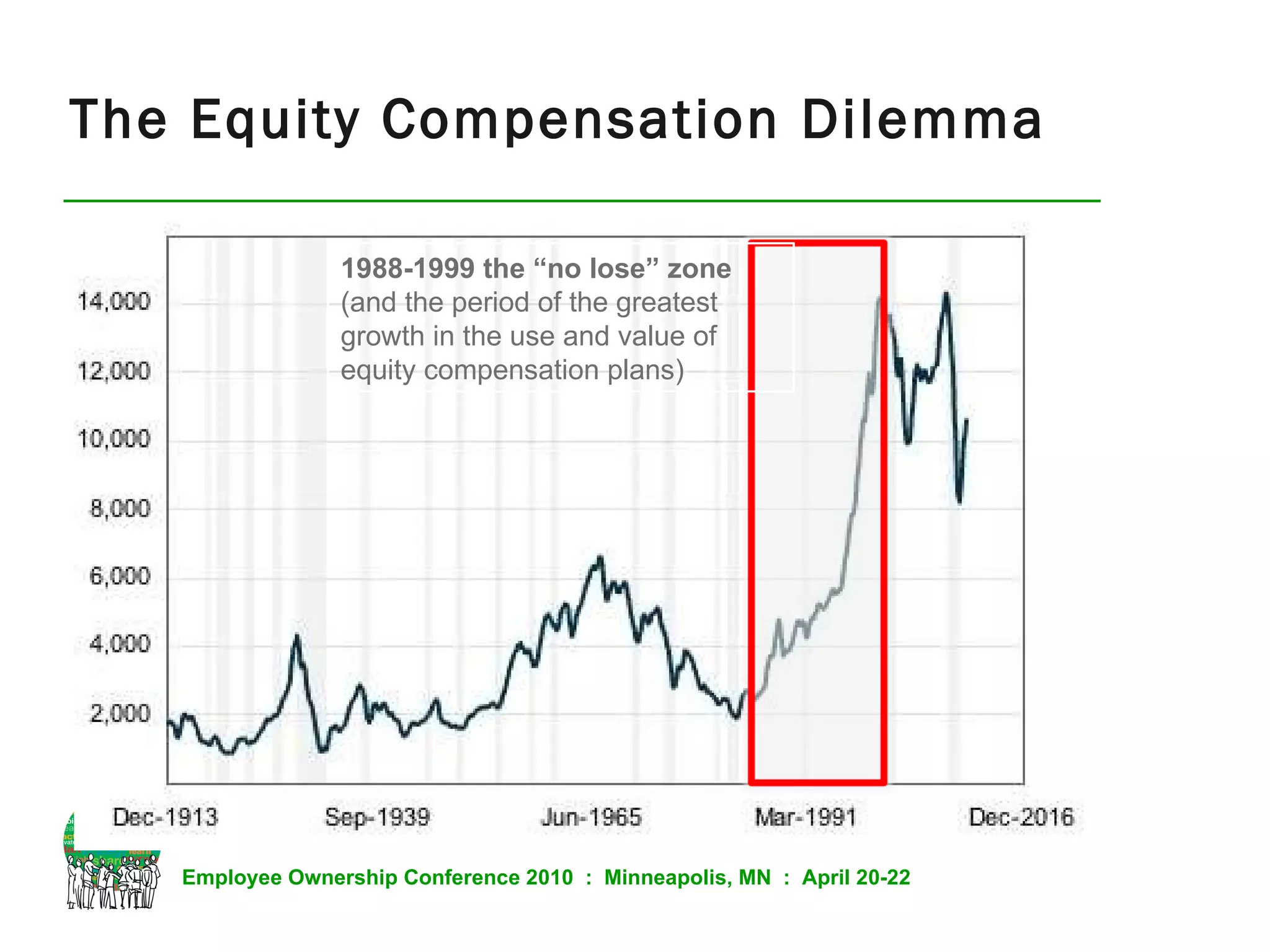

The document discusses equity compensation as an incentive for employee retention and motivation, particularly during ownership transitions in owner-managed companies. It outlines a seven-step exit planning process, highlights the advantages of both equity and cash incentives, and emphasizes the need for motivation among management and key employees. It also touches on the complexities of equity compensation and the importance of aligning corporate goals with effective incentive strategies.

![Questions Contact Us. John H. Brown, President Business Enterprise Institute, Inc. 888-206-3009 jbrown@exitplanning.com Contact Us. Dan Walter, President and CEO Performensation 877-803-9255 x. 700 [email_address] Skype: performensation Twitter: @performensation www.performensation.com](https://image.slidesharecdn.com/nceo-equitycomp-whoandhowmuch-100629184658-phpapp01/75/Equity-Comp-Who-and-How-much-to-give-23-2048.jpg)