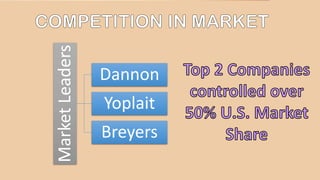

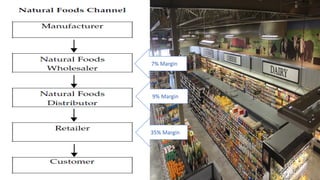

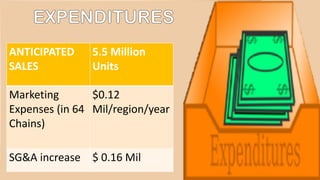

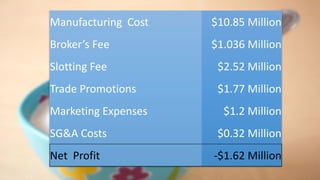

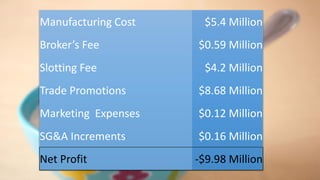

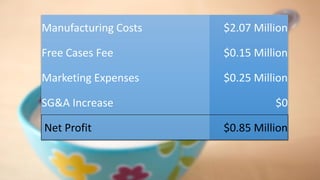

NatureView Farm is a small yogurt manufacturer that was founded in 1989. It produces organic yogurt with a longer shelf life. In 1999-2001, NatureView increased its revenues from $13 million to $20 million to position itself for acquisition. The document analyzes NatureView's market and distribution channels. It considers prospects for expanding into supermarkets or natural food stores. Financial projections are provided for expanding into each channel, with expanding into natural food stores projected to have the highest net profit of $0.85 million. The document also notes risks like competition, costs of expansion, and potential channel conflicts to consider.