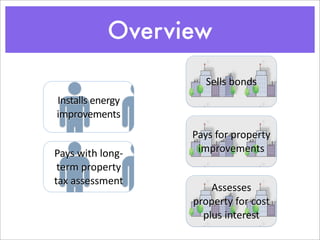

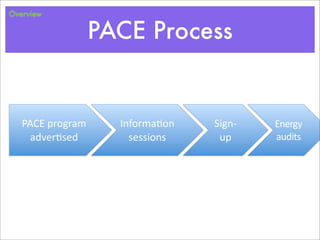

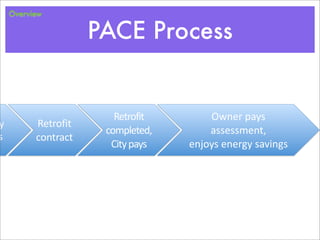

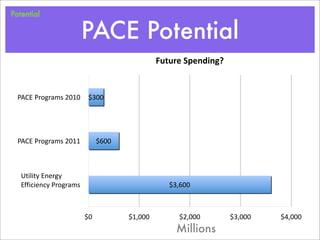

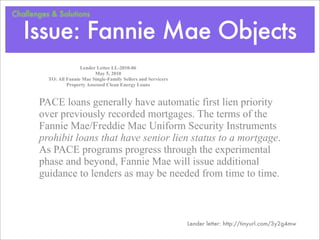

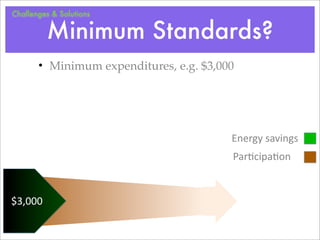

Property Assessed Clean Energy (PACE) programs allow homeowners to finance energy improvements through municipal bonds repaid via a surcharge on property taxes. PACE has grown to 21 states and $40 million invested but faces challenges from Fannie Mae, which refuses to accept mortgages with PACE loans due to lien priority issues. Solutions include lawsuits, legislation, and alternatives like on-bill financing, but participation may exceed energy savings without minimum standards for projects.