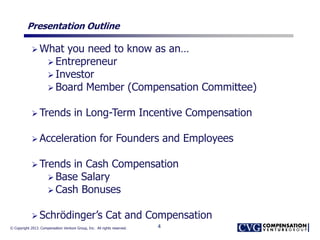

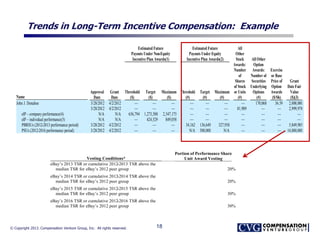

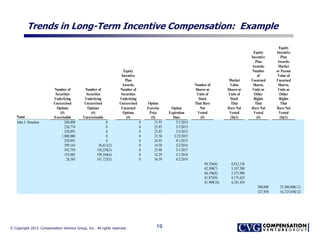

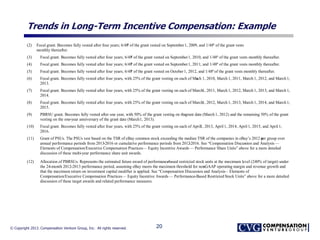

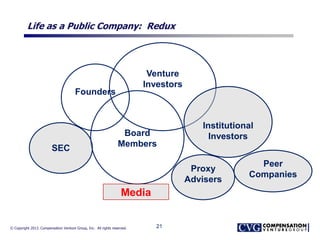

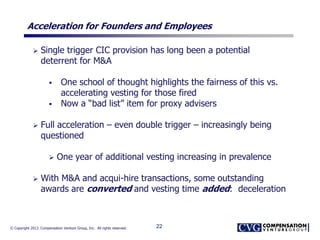

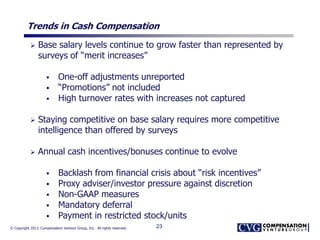

The document is a presentation by Fred Whittlesey of Compensation Venture Group on trends in executive compensation. Some key trends discussed include an increasing use of restricted stock units instead of stock options, adding performance conditions to equity awards, and adopting a "portfolio approach" using a mix of stock options, RSUs, and performance-based awards. There is also a growing influence from shareholders and proxy advisors on compensation design and an emphasis on issues like dilution, executive pay levels, and tying pay to performance. The presentation provides an example compensation plan for the CEO of eBay that incorporates a mix of stock options, RSUs, and performance share units with vesting based on total shareholder return goals.