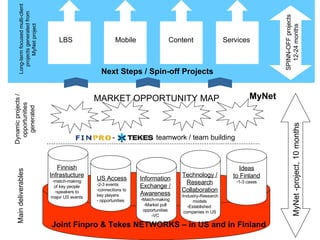

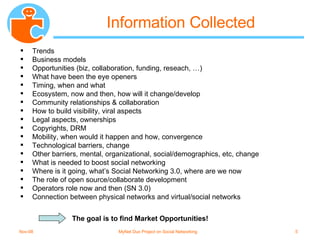

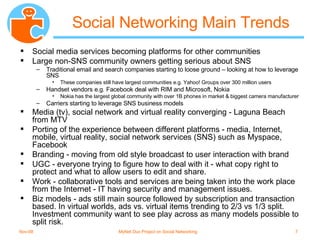

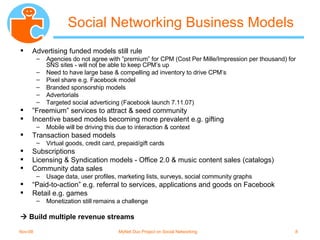

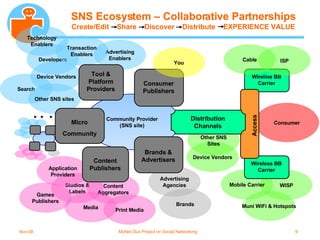

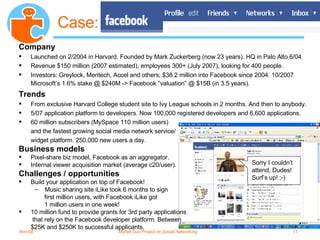

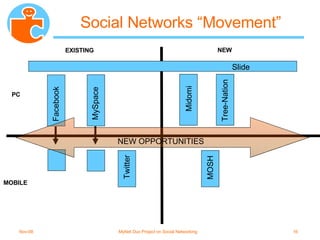

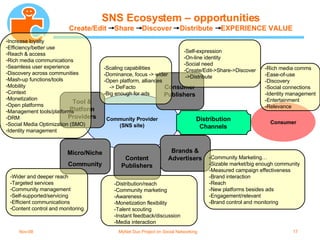

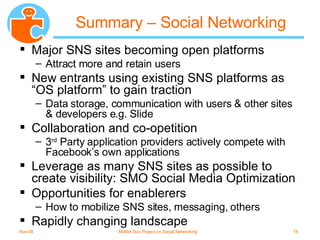

The document outlines the MyNet project aimed at exploring business opportunities in social networking, highlighting trends, ecosystem interactions, and market opportunities. It details the collaboration between Finnish and US players in social networking, emphasizing the transition from traditional media to social platforms. Key findings include the importance of community engagement, evolving business models, and the necessity for collaboration between technology and research sectors to capture market potential.

![Pekka Pärnänen, Maria Pienaar – FinNode/Finpro Silicon Valley Riku Mäkelä – FinNode/Tekes Silicon Valley 3945 Freedom Circle, Suite 110 Santa Clara, CA 95054, USA [email_address] [email_address] [email_address]](https://image.slidesharecdn.com/mynet-social-networking-summary-nov92007-1194583365689681-3/85/MyNet-Social-Networking-Summary-Nov9-2007-19-320.jpg)