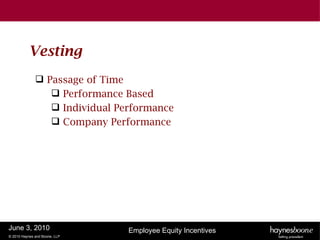

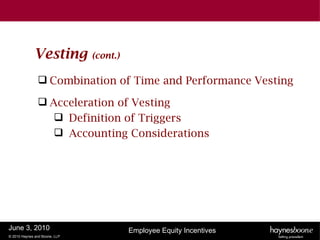

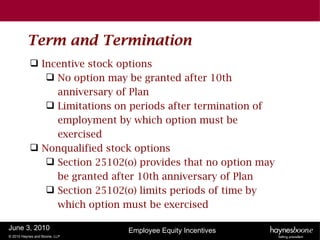

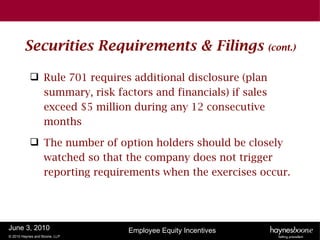

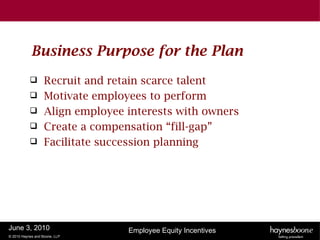

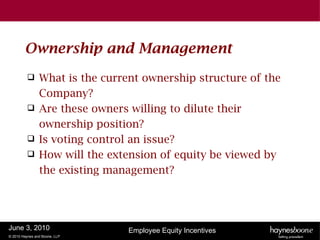

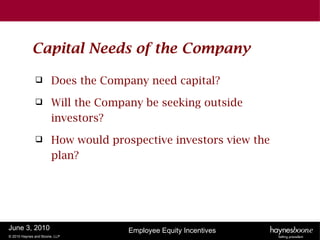

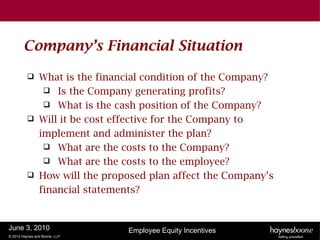

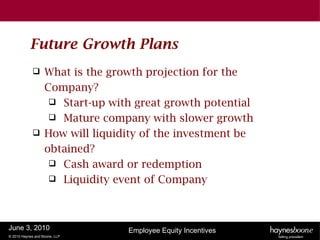

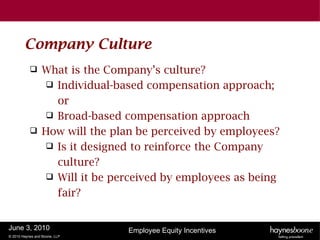

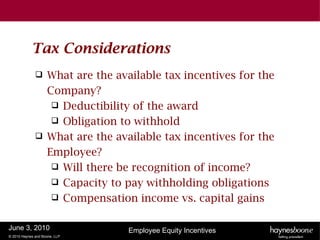

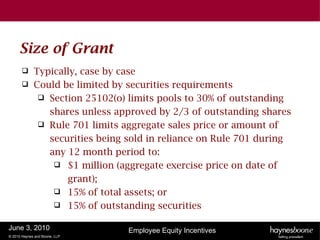

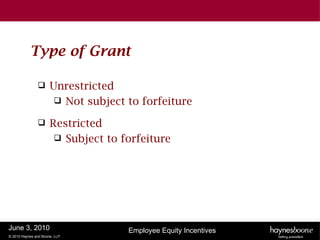

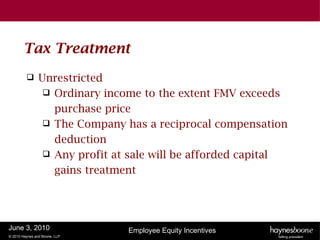

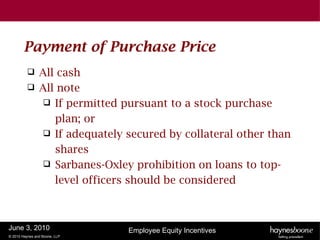

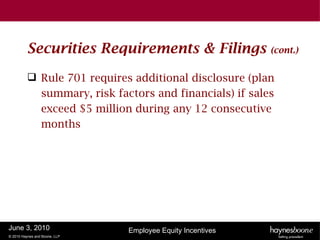

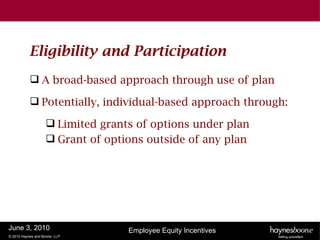

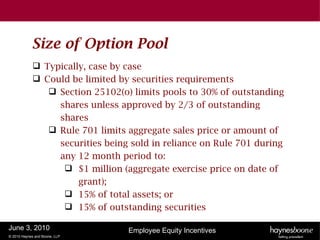

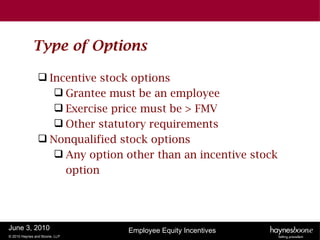

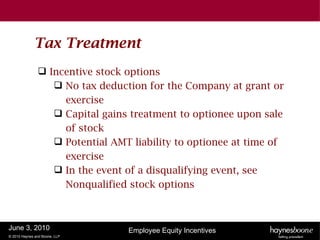

This document summarizes key considerations for designing an employee equity incentive plan, including business purpose, ownership structure, company financials, tax implications, and specific plan elements like type of equity grant, eligibility, vesting schedules, and voting rights. It was presented by Bart Greenberg of Haynes and Boone LLP to the Tech Coast Venture Network on employee equity incentives.

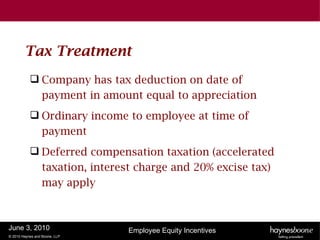

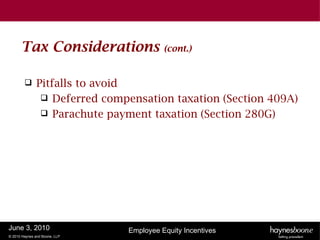

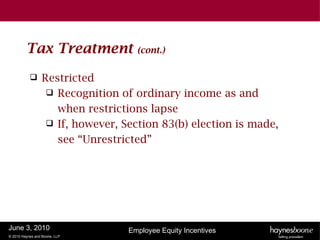

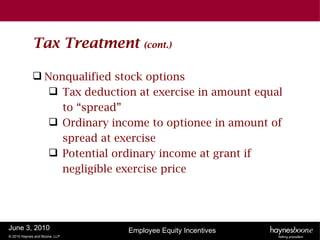

![Tax Treatment (cont.)

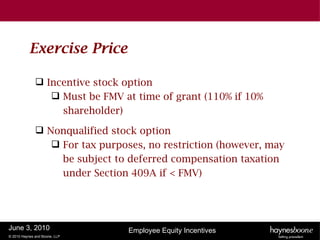

[Potentially] subject to deferred compensation

taxation (accelerated taxation, interest charge

and 20% excise tax) if exercise price < FMV

June 3, 2010 Employee Equity Incentives

© 2010 Haynes and Boone, LLP](https://image.slidesharecdn.com/employeeequityincentives-110818155959-phpapp02/85/Employee-equity-incentives-37-320.jpg)