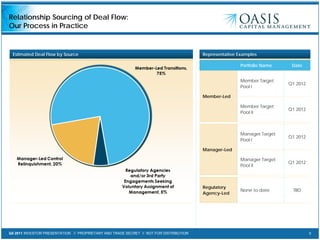

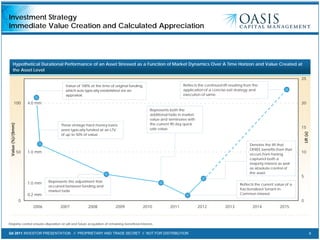

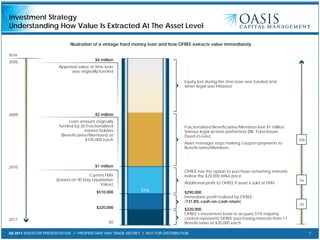

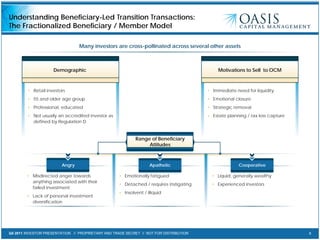

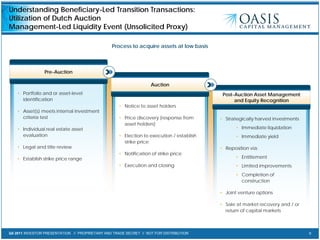

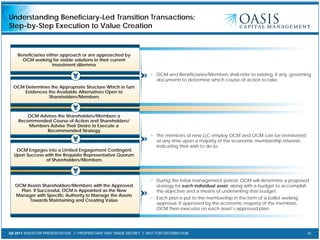

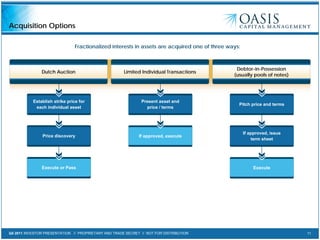

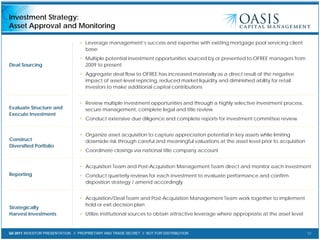

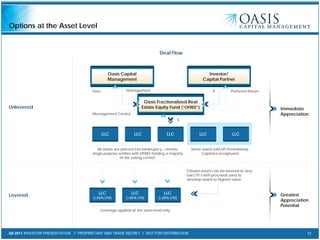

The Q4 2011 investor presentation outlines Oasis Capital Management's proposed fractionalized real estate equity fund, focused on acquiring distressed commercial real estate assets with potential for repositioning and appreciation. The fund caters to sophisticated investors with a limited liquidity profile and does not plan to register under the U.S. Investment Company Act, emphasizing the risks associated with real estate investments. Key strategies involve leveraging corporate governance for acquisitions, rapid asset appreciation, and structured liquidation processes for distressed assets.