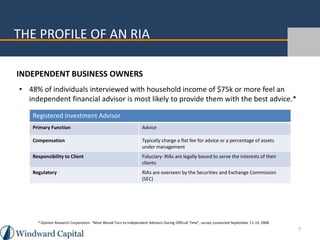

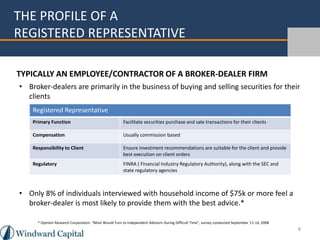

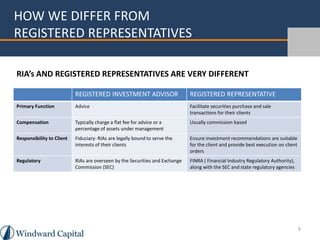

This document compares registered investment advisors (RIAs) and registered representatives. It discusses that RIAs are fiduciaries legally bound to serve clients' best interests, typically charging fees, while registered representatives facilitate securities purchases/sales and are usually commission-based. The document suggests RIAs provide personalized long-term financial advice aligned with clients' goals, unlike registered representatives whose primary function is facilitating transactions. It advises readers to consider their needs and preferences to determine the best option.