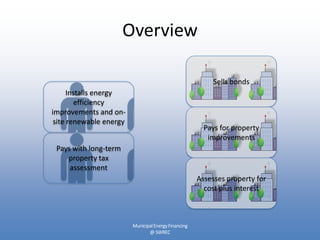

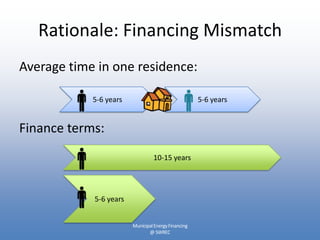

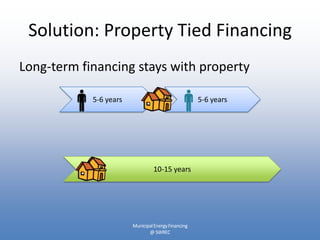

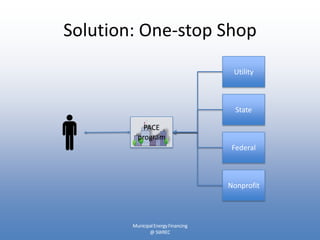

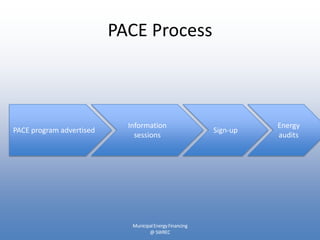

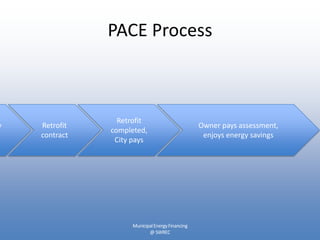

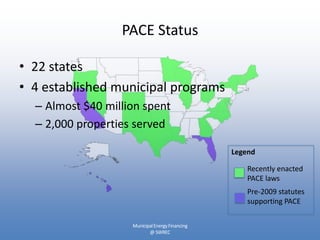

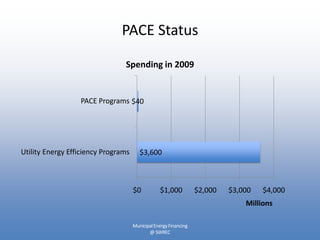

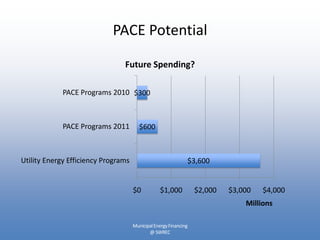

1) Municipal energy financing, also known as Property Assessed Clean Energy (PACE) programs, allow homeowners to finance energy improvements through assessments on their property tax bills.

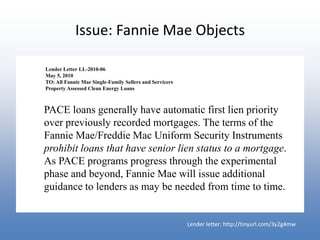

2) PACE programs have faced objections from Fannie Mae and Freddie Mac due to the senior lien status of PACE assessments.

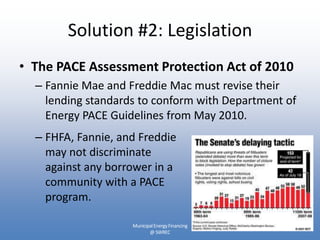

3) Solutions to overcome the objections have included lawsuits against Fannie Mae and Freddie Mac, legislation to require them to accept PACE loans, and alternatives like on-bill financing or junior lien structures.