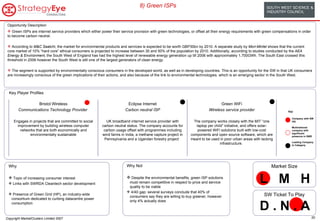

The document provides an overview and analysis of digital media trends in the South West region of England. It identifies regional strengths in areas like social networks, virtual worlds, e-learning, and content production. It also notes some weaknesses in distribution services and infrastructure. Key opportunities include social networks and user-generated content, virtual worlds, and e-learning/distance learning. Several companies active in these areas are also highlighted.