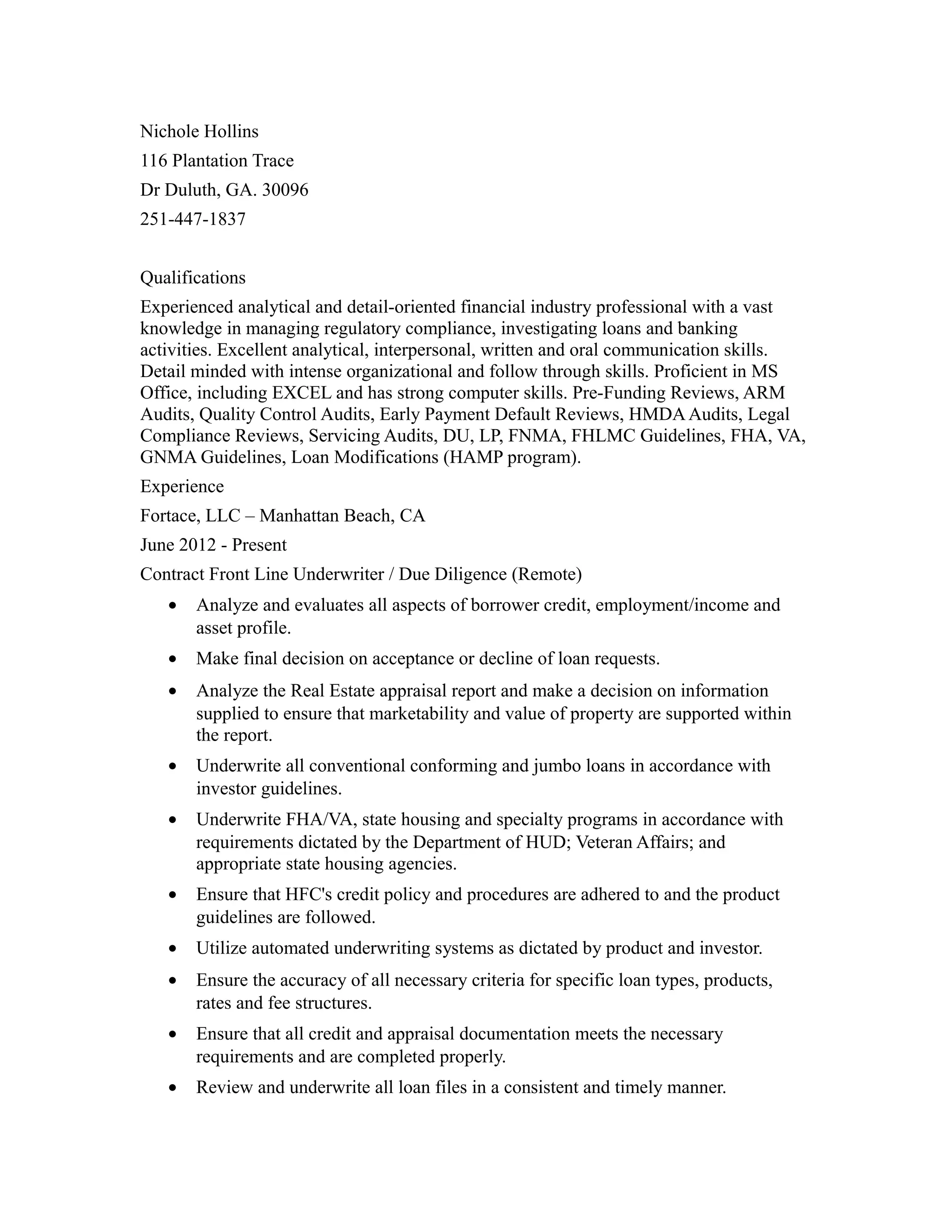

Nichole Hollins has over 15 years of experience in financial analysis and underwriting. She is currently a contract underwriter for Fortace, LLC where she analyzes borrower credit, income, assets and appraisals to make final loan approval decisions. Prior to her current role, she worked as an Underwriter III for Alabama Trust Bank National Association, where she underwrote complex loans, provided training, and ensured adherence to guidelines. She holds a Bachelor's degree in Medical Records and Health from Alabama A&M University.