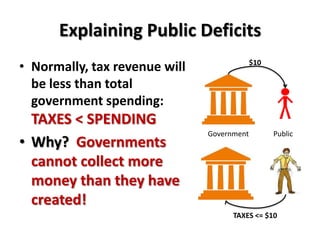

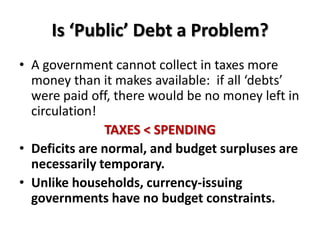

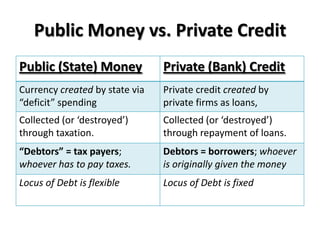

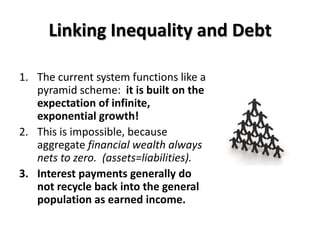

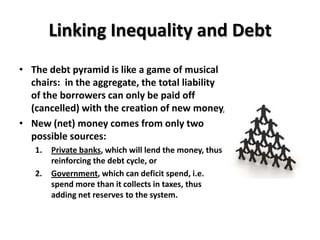

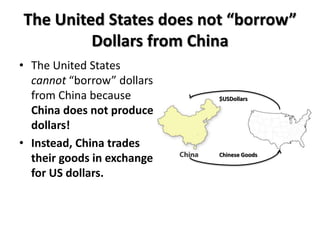

1) Government deficits are normal as tax revenue is usually less than government spending. Governments cannot collect more in taxes than the money they have created.

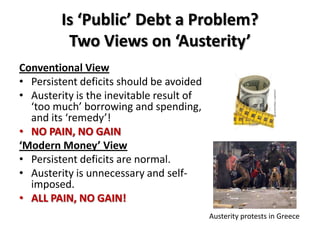

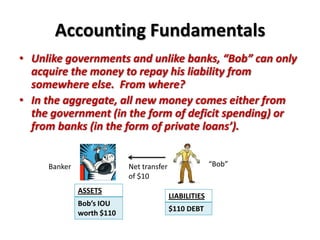

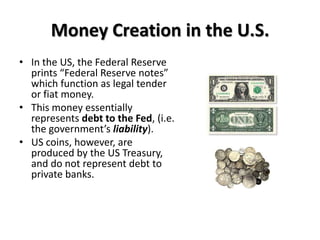

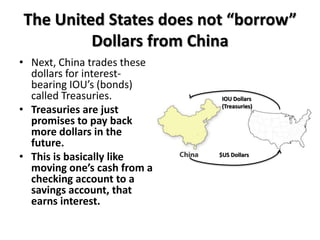

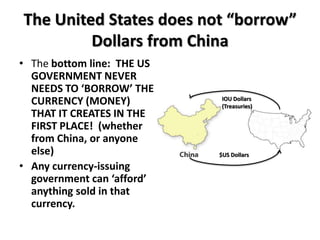

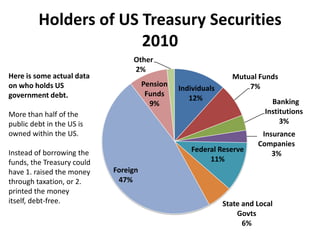

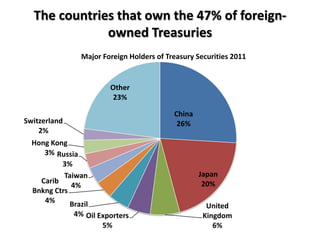

2) Unlike households, governments with their own currency are not constrained by budgets and deficits. Public debt is not necessarily a problem.

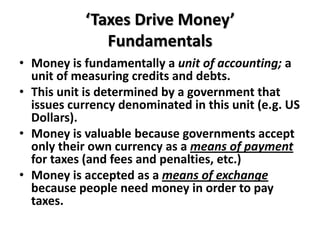

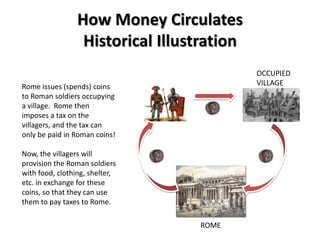

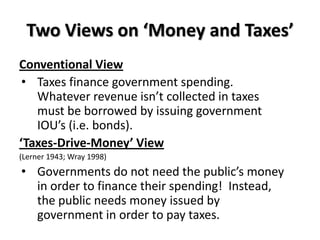

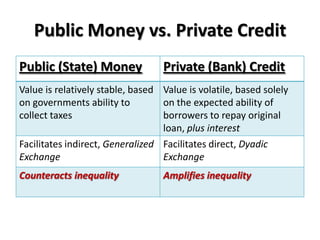

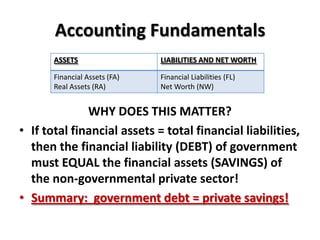

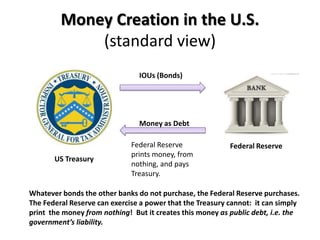

3) Money is created by governments through spending more than they collect in taxes. Taxes then ensure the money maintains value by creating demand for it to pay taxes. Government deficits correspond to private surpluses.