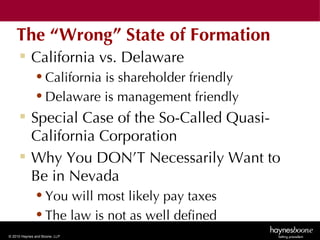

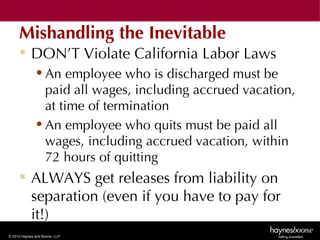

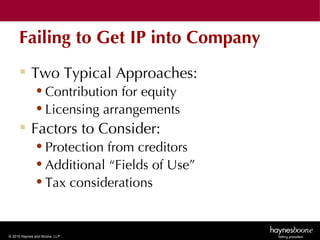

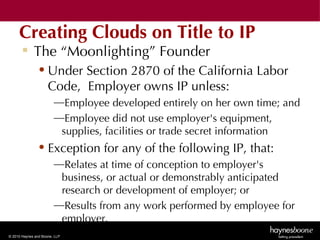

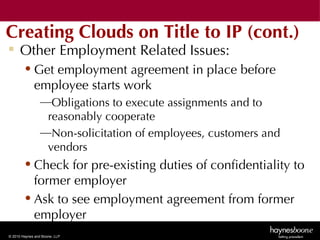

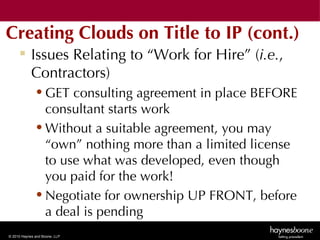

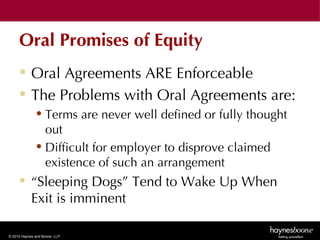

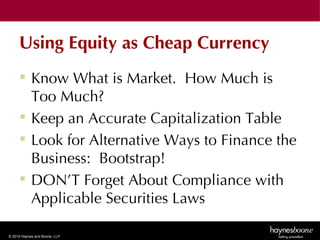

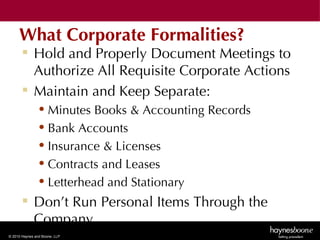

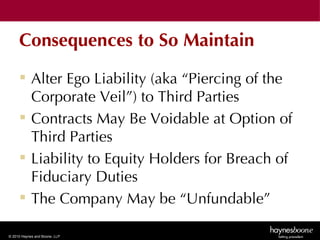

This document summarizes common mistakes made by entrepreneurs presented by Bart Greenberg of Haynes and Boone, LLP. It discusses mistakes related to business structure, intellectual property protection, improper use of equity, failure to maintain corporate formalities, and underestimating capital needs. The presentation provides advice on selecting the right business structure and state of incorporation, properly protecting intellectual property, using equity judiciously, following corporate formalities, accurately projecting financial needs, and having contingency plans.