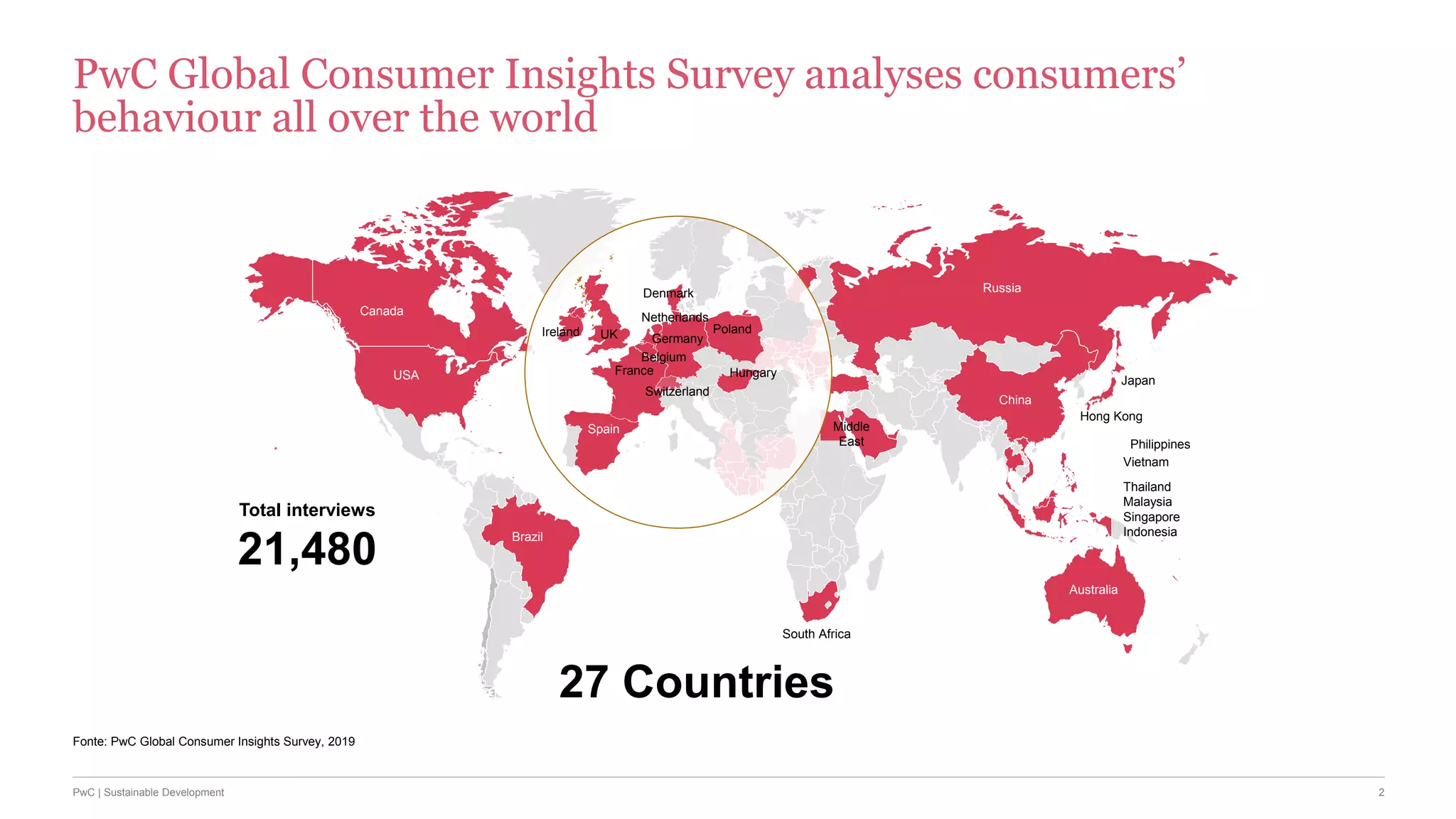

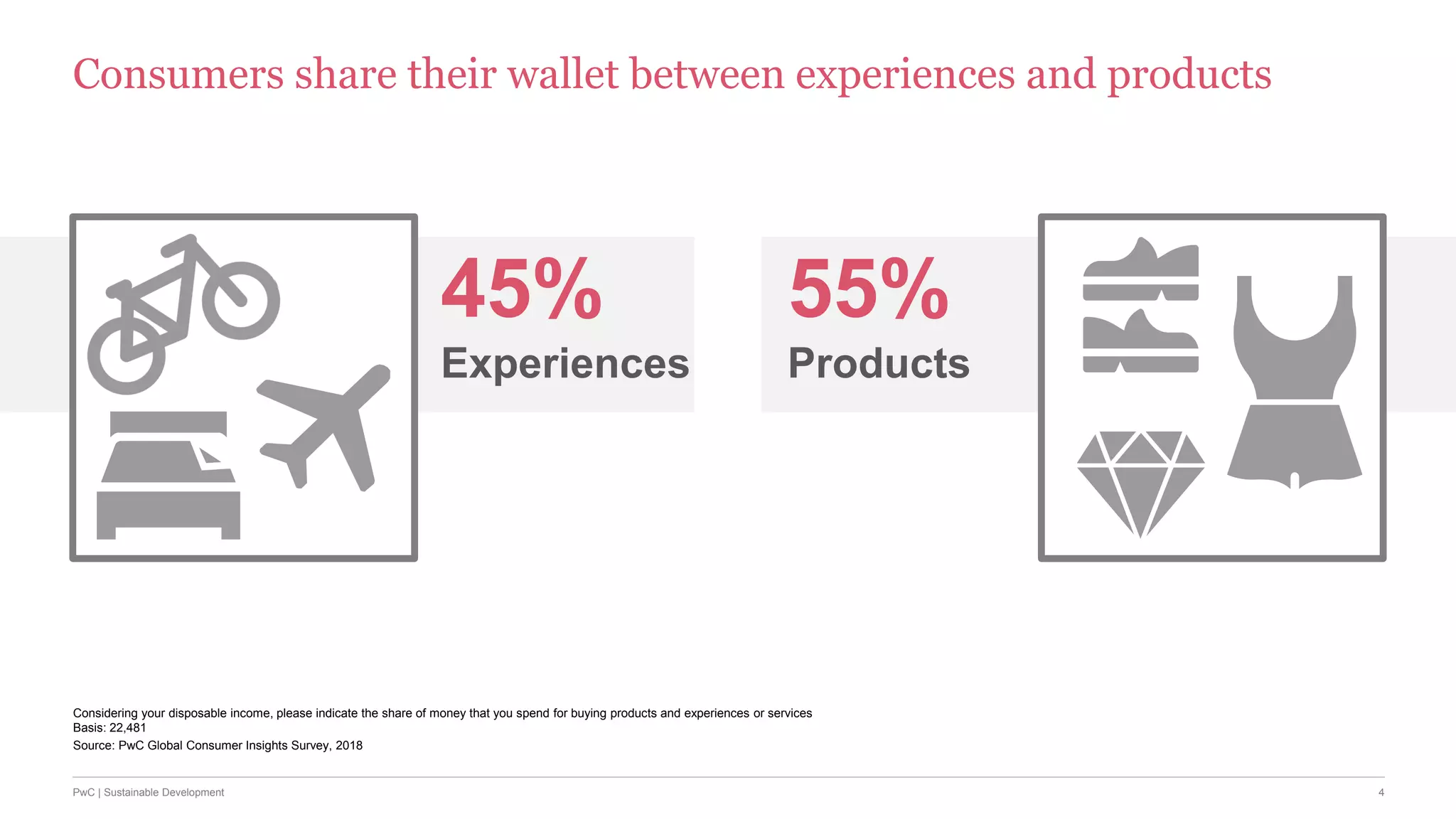

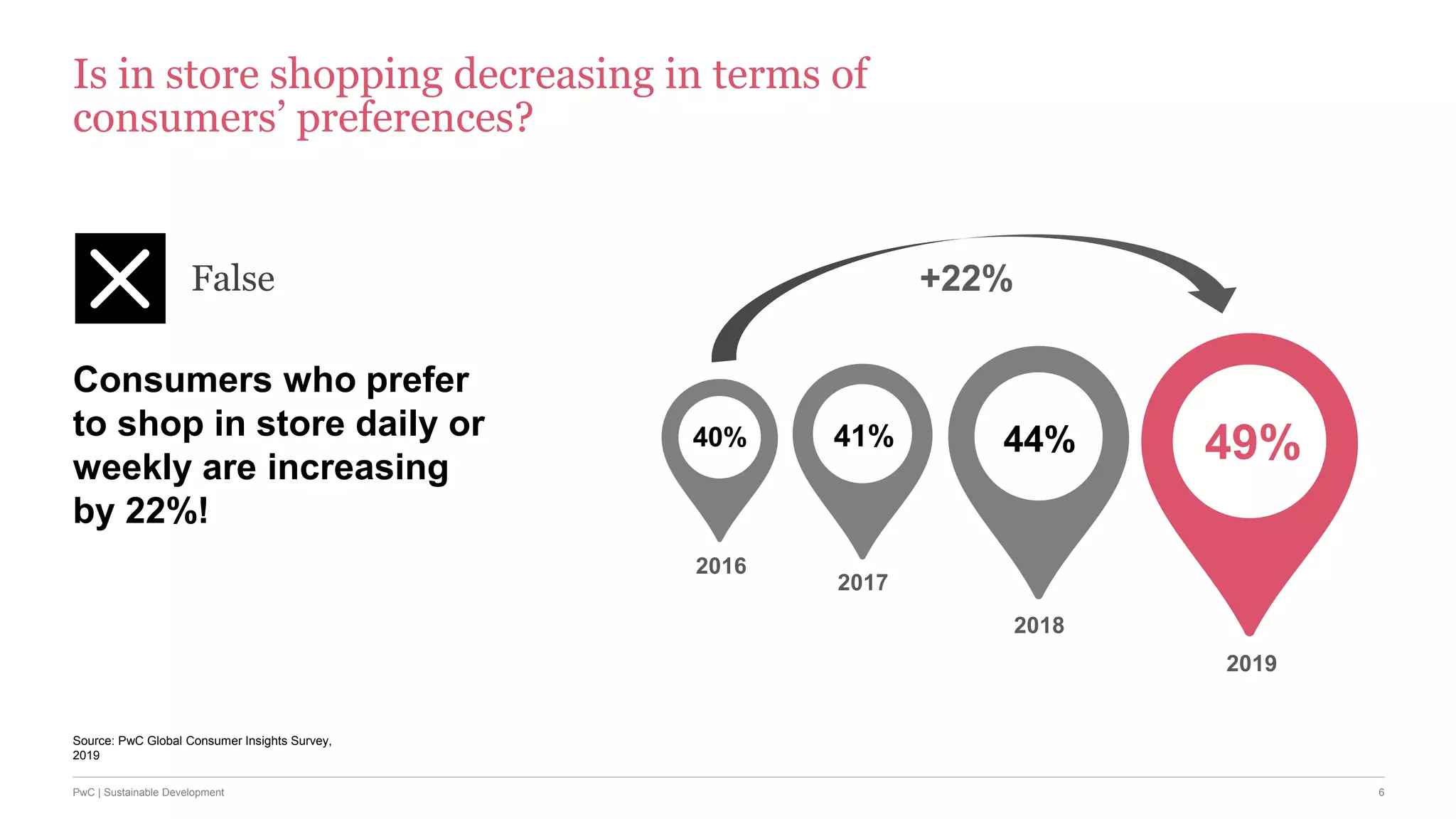

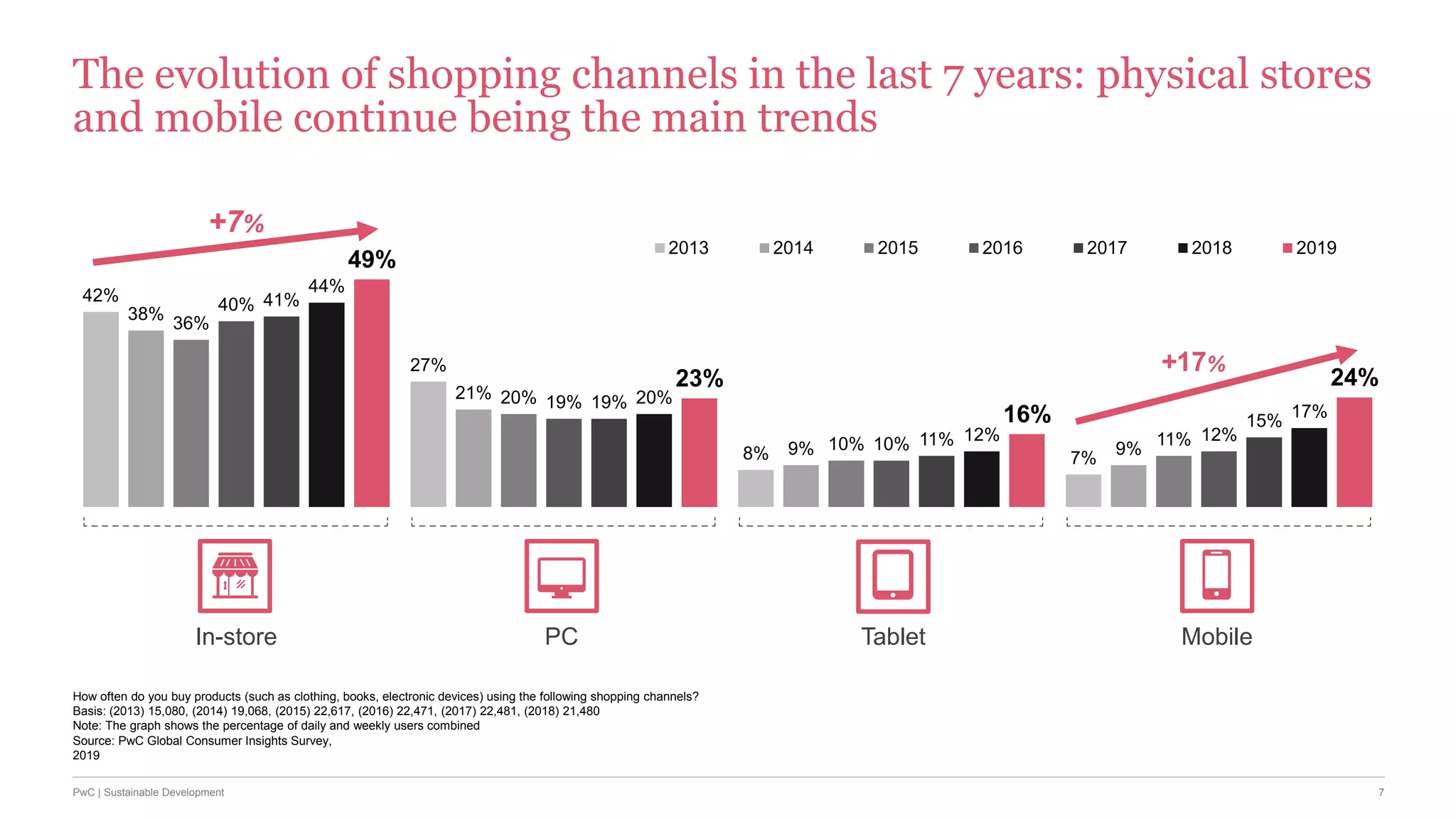

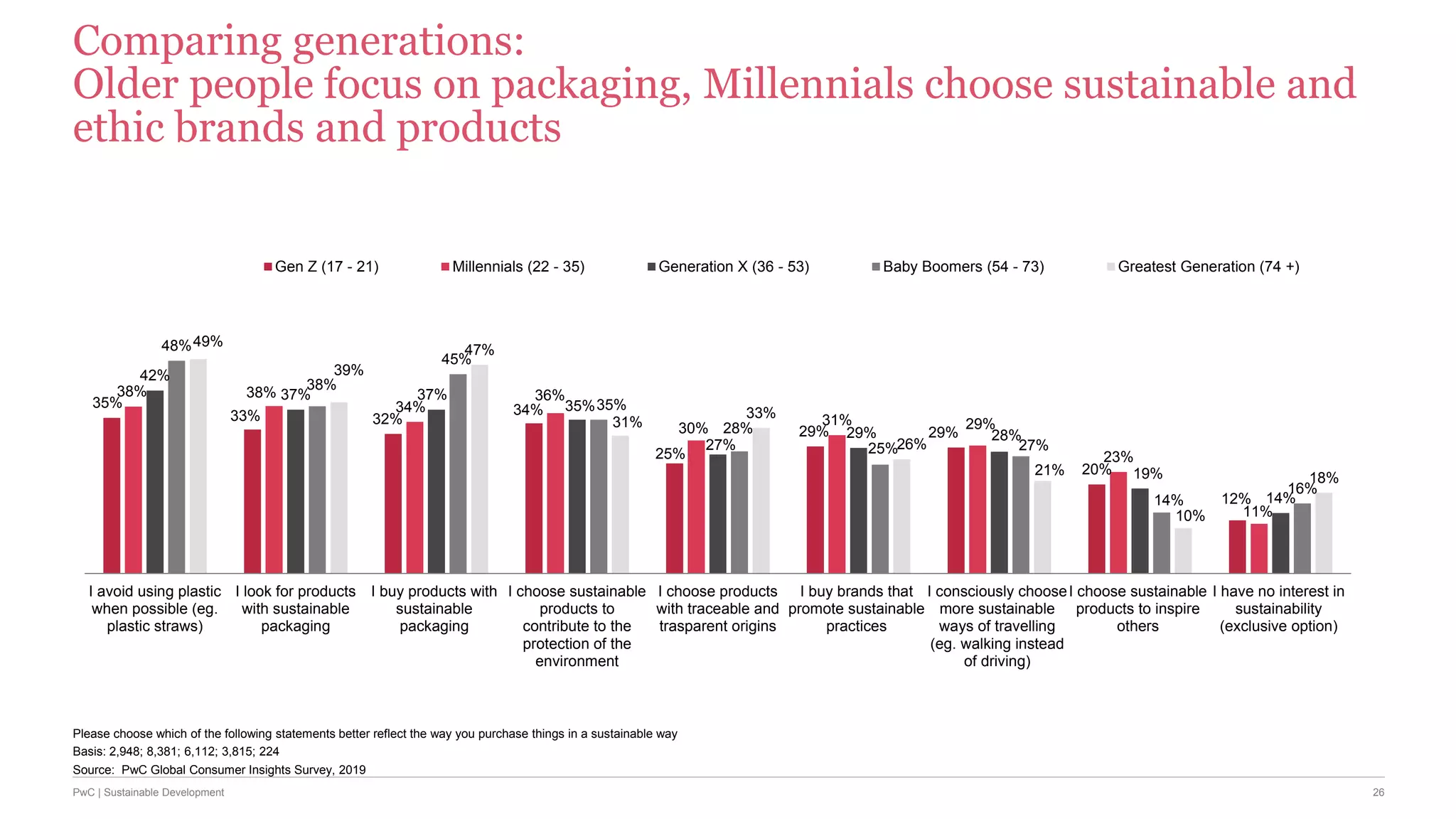

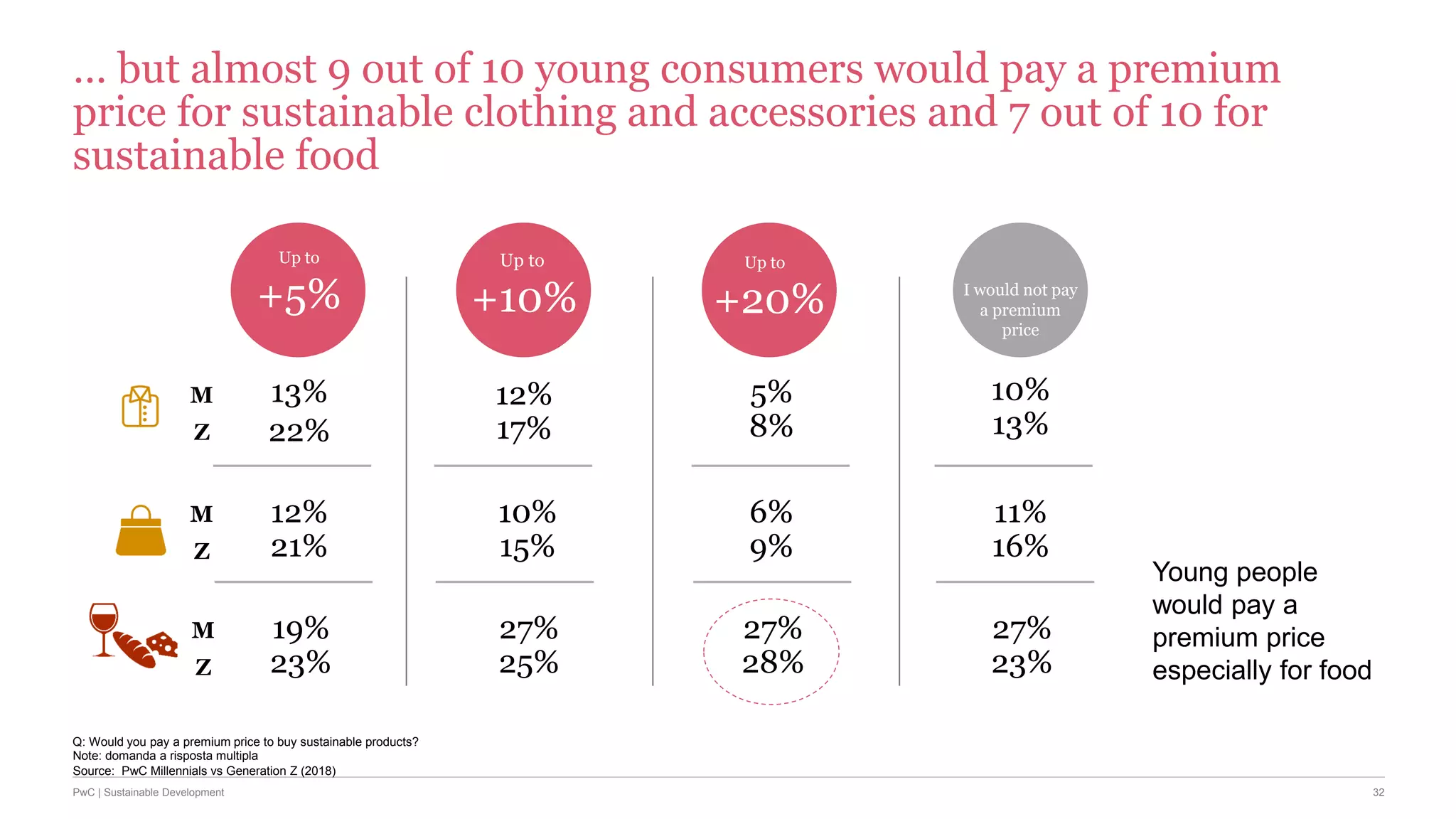

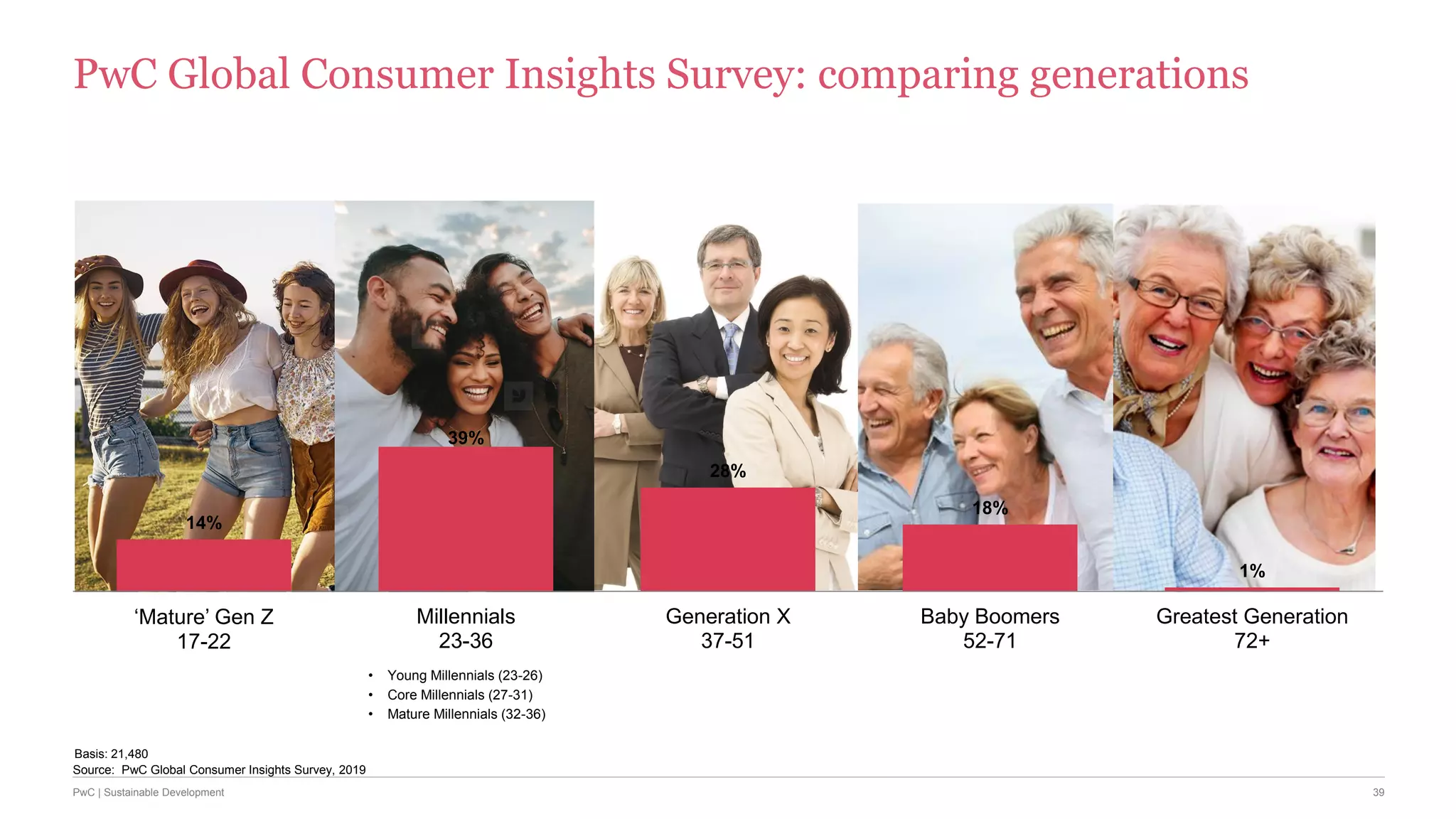

The document discusses the rising interest in sustainability among millennials and Generation Z, highlighting their buying behaviors and preferences, as analyzed through the PwC Global Consumer Insights Survey. Key findings include a preference for in-store shopping, a significant willingness to pay a premium for sustainable products, and a notable influence of social media on purchasing decisions. Additionally, it emphasizes the importance of transparent communication from brands about sustainability practices.