Embed presentation

Downloaded 89 times

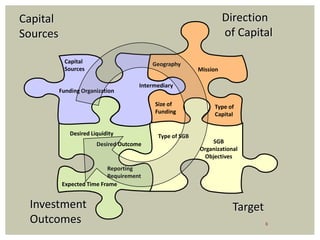

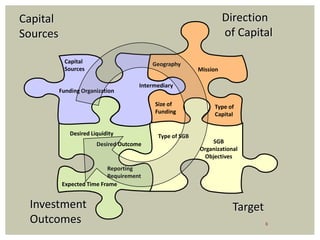

The document discusses the challenges and strategies of venture capital investing in the developing world, emphasizing the importance of local impact and the scarcity of up-round capital. It highlights the need for efficient syndication and capacity development, suggesting phased investing as a model for financing small and growing businesses. The report recommends actions such as treating capital as work in process and increasing collaboration with local capacity development organizations to improve investment outcomes.