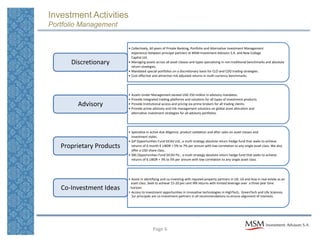

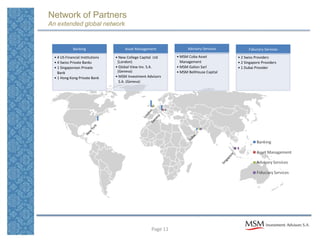

MSM Investment Advisors provides wealth management services for global families, including investment advisory, fiduciary, and corporate advisory services. They partner with other professional advisors and have a network of preferred partners that provide asset management, advisory, and real estate services. The team has over 60 years of combined experience in private banking, portfolio management, and alternative investments. MSM manages over $250 million in assets and provides discretionary portfolio management, advisory services, proprietary investment products, and assistance identifying co-investment opportunities. Their process involves collaboratively agreeing on clear deliverables and accountability measures with clients.

![Profile

Wealth Management Services

• MSM is a multi family office platform dedicated to providing global families with a highly

personalized, responsive and tailored wealth management and corporate advisory service.

• MSM provides an Investment Advisory Service designed to offer independent advice focused

exclusively on ensuring clients meet their individual risk adjusted investment objectives.

• MSM provides oversight and performs quarterly reviews on all client fiduciary and trust

structures to ensure relevance and effectiveness. [We partner with professional advisors

seasoned in handling such matters and take appropriate action where required]

• MSM has preferred partners and a network of alliances that provide discretionary asset

management, corporate advisory and real estate services

Page 3](https://image.slidesharecdn.com/presentationformsmpaisleydecember112007powerpointversion-13232078383037-phpapp02-111206154434-phpapp02/85/MSM-Presentation-3-320.jpg)