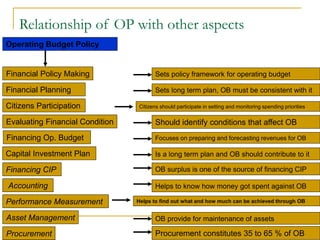

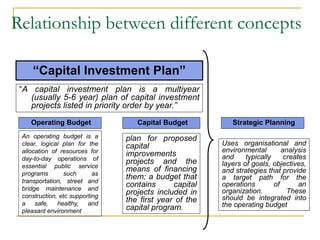

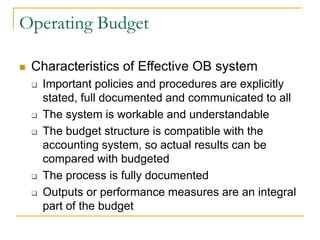

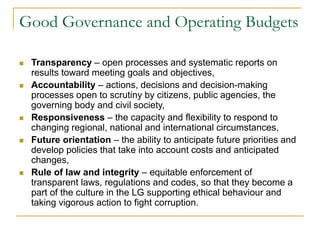

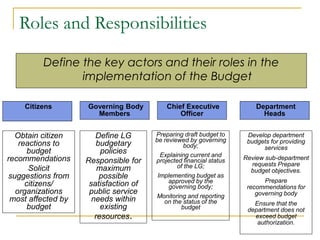

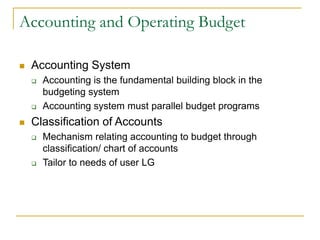

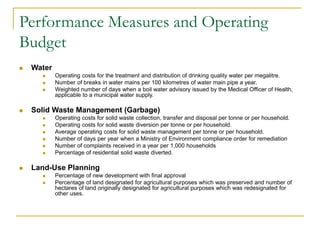

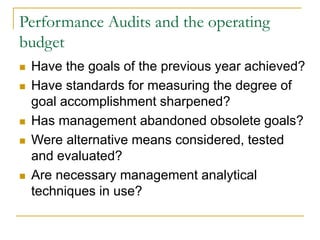

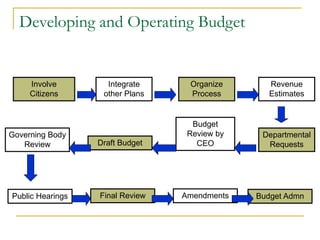

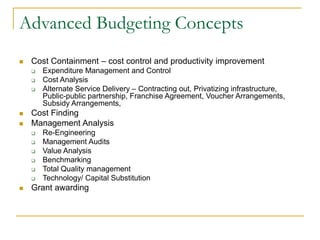

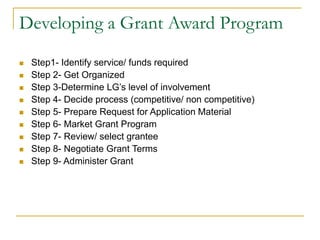

The document provides an overview of operating budget concepts and processes for local governments. It discusses key relationships between operating budgets and other financial planning aspects such as capital investment plans, strategic planning, accounting, and more. The document also examines characteristics of effective operating budget systems and the roles and responsibilities of various actors such as citizens, governing bodies, department heads, and chief executive officers in the budget preparation and implementation process.