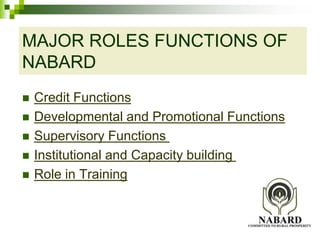

NABARD was established in 1982 by an act of Parliament to serve as the apex development bank for agriculture and rural development in India. It provides refinancing support to agriculture, small industries, and rural development efforts. NABARD's functions include implementing policy related to agricultural credit, promoting irrigation projects, supporting research and development, and providing refinancing during natural calamities.