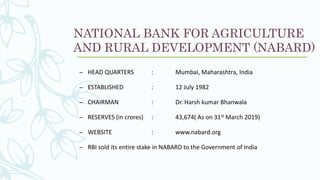

NABARD is the National Bank for Agriculture and Rural Development established in 1982 by the Government of India to aid rural development. Headquartered in Mumbai, NABARD provides credit and banking services to promote rural development, support agriculture and allied activities. It serves as a refinancing body and promotes policies and programs focused on integrated rural development and financing agriculture.