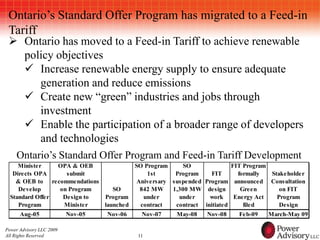

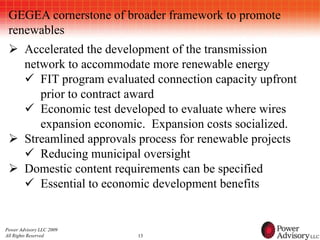

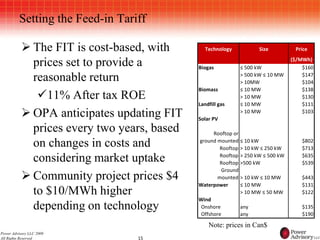

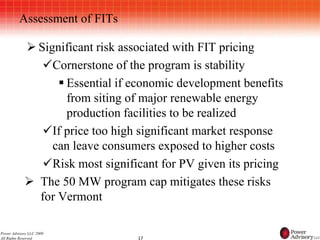

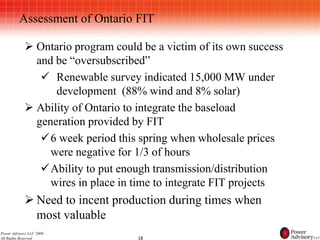

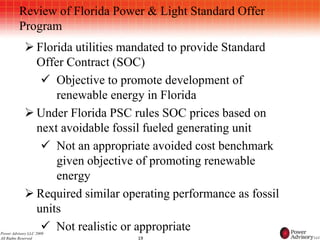

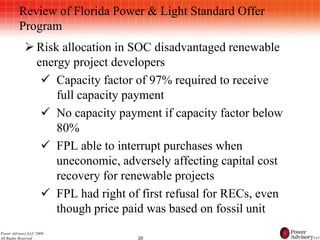

The document discusses the design and lessons learned from standard offer and feed-in tariff programs, primarily focusing on Ontario's experience. It contrasts the pricing mechanisms of standard offers and feed-in tariffs, highlighting Ontario's shift to a feed-in tariff to better achieve renewable energy objectives. Key issues addressed include challenges in program implementation, the need for clear policy objectives, and the importance of capacity assessment and stakeholder involvement.