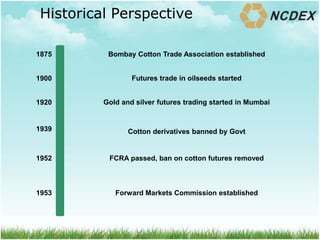

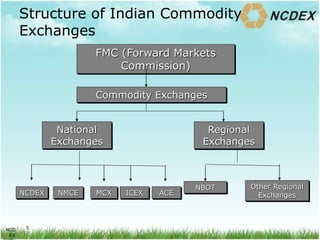

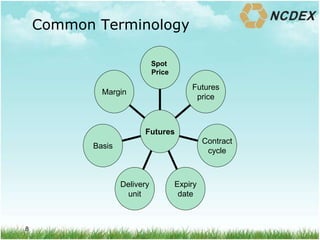

The document provides an overview of opportunities in the Indian commodities market and NCDEX in particular. It discusses the history of commodity trading in India dating back to the early 1900s. NCDEX is one of the leading commodity exchanges in India with a wide range of agricultural and other commodities available for trading. The exchange provides a platform for price discovery, risk management, and ensuring orderly market functioning. Common terms related to futures trading are also explained.