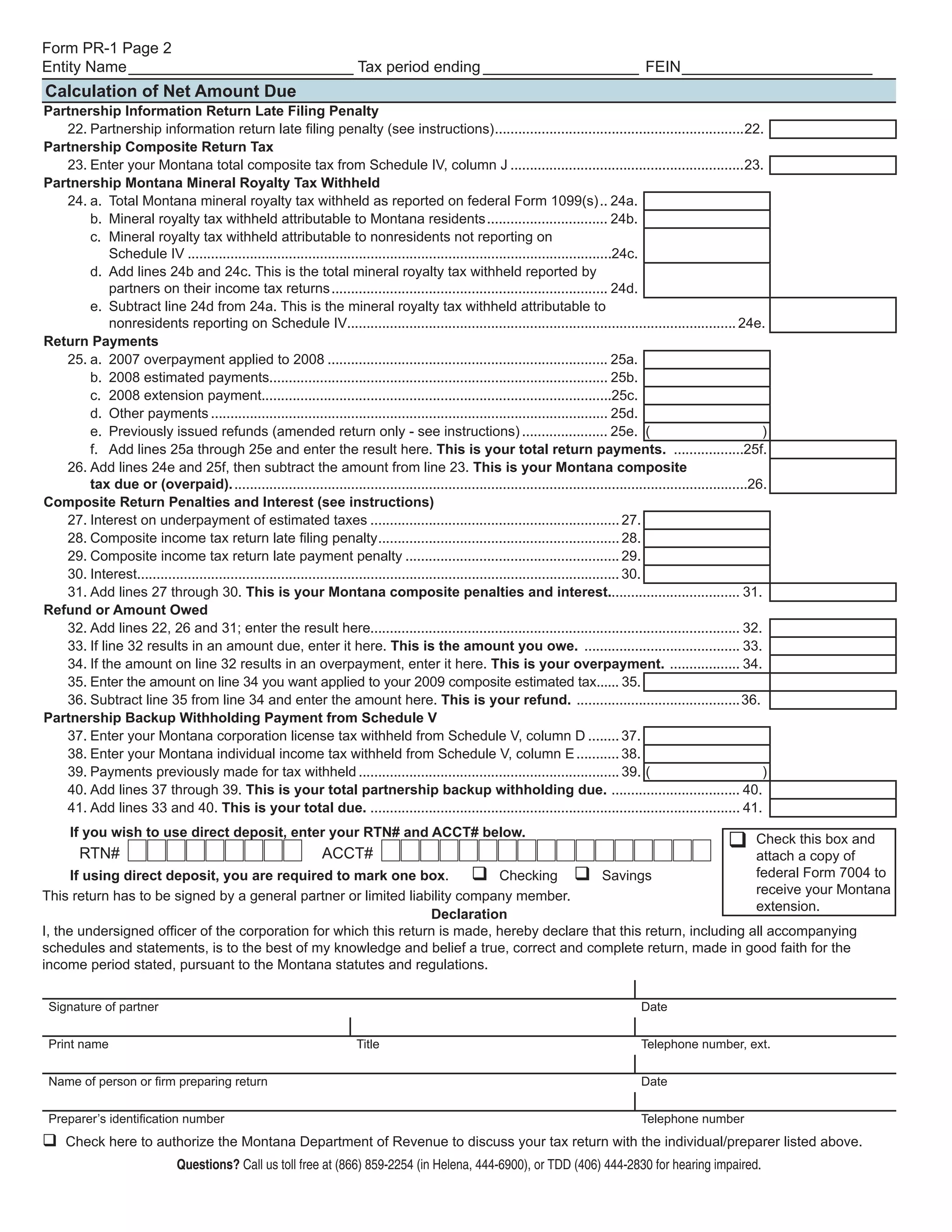

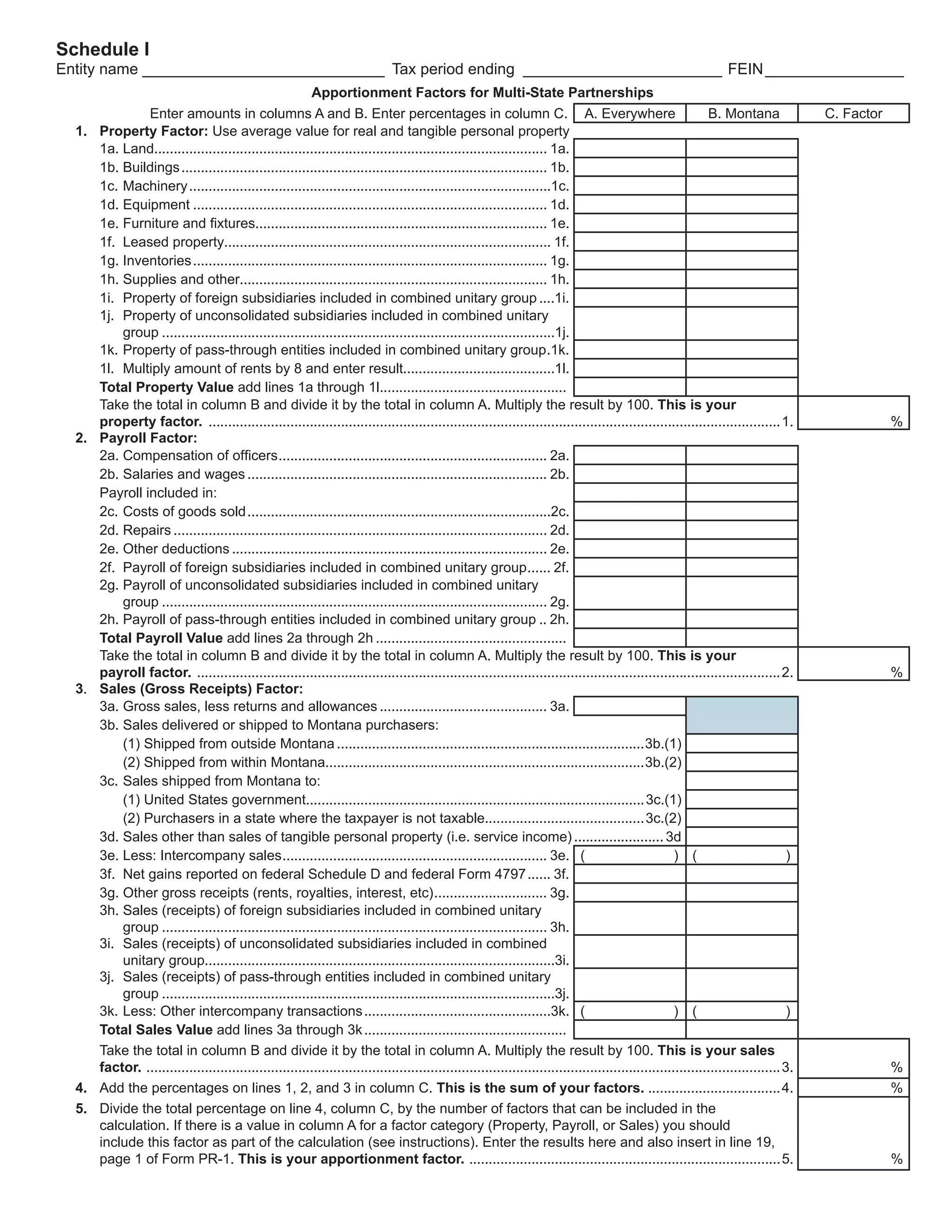

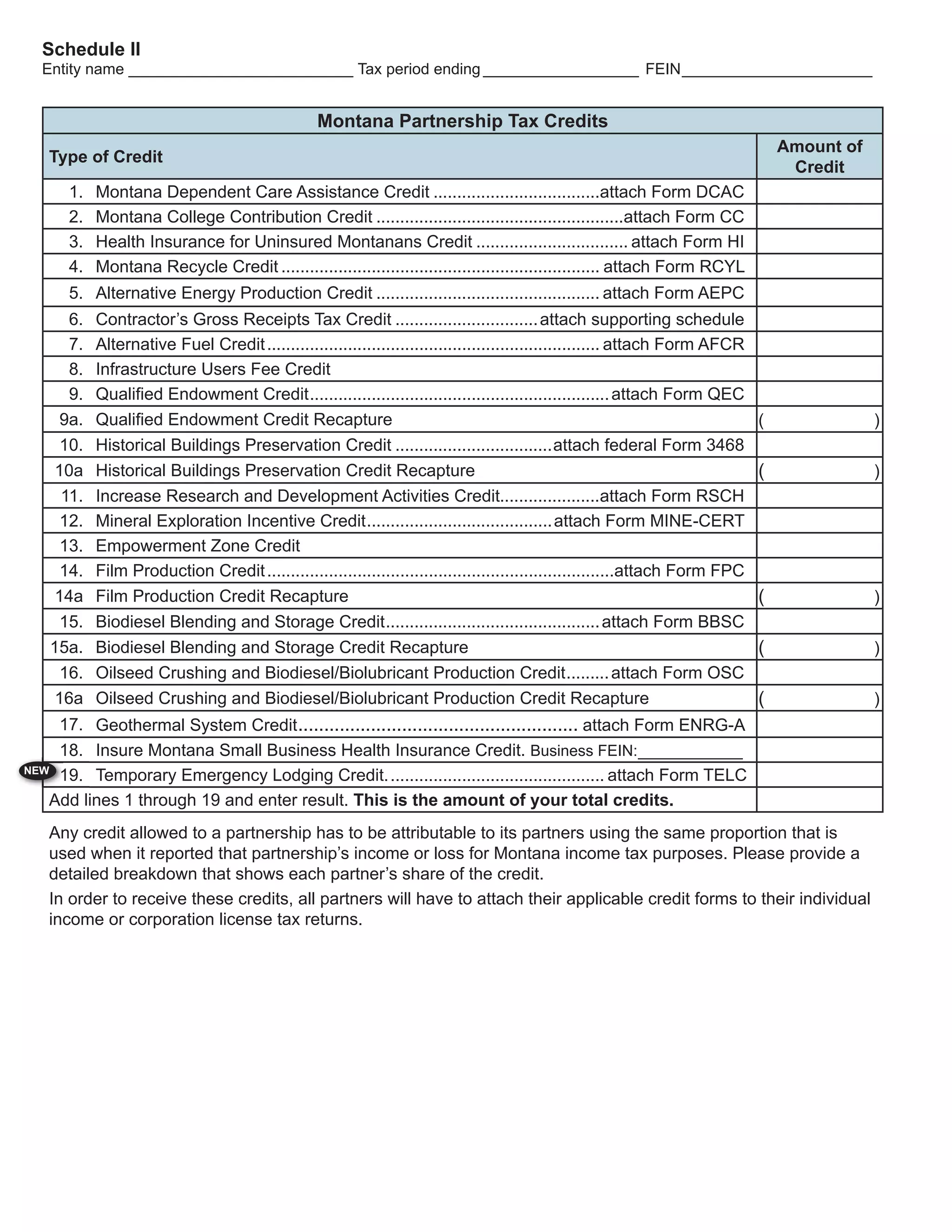

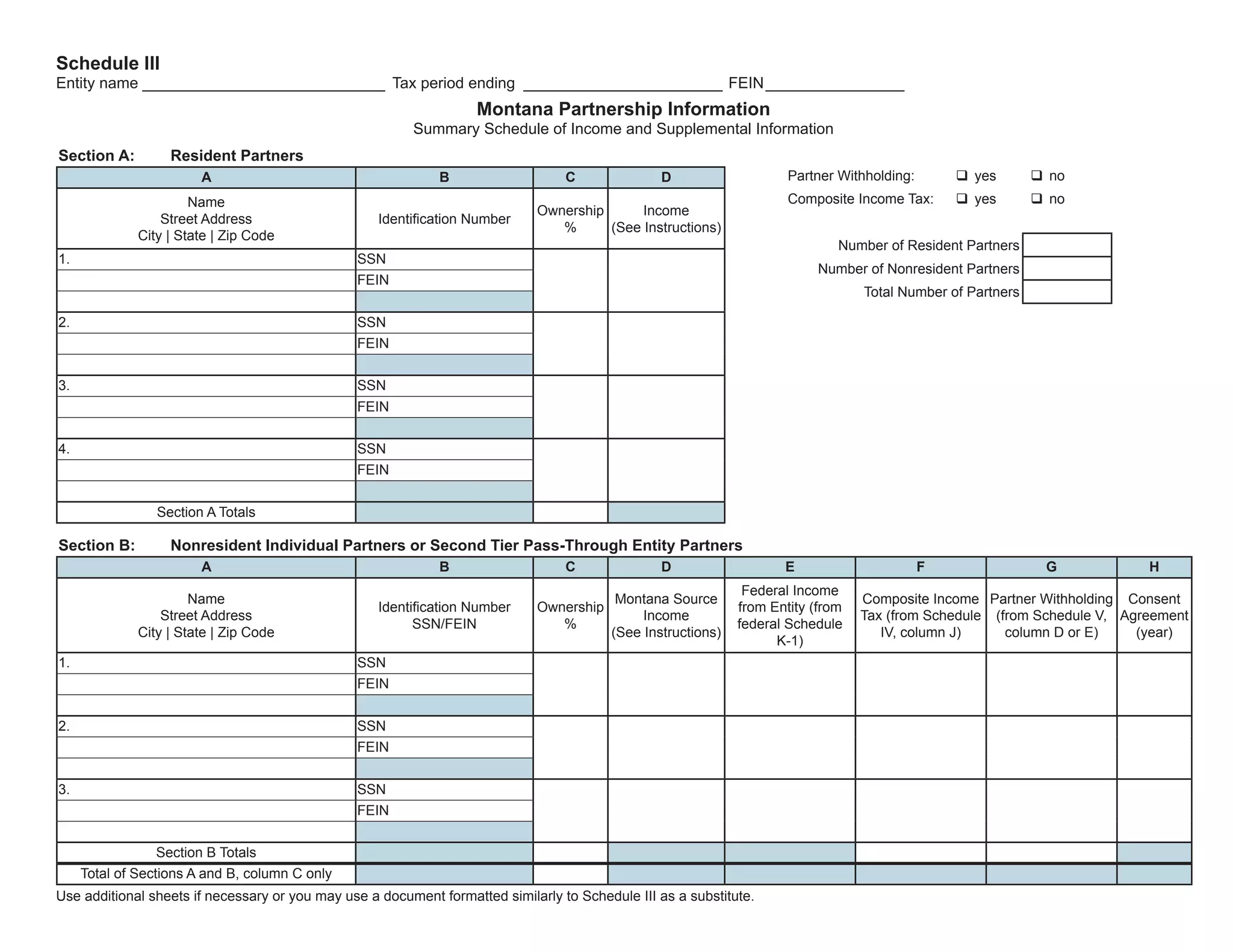

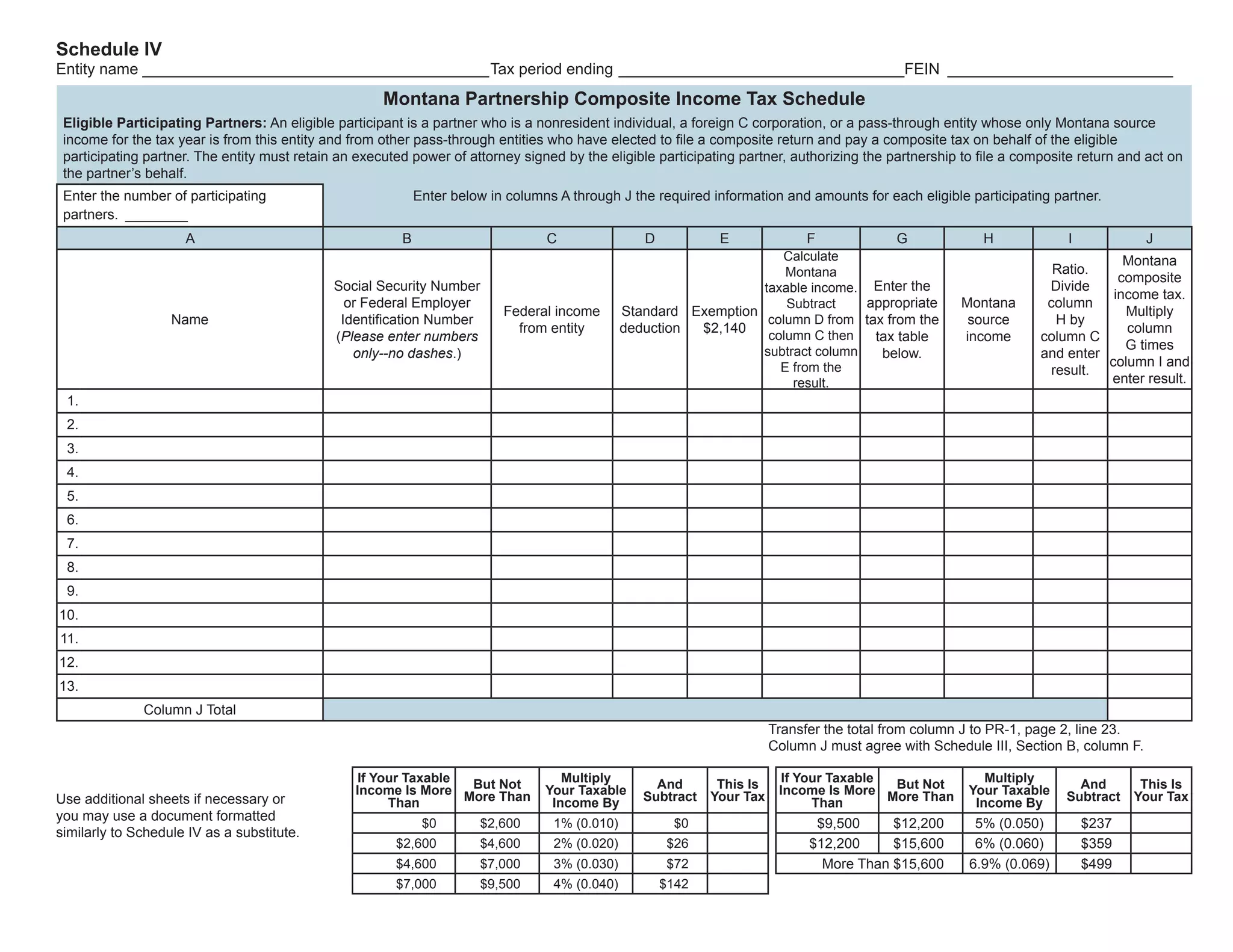

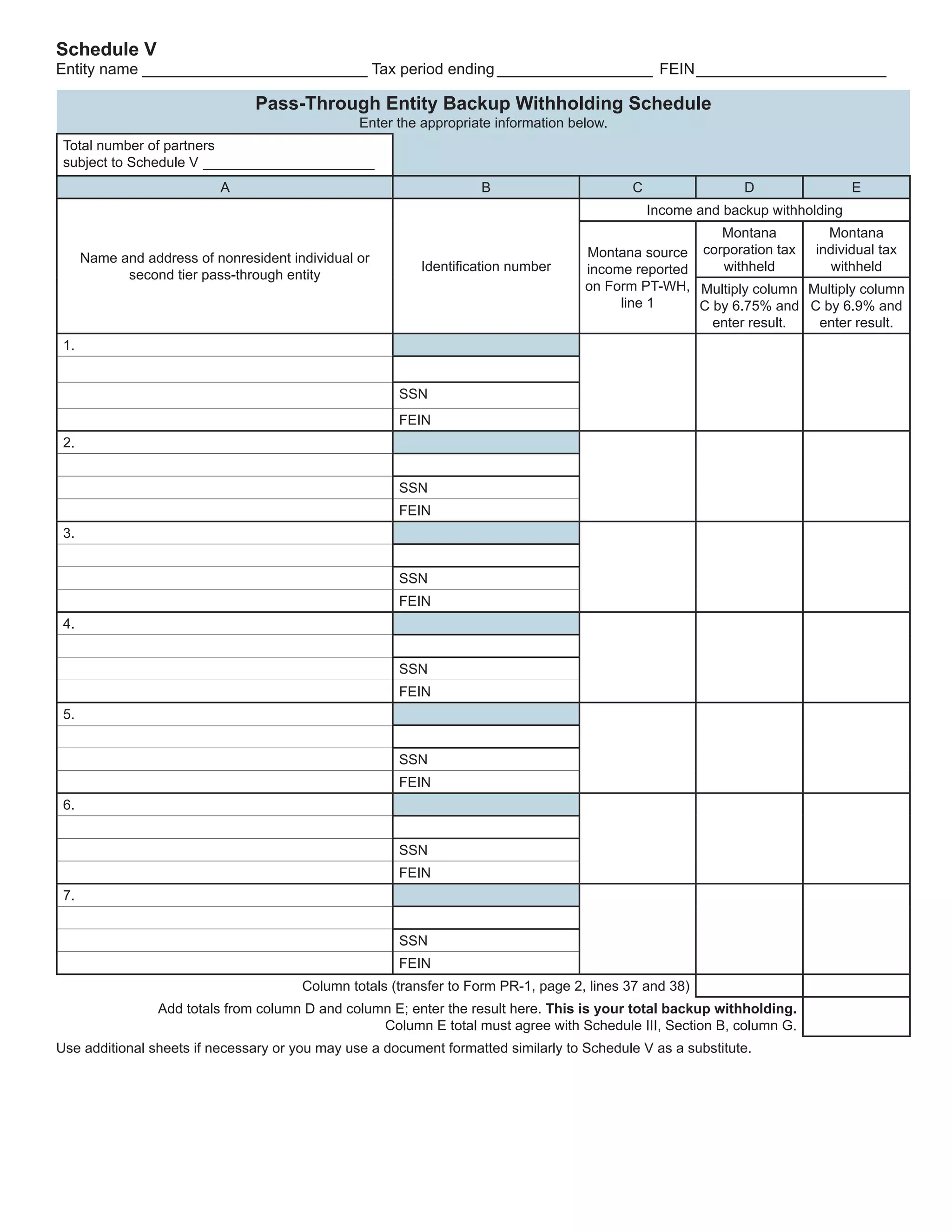

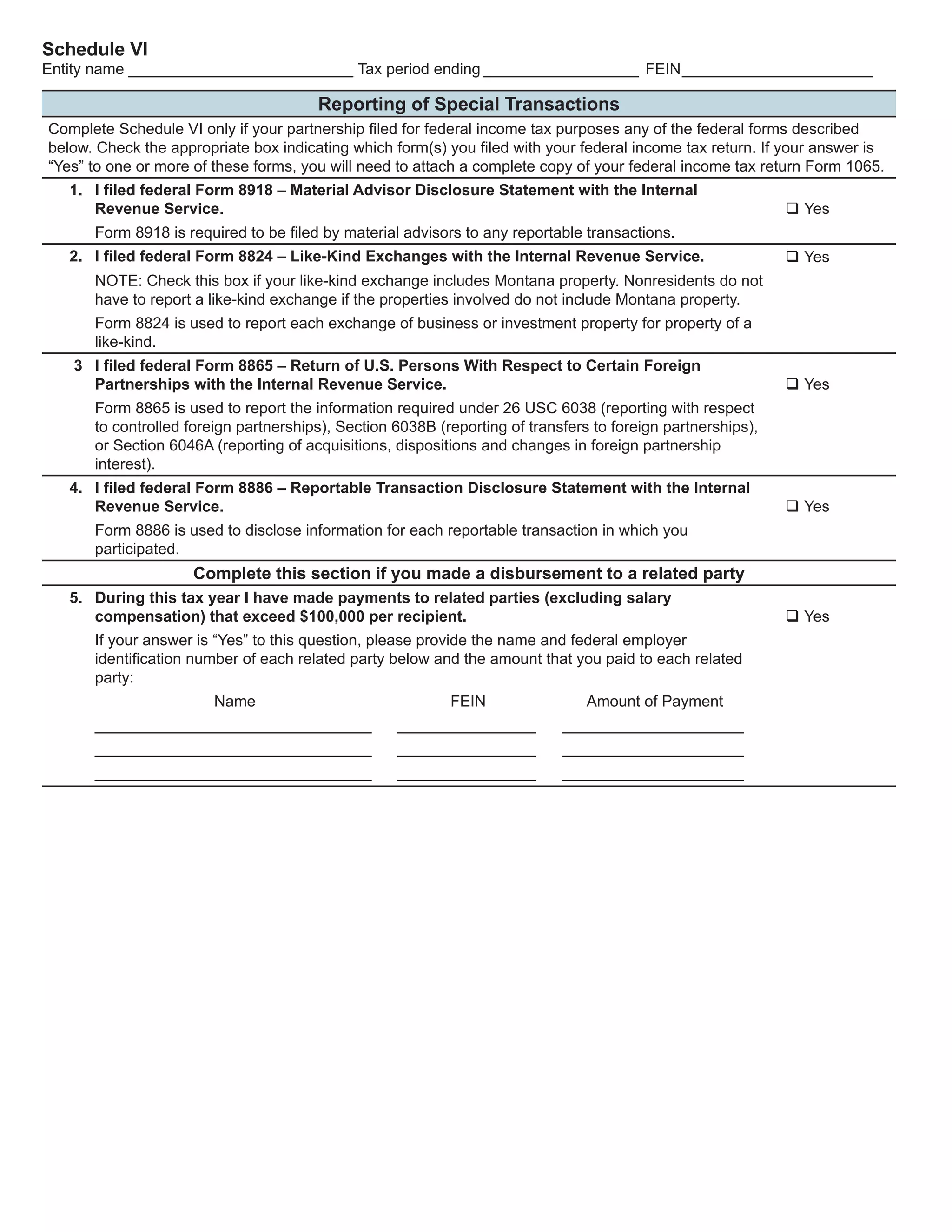

This document is a 2008 Montana Partnership Information and Composite Tax Return form. It contains sections for reporting partnership income and deductions, Montana additions and deductions to income, multi-state apportionment and allocation, calculation of net amount due including taxes and penalties, and partnership tax credits. Partnerships use this form to file their annual Montana tax return and report income and tax details to the Montana Department of Revenue.